Adobe (ADBE) stock was supposed to get a big boost by adding AI to its offerings, and yet so far the transformational technology has only put shares under pressure.

The result? Although truly long-time shareholders are still sitting on market-beating returns, ADBE isn't the same buy-and-hold beast of yore.

While Magnificent 7 stocks such as Nvidia (NVDA) and Microsoft (MSFT) helped the tech-heavy Nasdaq Composite gain 25% over the past 52 weeks, ADBE is down a painful 30%.

It gets worse. Shares lost more than a quarter of their value last year. And while ADBE popped 77% in 2023, it lost more than 40% in 2022. Yikes.

If it's any consolation to restive shareholders, many steps forward and a few steps back is sort of par for the course for volatile ADBE stock.

Much of the recent underperformance can be attributed to competition in generative AI. For years, the company enjoyed a near monopoly in its niche. Its Creative Suite – which includes the likes of Photoshop, Premiere Pro for video editing and Dreamweaver for website design, among others – really had no peer.

But times change. The emergence of Microsoft's (MSFT) Azure and other cloud-based competitors have taken a bite out of Creative Cloud.

True, Adobe's suite of products still commands a market share of more than 60%, but there's no question the company – and its shareholders – have been feeling the heat.

Indeed, ADBE now lags the broader market on an annualized total return basis by more than 20 percentage points over the past three- and five-year periods.

The bottom line on Adobe stock

It wasn't supposed to be like this. After all, Adobe's hot 2023 run was a lot more like what longtime shareholders have come to expect from the large-cap stock.

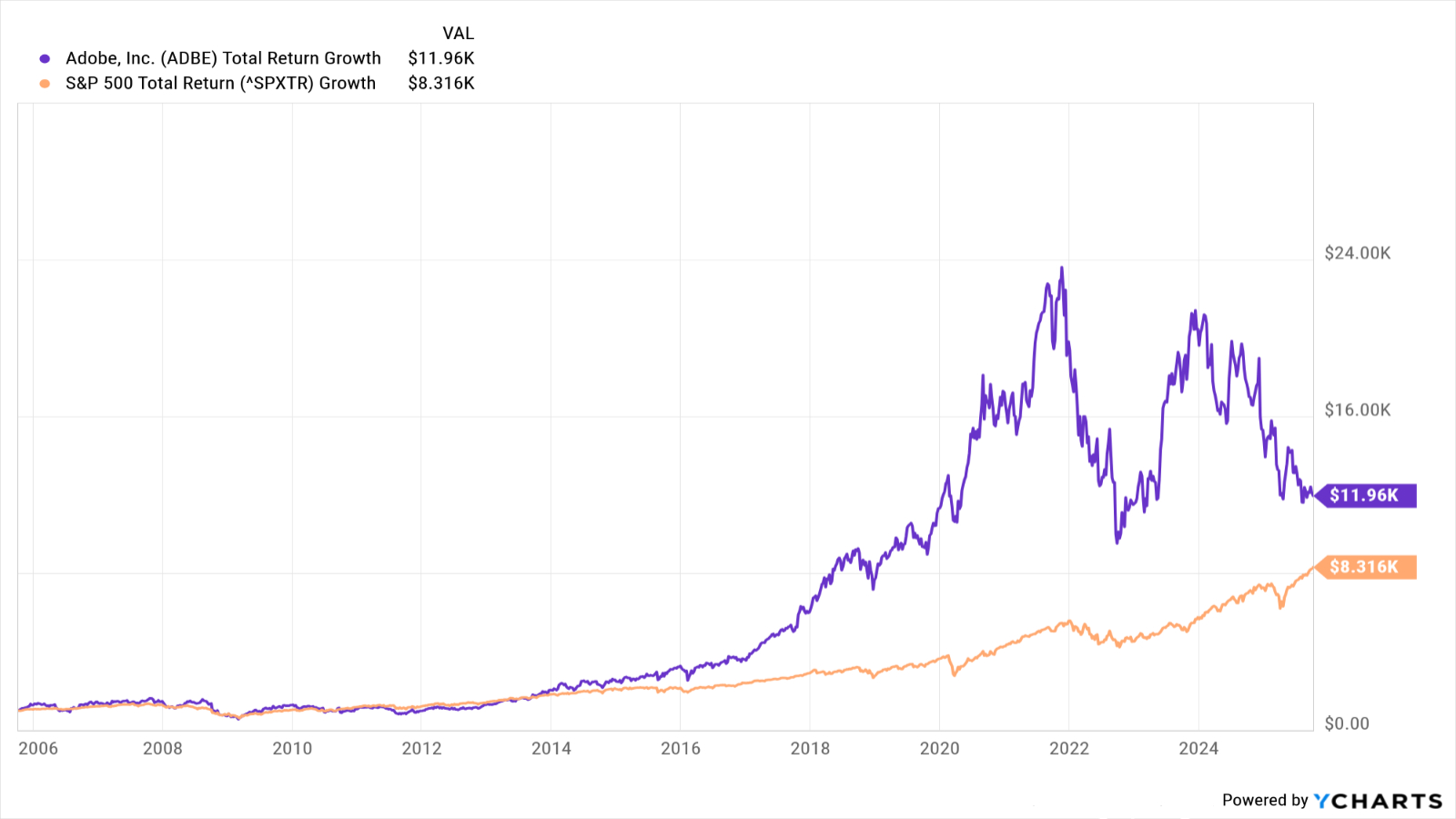

Have a look at the chart below and you'll see that a $1,000 investment in Adobe stock 20 years ago would today be worth nearly $12,000. The same money invested in the S&P 500 would theoretically have grown to about $8,300.

Although Adobe is maintaining its market-beating ways, the outperformance gap has narrowed alarmingly since shares peaked back in November 2021.

Happily for bulls, Wall Street believes ADBE can one-day reclaim its record high. Of the 40 analysts issuing opinions on Adobe stock surveyed by S&P Global Market Intelligence, 20 rate it at Strong Buy, five call it a Buy, 12 have it at Hold and three say it's a Strong Sell.

That works out to a consensus recommendation of Buy, with solid conviction.