Amongst those who believe an energy transition is occurring -- in that we are transitioning away from fossil fuels and to something else, potentially a carbon-free solution -- nuclear remains extremely intriguing. And for the most part, nuclear is expected to come from nuclear power plants, which in turn rely on uranium as their source of fuel. Moreover, power plants tend to exhibit inelastic price demand for uranium; this fact, coupled with the fact that the uranium market is small was in a bear market for most of the 2010s leads many to be extremely bullish on uranium.

In this article, we'll a take look at some of the most prominent uraniums stocks for US investors to see which, if any, would be worthy of investment.

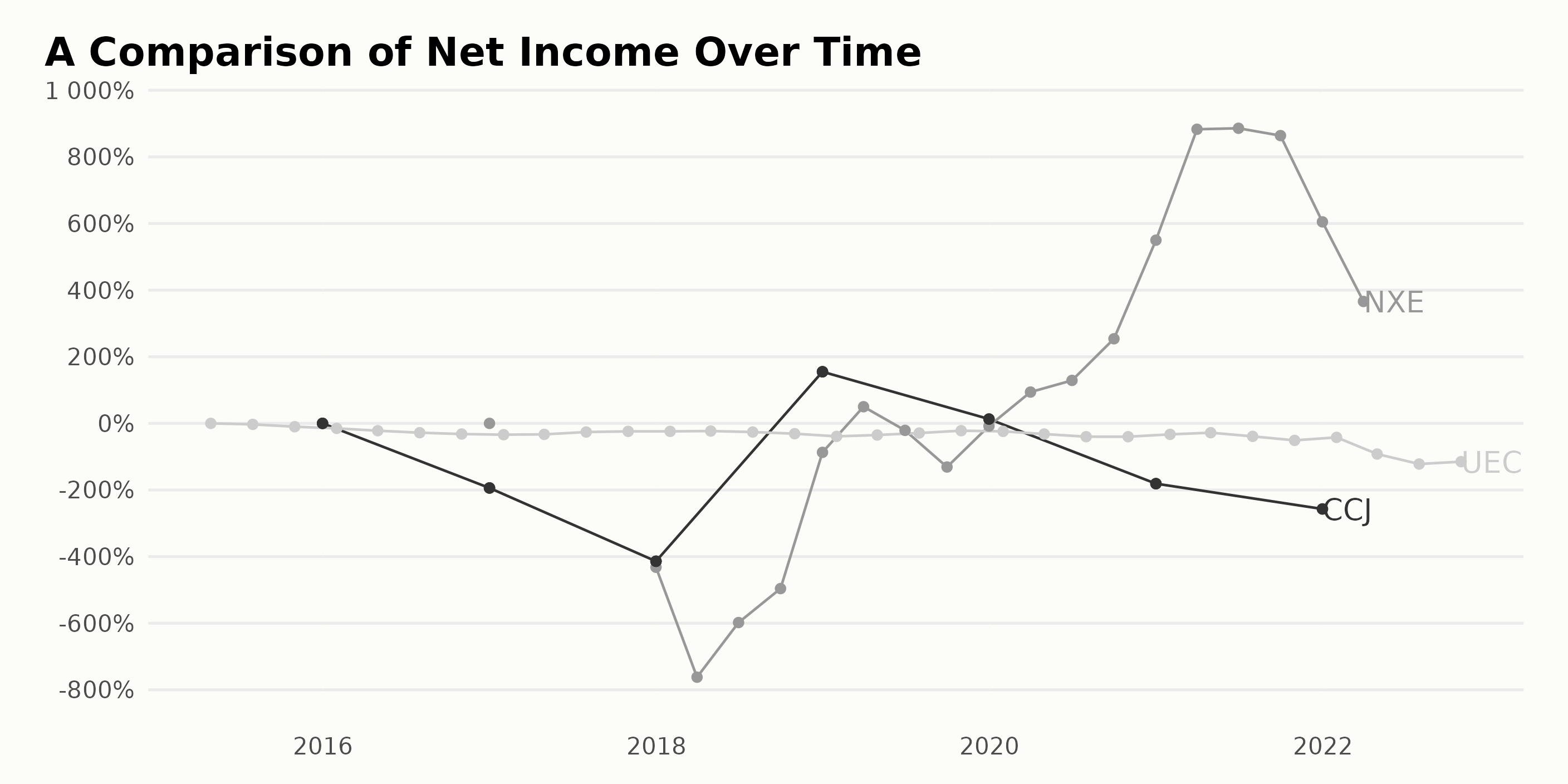

Looking for Profit? Try NXE

The Net Income of both CCJ and UEC has been decreasing steadily; for CCJ, the decline started in 2018, and for UEC it started more recently in 2022. Still, though, net income is positive for UEC; its most recent data shows that the Net Income in October 2022 was 3,569,826, which was a decrease from the previous year at 5,252,000. This represents a rate of change of -32.4%. By comparison, NXE's most recent Net Income was 7,867,000, representing a rate of change of +7.3% from the previous year. Therefore, the rate of change of UEC's Net Income is lower than NXE's rate of change. As for CCJ, it has a history of profitability, but is trailing twelve month net income on its October 2022 SEC filing did report a small loss of around 19 million. In sum, for those seeking the safety of income, NXE may be the most appealing option.

Revenue: UEC Crosses Zero Line

As for revenue, UEC has the benefit of going from zero to positive during the past 8 years. Specifically, from it's reported value of 0 in October 2016 to January 2022, its revenue grew an average of 1.28 million USD every 3 months, going from 0 to 80.5 million USD. Since then, revenue of UEC has continued to inch higher, and is now at over $81 million for its most recent publicly reported trailing twelve months.

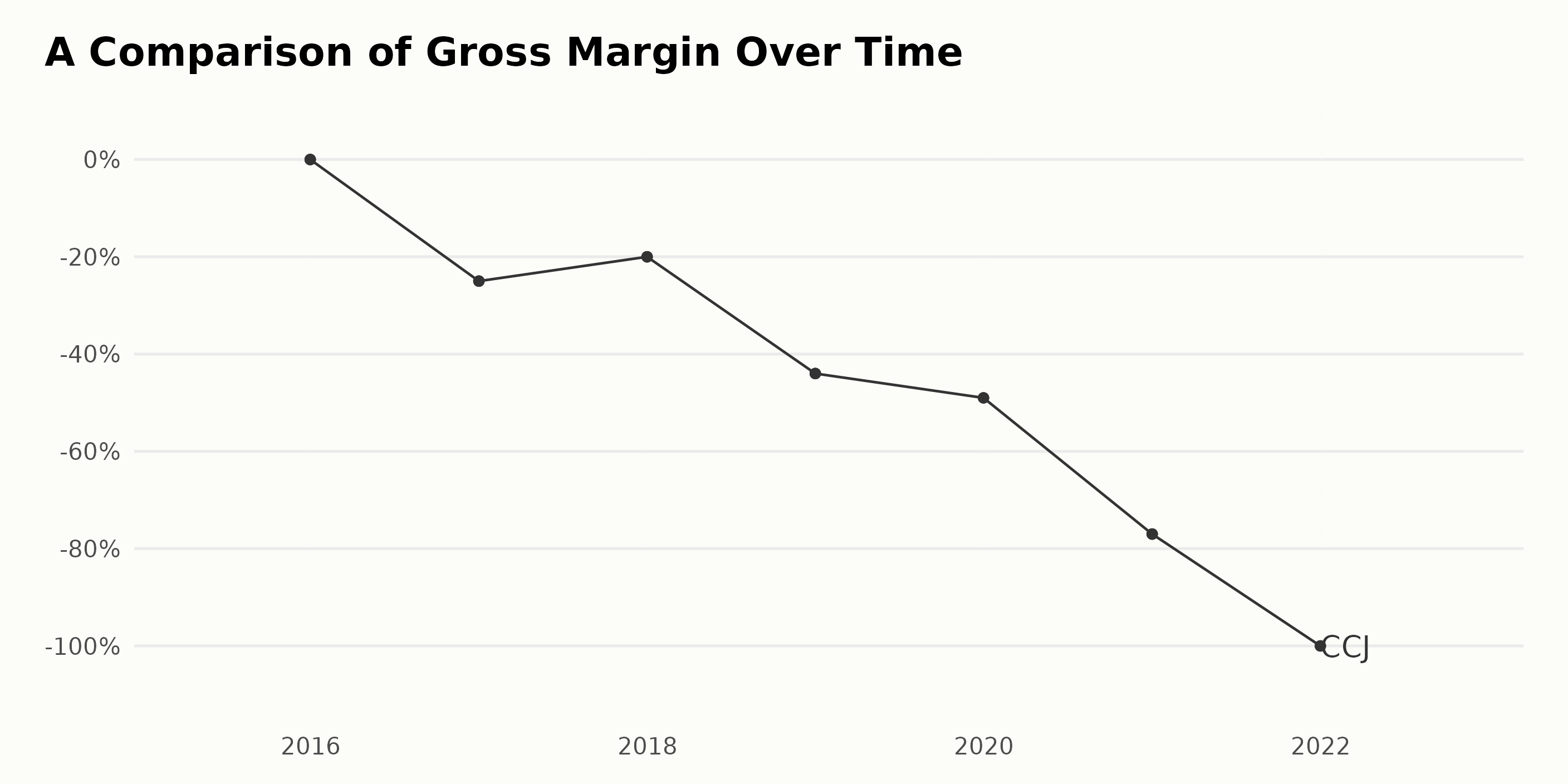

Gross Margin: Potential Red Flags for CCJ

UEC's most recent reported Gross Margin was 26.3% (0.263) in October 2022. This was a slight decrease of 15.1% (0.052) since April 2022 when the Gross Margin was 31.5% (0.315). This follows a similar trend across the last couple years with their Gross Margin seeing fluctuations between around 25-32%. The rate of change was higher in earlier years, with a 24.7% (0.247) decrease from its April 2016 value to April 2015. This is in stark contrast to CCJ, which has seen a collapse of its gross margin since 2016, as the chart below illustrates.

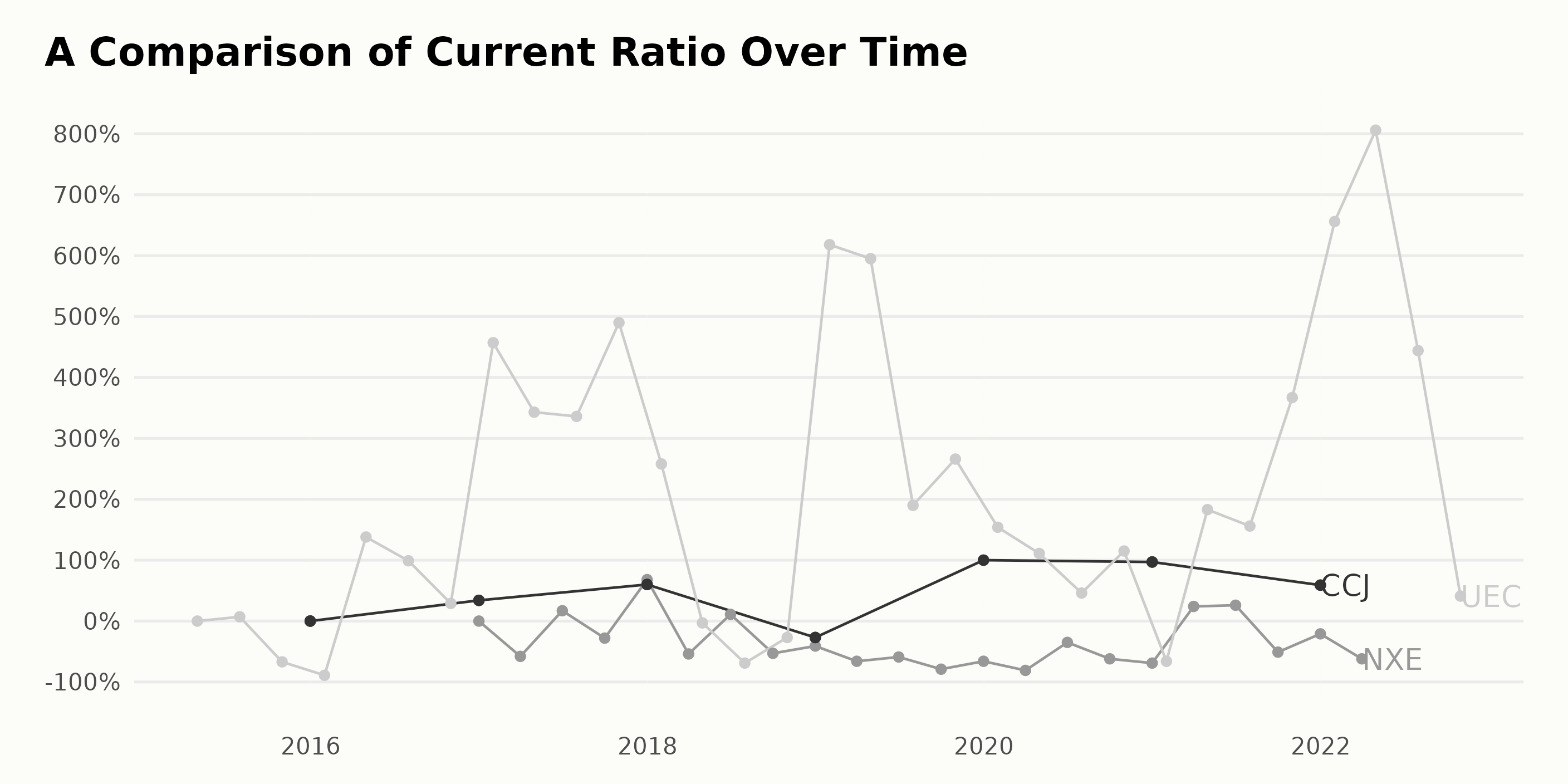

Comparing Changes in Current Ratio

Some analysts prefer to look at the current ratio to get an idea of a company's balance sheet, and its ability to remain solvent in the short-term. The Current Ratio of UEC is trending upward over time, increasing from 0.24 in January 2016 to 3.12 in October 2022. The highest Current Ratio reported was 20.04 in April 2022, and the lowest current ratio was 0.24 in January 2016. The current ratio for UEC has seen a change of +2.88 between October 2022 and July 2021, and from January 2019 to October 2021, the current ratio increased by +2.53. On the other hand, the highest rate of change can be observed from July 2021 to April 2021 with a change of +5.36. While NXE's current ratio stands out in the chart below, it's worth noting the company's ratio is still very positive -- and thus it does not appear to be in danger of insolvency.

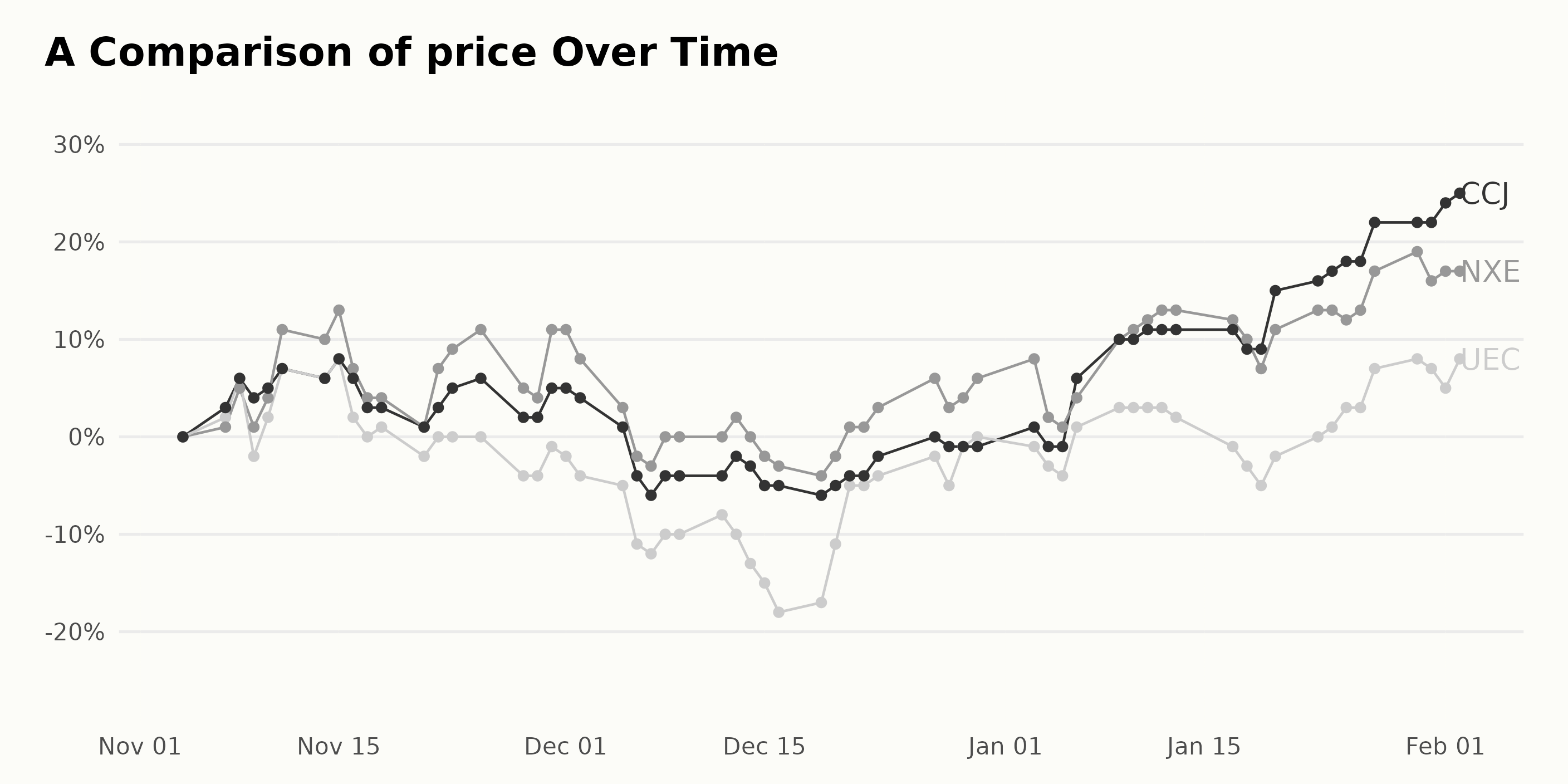

Comparing Share Price Trends of UEC, NXE and CCJ from November 2022 to February 2023

The share price of UEC has had an overall increasing trend from November 2022 to February 2023, with a sharp increase from 3.71 in December 2022 to 4.09 in February 2023. The share price of NXE has had a volatile but overall increasing trend from November 2022 to February 2023, with a high of 4.865 in February 2023. Lastly, the share price of CCJ has had an overall increasing trend from November 2022 to February 2023, with a sharp increase from 21.87 in December 2022 to 28.23 in February 2023. CCJ does have the most momentum here, and when coupled with its market cap, it may lead to the question of whether or not capital will head to large caps first if a sustained bull market in uranium emerges.

shares were trading at $415.09 per share on Thursday afternoon, up $4.29 (+1.04%). Year-to-date, has gained 8.54%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Simit Patel

Simit Patel has 2 decades of investing experience applying a top-down approach starting with macroeconomics followed by price action technical analysis to find more winning trades.

If a Bull Market in Uranium is Coming, You'll Want to Know About UEC, CCJ, and NXE StockNews.com