/Idex%20Corporation%20logo%20and%20lab%20sign-by%20viewimage%20via%20Shutterstock.jpg)

Northbrook, Illinois-based IDEX Corporation (IEX) is an applied solutions company specializing in a range of applications such as fluid and metering technologies, health and science technologies, and fire, safety, and other products. With a market cap of $12.3 billion, IDEX’s operations span the Americas, Europe, and the Indo-Pacific.

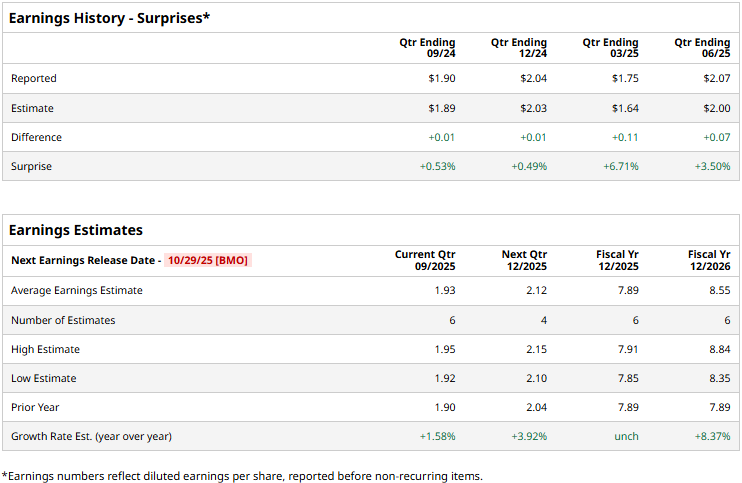

The industrial major is gearing up to release its Q3 results before the market opens on Wednesday, Oct. 29. Ahead of the event, analysts expect IDEX to report an adjusted profit of $1.93 per share, up a modest 1.6% from $1.90 per share reported in the year-ago quarter. On a more positive note, the company has consistently surpassed Wall Street’s bottom-line projections in each of the past four quarters.

For fiscal 2025, analysts expect IDEX to report an adjusted EPS of $7.89, remaining flat year-over-year. While in fiscal 2026, its earnings are expected to grow 8.4% year-over-year to $8.55 per share.

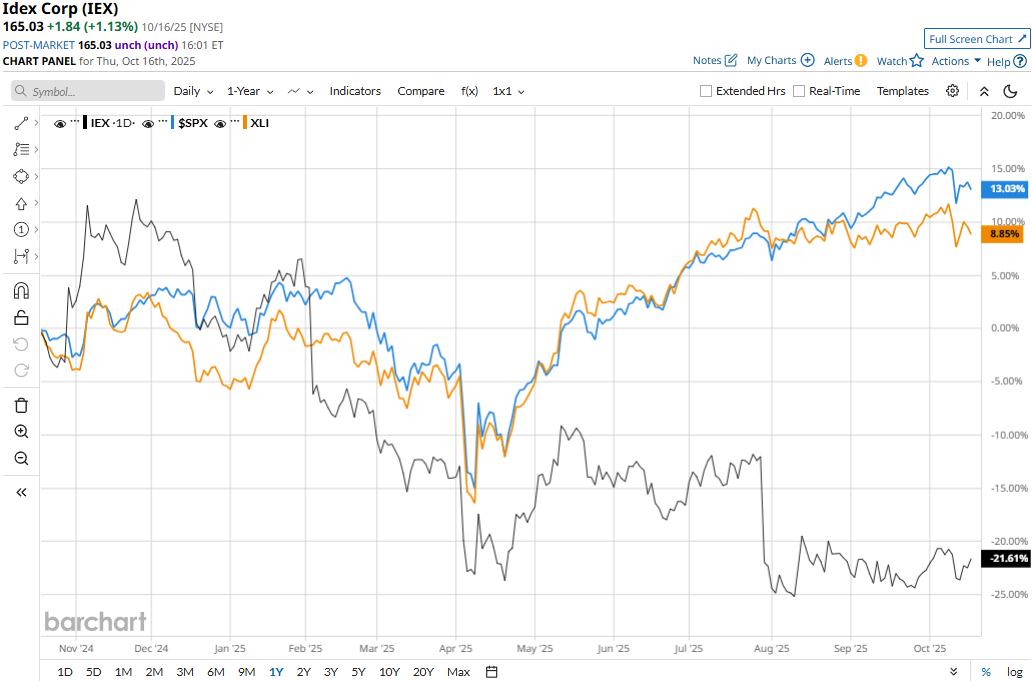

IEX stock prices have tanked 21.6% over the past 52 weeks, notably lagging behind the Industrial Select Sector SPDR Fund’s (XLI) 8.9% gains and the S&P 500 Index’s ($SPX) 13.5% returns during the same time frame.

Despite delivering better-than-expected results, IDEX’s stock prices dropped 11.3% in a single trading session following the release of its Q2 results on Jul. 30. Driven by a slight uptick in organic revenues and contributions from acquired businesses, the company achieved record sales during the quarter. Its net sales came in at $865.4 million, up 7.2% year-over-year, beating the Street’s expectations by almost 1%. Further, the company delivered an adjusted EPS of $2.07, surpassing the consensus estimates by 3.5%. However, the company’s full-year guidance didn’t match the Street’s expectations, triggering the sell-off.

Analysts remain cautiously optimistic about the stock’s prospects. IEX maintains a consensus “Moderate Buy” rating overall. Of the 13 analysts covering the stock, opinions include six “Strong Buys,” one “Moderate Buy,” and six “Holds.” Its mean price target of $192.64 suggests a 16.7% upside potential from current price levels.