Are you one of the 60 million generous households in America that give to charity each year? If so, you might be missing out on one of the best tax deductions in the tax code. Fortunately, there is a simple strategy that can help save you thousands of dollars when you file your taxes for 2023 — it’s called bunching.

In 2017, the Tax Cuts and Jobs Act roughly doubled the standard deduction through 2025. But while this large deduction helped lower taxes for millions of households, it also made it more difficult to qualify for a lot of common individual tax deductions, including one that is near and dear to the hearts of many — the tax deduction for charitable giving.

However, there is good news. A simple tax strategy called “bunching,” or “bundling,” can let taxpayers who don’t normally qualify for itemized deductions get access to the charitable deduction. All it requires is a little planning and access to an account called a donor-advised fund (DAF).

Bunching: A tax strategy you should know

The concept behind bunching is simple. Instead of taking the standard deduction every year, by grouping your charitable contributions for multiple years together into a single tax year, you can exceed the standard deduction and take advantage of valuable itemized deductions like charitable donations.

The 2023 standard deduction for married couples filing jointly is $27,700, and in 2024, it will rise an additional $1,500 to $29,200. For single individuals and married couples filing separately, the standard deduction is $13,850, rising to $14,600 in 2024. For most households, that level is difficult to clear, and in 2024, it will get even more challenging. As a result, 2023 is an excellent year to take advantage of this strategy.

Examples: Standard Sam and Bunching Betty

Let’s look at a simple example of how this strategy can work and potentially save you thousands of dollars in taxes. Meet Standard Sam and Bunching Betty.

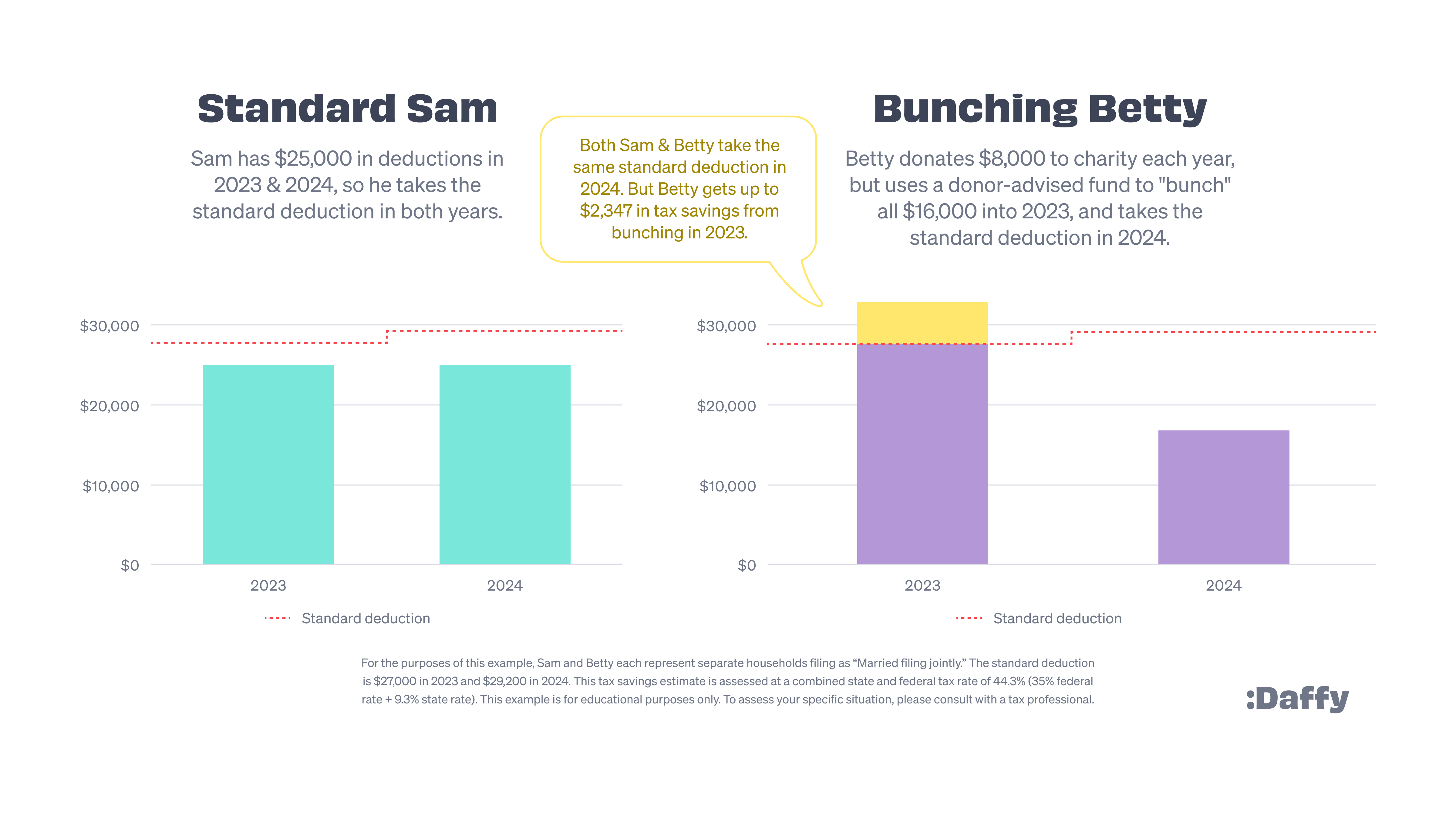

Now, while Sam and Betty don’t know each other, it turns out they have a lot in common. Both Sam and Betty give generously to charity every year, making $8,000 in annual donations to their church, their children’s schools and other charities. In 2023, they both also have $17,000 in other deductible expenses, like mortgage interest and property taxes. As a result, each of their households ends up every year with about $25,000 in tax deductions — not enough to clear the hurdle to itemize.

Standard Sam decides to take the standard deduction of $27,700 in 2023. This makes sense to him, of course, since his itemized deductions of $25,000 would be lower. In fact, Standard Sam ends up taking the standard deduction in both 2023 and 2024.

Bunching Betty knows better. Looking ahead to 2024, she knows that her household will make about $8,000 in charitable donations again. Instead of taking the standard deduction two years in a row, she puts the $8,000 she intends to give out in 2024 into a DAF, a tax-advantaged account for charity, before Dec. 31, 2023. Since this is considered a charitable contribution, this allows her to claim the tax deduction for this contribution in 2023. Her deductions for 2023 now come to $33,000, well over the standard deduction.

As a result, Bunching Betty gets an additional deduction of $5,300 in 2023, while still qualifying for the standard deduction in 2024. At a combined state and federal tax rate of 44.3% (35% federal plus 9.3% state), that could mean tax savings of as much as $2,347!

Of course, the best part of this strategy is that it helps ensure that the money that Betty will need to support her charities is safely put aside for 2024, invested tax-free in the DAF. And who knows, perhaps gains on those investments will provide for even more charitable donations in 2025!

It’s not too late to open a DAF and bunch your donations

DAFs have been around for decades, and they are rapidly growing in popularity due to the convenience and flexibility they offer. There are more than 1.9 million DAF accounts in the U.S. now, according to the National Philanthropic Trust, and they have grown by an average of 22.6% per year since 2018.

Once you learn about tax strategies like bunching, it’s easy to understand why. DAFs allow you to contribute money at any time, immediately qualify for the charitable deduction in the current tax year, invest the money tax-free and then make donations to charities at your discretion.

Bunching charitable contributions isn’t right for everyone, but if your household donates to charity regularly, it would be foolish not to consider it. This strategy can be done in any year but could be even more valuable in years where you have extra income and might even be in a more expensive tax bracket.

There are three steps to leveraging this strategy:

- Estimate your deductions for this year. Did you take the standard deduction last year? The year before? Many people don’t know this offhand, but finding out can be as simple as just referring to your taxes from last year or asking your accountant. Look for significant changes in your deductions: mortgage interest, state and local taxes, etc.

- Look at your charitable giving annually. Most people who give to charity tend to support the same organizations every year combined with a few donations that were made based on current events or a specific request. How much did you give to charity this year? How much will you likely give to charity next year?

- Set up a DAF. Charitable bunching doesn’t mean you have to rush to decide on how to distribute your funds. Most major brokerages offer some form of DAF account, although many of them have high minimums and fees. Fortunately, new providers, like Daffy.org, will let you open up an account with no minimums and a fee as low as $3 per month. (I am the co-founder and CEO of Daffy.org.)

The end of the calendar year brings with it both holiday cheer and tax planning. Charitable giving has a unique way of combining both, and bunching can help generous households be more generous for years to come.

Assumptions that were used in the above example: Assessed at a combined state and federal tax rate of 44.3% (35% federal rate + 9.3% state rate).

The information provided is for educational purposes only and should not be considered investment advice or recommendations, does not constitute a solicitation to buy or sell securities, and should not be considered specific legal investment or tax advice. To assess your specific situation, please consult with a tax and/or investment professional.