Not too long ago, Microsoft (MSFT) stock's glory days looked to be behind it as sales of desktop PCs slipped into a seemingly irreversible decline.

Although the dot-com days of the 1990s minted many a "Microsoft millionaire," the aftermath of the tech bust led Microsoft stock to trade mostly sideways for more than a decade.

But the past 10-plus years have been nothing short of a renaissance for the tech giant. When CEO Satya Nadella ascended to the top job in 2014, he not only began instituting cultural changes, but he transformed Microsoft's core strategy too.

Cloud computing and subscription-based services were in; the days of selling software licenses via physical compact disks were passé.

That focus on enterprise customers and – most importantly – Microsoft's shift to selling cloud-based services such as Azure and Office 365 has been an astounding success.

Today, Microsoft is a dominant player in cloud computing and a leader in artificial intelligence (AI) – and MSFT's returns prove it.

Indeed, Microsoft stock has been so remunerative since Nadella took over that long-term investors might not even notice that dud decade-plus following the tech bust.

Between January 1990 and December 2020, shares in Microsoft, which joined the Dow in 1999 at the height of the dot-com boom, generated a total return of 57,730%. The S&P 500's total return came to a mere 1,950% over the same span.

Along the way, Microsoft generated $1.91 trillion in wealth for shareholders, good for an annualized dollar-weighted return of 19.2%, according to Hendrik Bessembinder, professor of finance at the W.P. Carey School of Business at Arizona State University.

Only Apple (AAPL) generated more wealth for shareholders over those three decades, making Microsoft one of the best stocks of the past 30 years, per Bessembinder's findings, which account for cash flows in and out of the business and other adjustments.

The bottom line on Microsoft stock

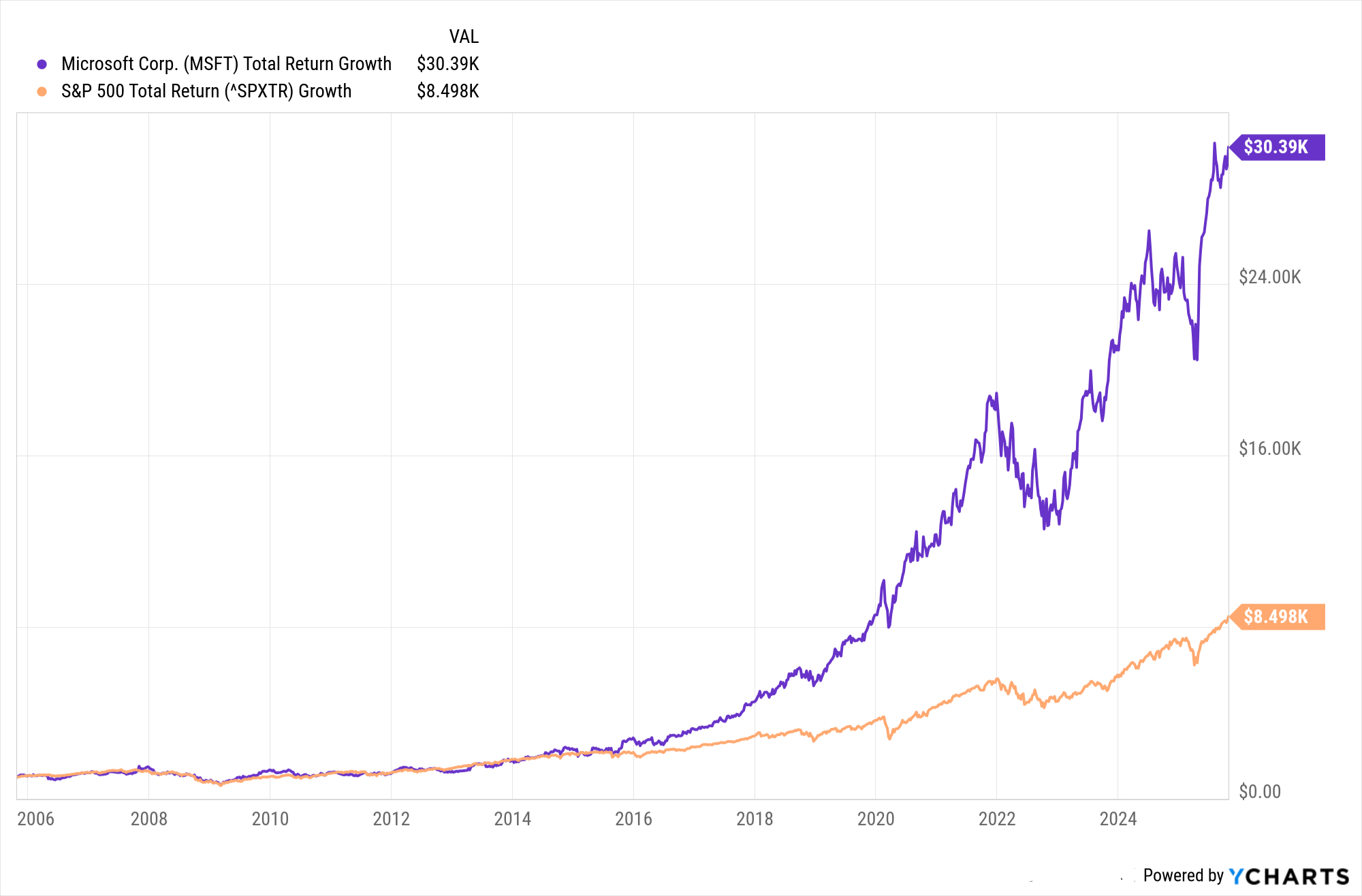

Have a look at the chart below and you'll see that if you put a grand into Microsoft stock two decades ago, it would be worth more than $30,000 today. That's good for an annualized total return (price change plus dividends) of 18.7%.

The same amount invested in the S&P 500 20 years ago would theoretically be worth about $8,500 today, or 11.4% annualized.

But wait, there's more.

Over its entire life as a publicly traded company, Microsoft has generated an annualized total return of 22.3%. The S&P 500's total return comes to 10.8% annualized over the same span.

Happily for Microsoft bulls, analysts very much expect shares to continue their market-smashing ways.

Of the 58 analysts issuing opinions on Microsoft stock surveyed by S&P Global Market Intelligence, 45 call it a Strong Buy and 13 say Buy.

It's rare for a stock with this much coverage to receive no Hold or Sell calls. The result is a consensus recommendation of Strong Buy with extremely high conviction.

No wonder MSFT routinely ranks as a top-rated Dow Jones stock, as well as one of analysts' top S&P 500 stocks to buy now.

Check out the stocks billionaires are buying or hedge funds' top blue chip stocks and you'll see that much of the putative smart money agrees with Wall Street's assessment.