Walt Disney (DIS) stock is showing signs of life again vs the broader market, but long-term shareholders might be forgiven if they've grown impatient with their returns.

Disney was having a terrific 2024 through late May. Shares were up 35% for the year to date, making DIS the best-performing component of the Dow Jones Industrial Average.

Then the bottom fell out. The media and entertainment giant's revenue came up short of Wall Street's expectations. DIS stock predictably paid the price.

Wall Street, however, continued to be bullish on the name — and that turned out to be a canny call for traders. After all, DIS stock went on to rally sharply off its summer nadir.

For all of 2024, however, DIS once again lagged the performance of the S&P 500 — an all-too-frequent occurrence. Indeed, shares underperformed the broader market through the first eight-plus months of 2025, too.

That's just how it's been for a good long while. On an annualized total return basis (price change plus dividends), DIS comes up well short of the broader market over pretty much any standardized period you care to measure beyond the past year.

Everyone remembers how the pandemic clobbered Disney, whose theme parks and film businesses were epically exposed to COVID-19. Dividend investors certainly recall that the company suspended its payout in the early months of the outbreak to conserve cash.

Disney reinstated the dividend at the end of 2023. It was welcome news for income investors and certainly helped bolster the share price.

Perhaps fewer remember how DIS stock more than doubled from March 2020 to March 2021, when shares hit an all-time high as a pandemic recovery play. At the top, Disney boasted a market cap of more than $366 billion.

What Disney shareholders would probably like to forget is that DIS is still far below its peak. Shares have lost more than 40% of their value since hitting a closing high back in March 2021, shedding more than $160 billion in market value in the process.

To put such a sum in context, that's more than the market values of six of 30 Dow Jones stocks, including Amgen (AMGN), Honeywell International (HON) and Nike (NKE).

DIS was one of the 30 best stocks in the world in the three decades ended 2020. What happened?

The rise of streaming and other tectonic changes in the past decade have Disney facing tough questions.

If CEO Bob Iger's first tenure was all about acquiring assets and making Disney bigger, his sequel run as top executive is all about remaking Disney for the new competitive landscape.

The bottom line on Disney stock

As noted above, Disney was one of the best stocks in the world over the three decades from 1990 to 2020. Mostly, though, it's been a huge bust.

While it's true that you can manipulate historical returns by fussing with their beginning and end points, Disney's record vs the broader market over pretty much any standardized period you care to measure is terrible.

For its entire history as a publicly traded company, Disney stock has generated an annualized total return of 8.2%. That trails the S&P 500 by about 2.5 percentage points.

The past two decades have been only a little better for Disney, with shares returning 9.2% vs 10.8% for the broader market.

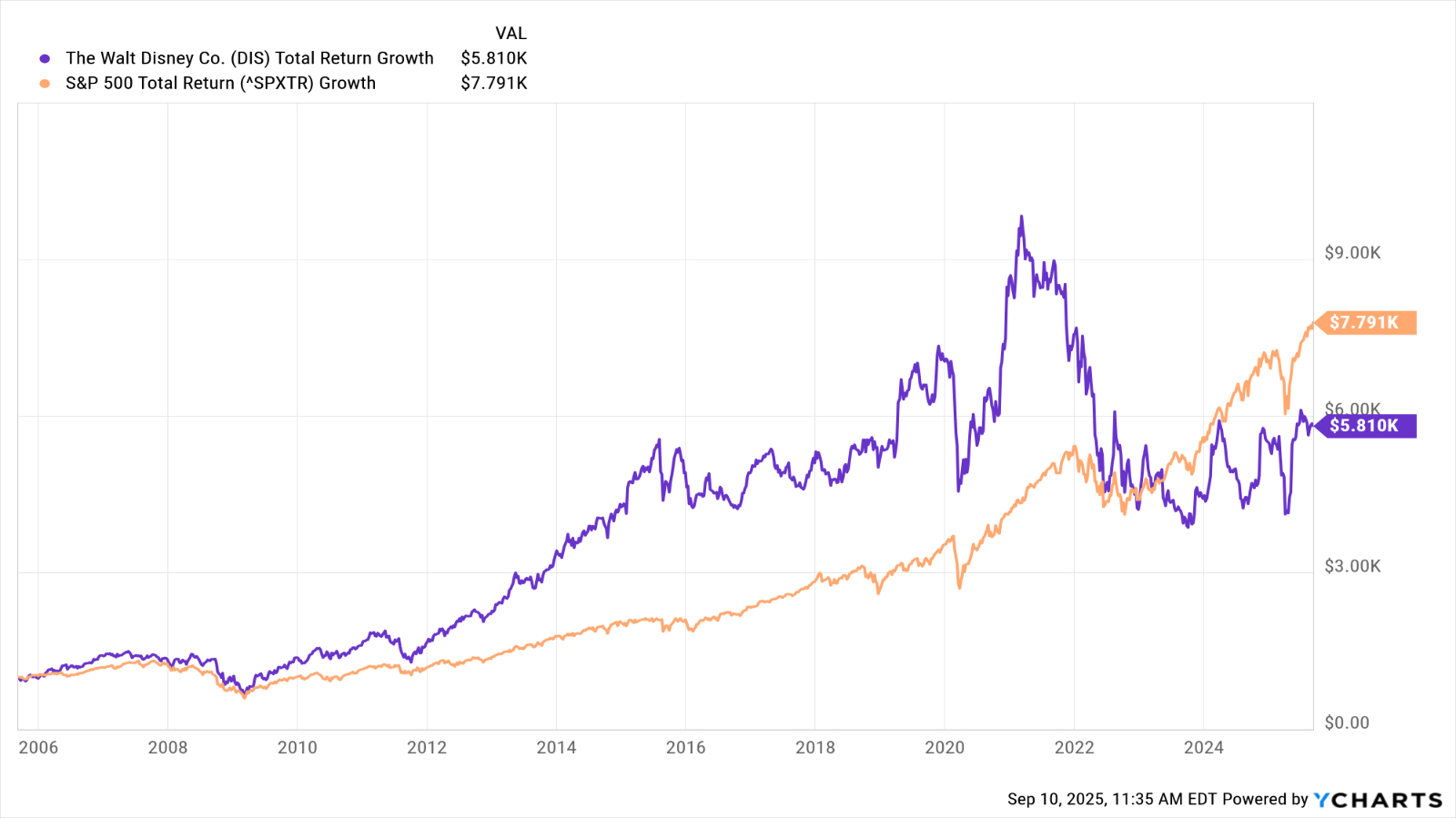

To get a sense of what this underperformance looks like on a brokerage statement, have a gander at the above chart. Note that if you put $1,000 into Disney stock 20 years ago, it would be worth about $5,800 today.

The same amount invested in the S&P 500 two decades ago would theoretically be good for about $7,800 today.

Disney shareholders expected more. If they feel those returns are disappointing, they are not wrong.

If there's a sliver of a silver lining for buy-and-hold Disney investors, at least Wall Street likes its chances of beating the market in the next 12 to 18 months.

Of the 30 analysts issuing opinions on DIS stock surveyed by S&P Global Market Intelligence, 19 rate it at Strong Buy, four say Buy, six have it a Hold, and one calls it a Strong Sell. That works out to a consensus recommendation of Buy, with strong conviction.