Monthly cost: $24

Yearly cost: $240

Family plan: $35/month

No. of bureau scores: 3

No. of bureaus monitored: 3

Frequency of credit reports: Yearly

Type of credit score: VantageScore 3.0

Credit-improvement simulator: Yes

Credit-lock/freeze button: Yes

Security software: VPN, browser extensions

Investment account monitoring: Yes

Max. ID-theft coverage: $1 million

Data Breach Alerts: Yes

Medical Records Monitoring: Yes

Payday loan monitoring: Yes

Sex Offender Alert: Yes

Title Change Alert: No

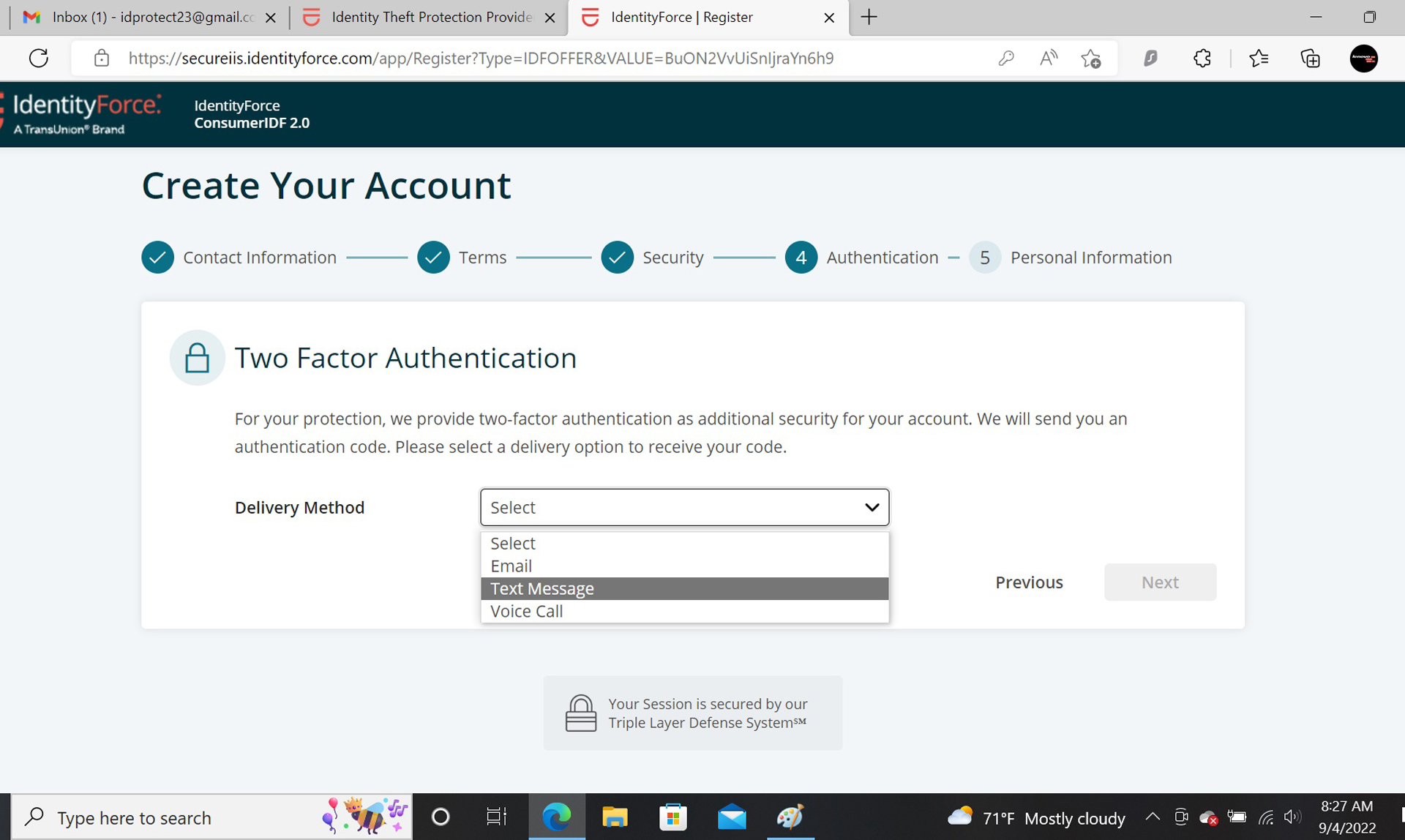

Two Factor Authentication (2FA): Yes

The last few years IdentityForce has led the pack with the best assortment of identity protections for the best price, but the world has changed and IdentityForce has remained basically the same while its competitors have innovated and added valuable protection features.

It continues to provide thorough ID protection, financial monitoring and a good level of insurance and services, but its combination of VPN and browser extensions can’t compete with the best. Ironically, that includes the likes of Bitdefender Ultimate Plus, which uses IdentityForce’s ID protection services but goes the extra online mile with malware protection, a secure password manager and other security-related goodies.

Our IdentityForce UltraSecure+Credit review will help you decide if this is still the best identity theft protection service for you or if you’re better off going with Bitdefender Ultimate Plus or another service instead.

IdentityForce UltraSecure+Credit: Costs and what’s covered

Owned and operated by TransUnion, IdentityForce continues its admirably simple two-plan lineup. It is like a breath of fresh air compared to the choices that Norton LifeLock has but doesn’t allow you to customize protection and levels of insurance and credit monitoring.

The IdentityForce UltraSecure plan costs $18 a month or $180 a year for an individual or $25 a month or $250 a year for a family that includes an unlimited number of children under 18 years old. The protection comes with $1 million in identity theft insurance to cover lost funds, documents and to pay for missed work time. The Family plan protects kids with ChildWatch, which checks children’s social media accounts and also includes credit and account activity monitoring. On the downside, there’s no credit monitoring, while the base plans from competitors generally have at least one bureau’s scores.

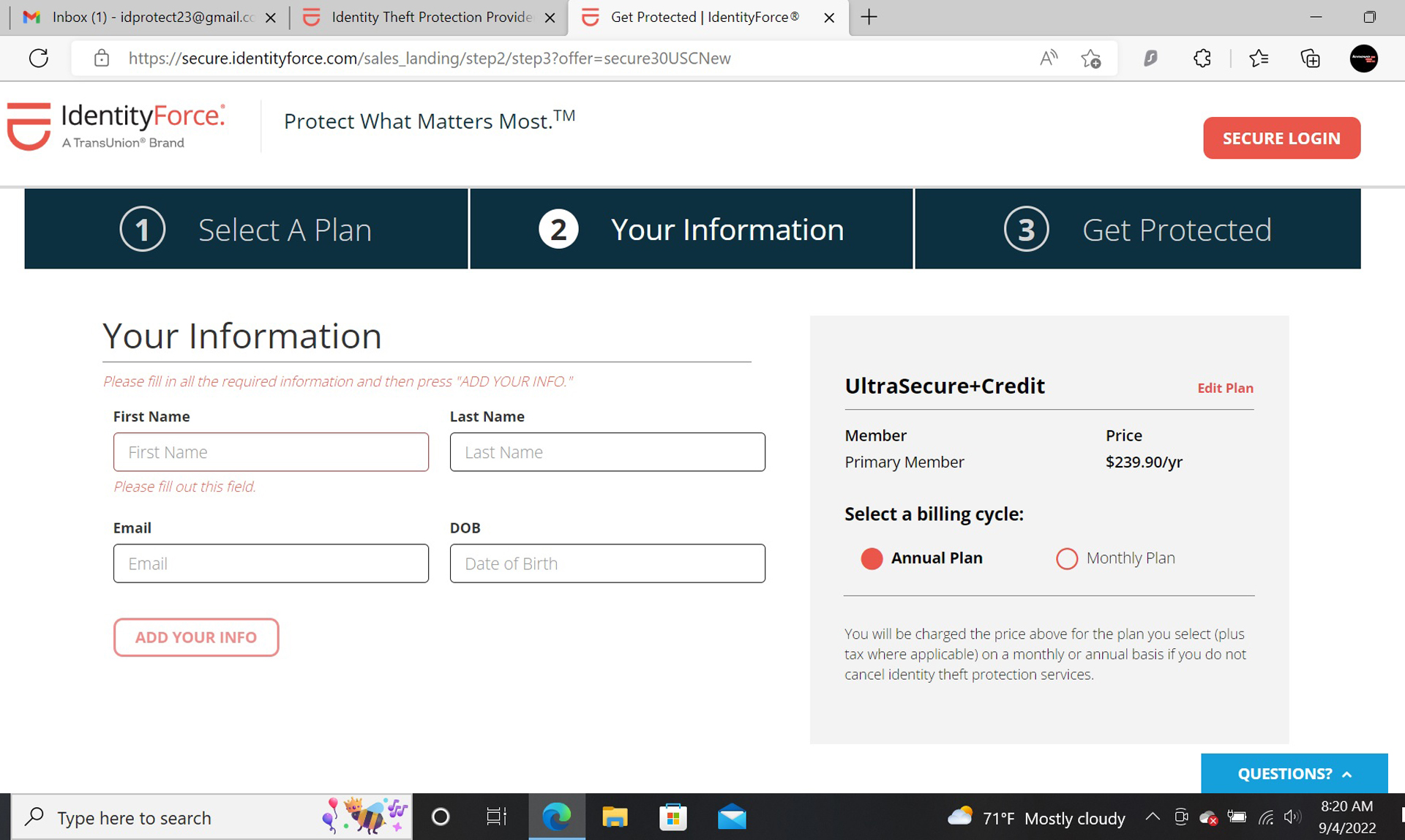

If you want credit scores, the UltraSecure+Credit plan includes them and was the version I reviewed. It costs $24 a month or $240 a year for an individual or $35 a month or $360 a year for a family; again, they’re generous with an unlimited number of children under 18 years old. The top plan has the same $1 million of ID theft insurance but adds credit scores and quarterly credit reports from Equifax, Experian and TransUnion. This is augmented with a credit score tracker, well-designed credit simulators and utilities, like a password manager, but no malware protection.

The top plan offers a TransUnion credit Freeze button which can lock your credit instantly.

Unlike others, IdentityForce doesn’t discount the first year of service, but there is a 30-day free trial. On the other hand, the billing starts immediately but you can request a refund. IdentityForce secured a coveted A+ with the Better Business Bureau showing a good relationship with its customers.

UltraSecure+Credit review: How we tested

Along with the other identity protection services, late in the summer of 2022, I signed up for IdentityForce Ultra Secure+Credit and paid for it with my credit card; later, Tom’s Guide reimbursed me. I checked in several times a week with a variety of computers and canceled the service after three months of intensive use.

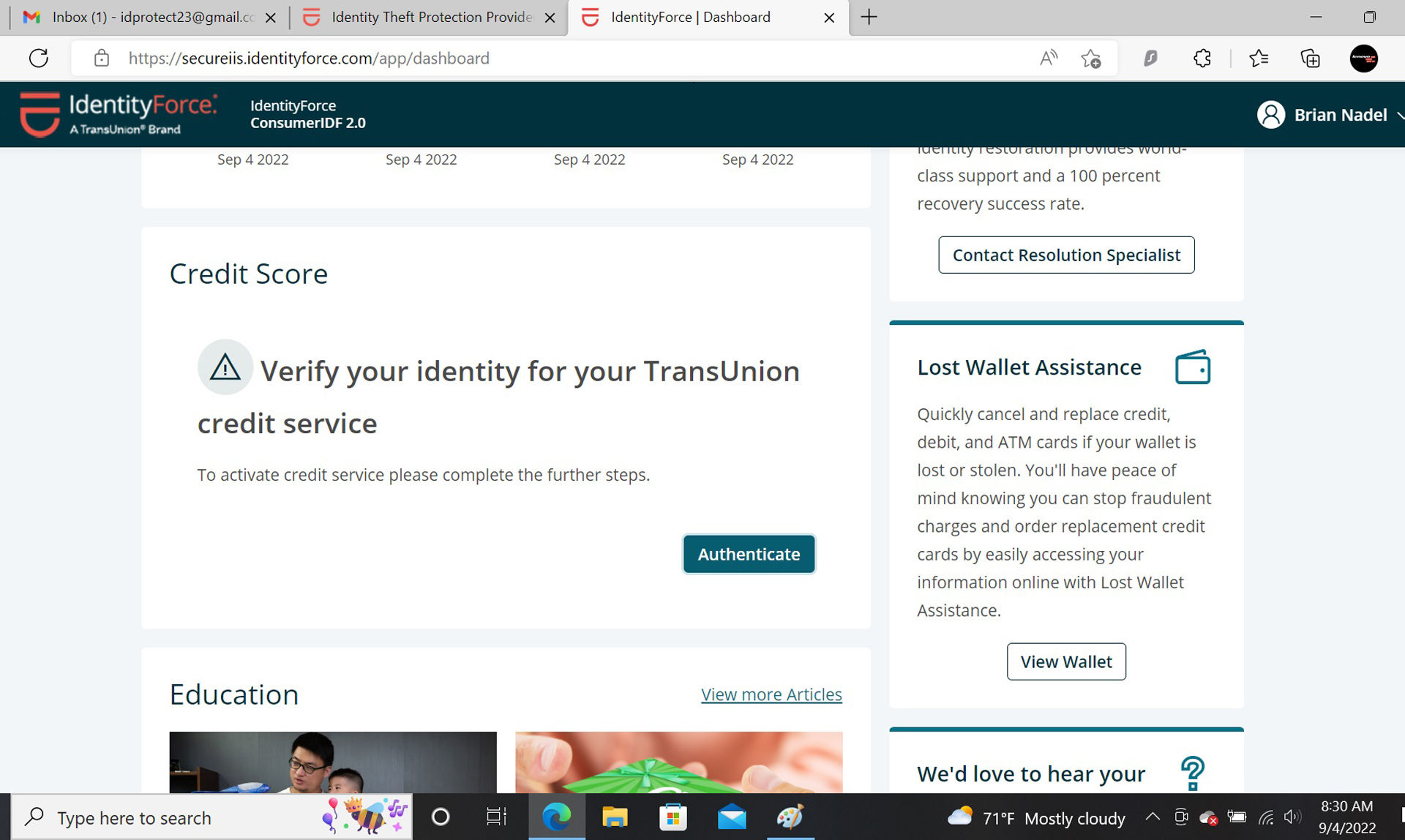

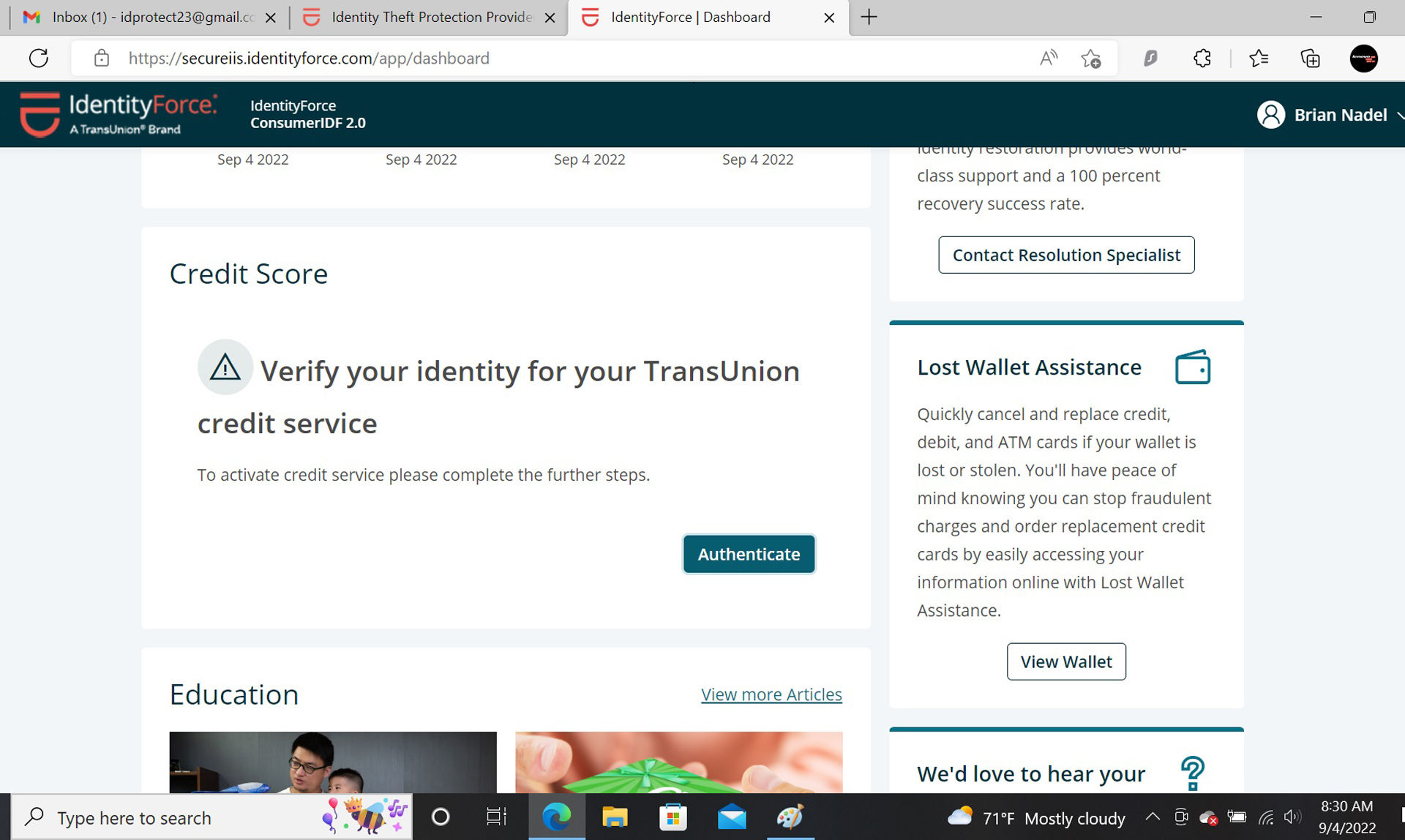

IdentityForce UltraSecure+Credit review: Credit scores, reports and monitoring

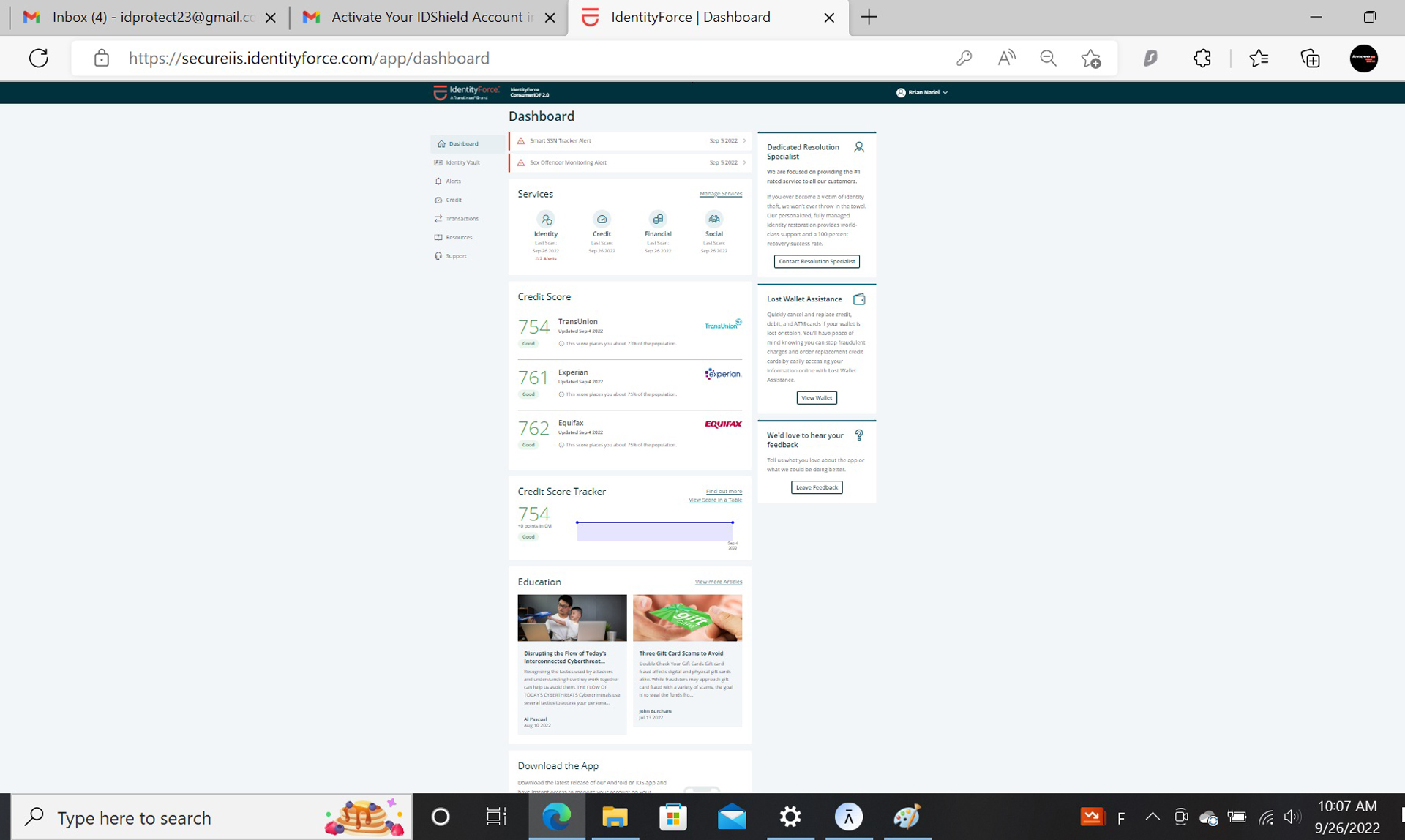

While the IdentityForce UltraSecure plan lacks any credit monitoring or reporting, the IdentityForce UltraSecure+Credit service makes up for it. There are instant scores and access to your VantageScore 3.0 composite score. It’s not as popular with lenders compared to the FICO scores they actually use to write loans and mortgages. Still, it should be fine for most looking to see their chances of getting a loan. There’s also a month-by-month tracker to see trends in scores over time.

The Ultimate+Credit plan also comes with Equifax, Experian and TransUnion quarterly reports. A step down from the competition’s monthly reports, it’s better than those that lack access to the reports or those that send them out annually.

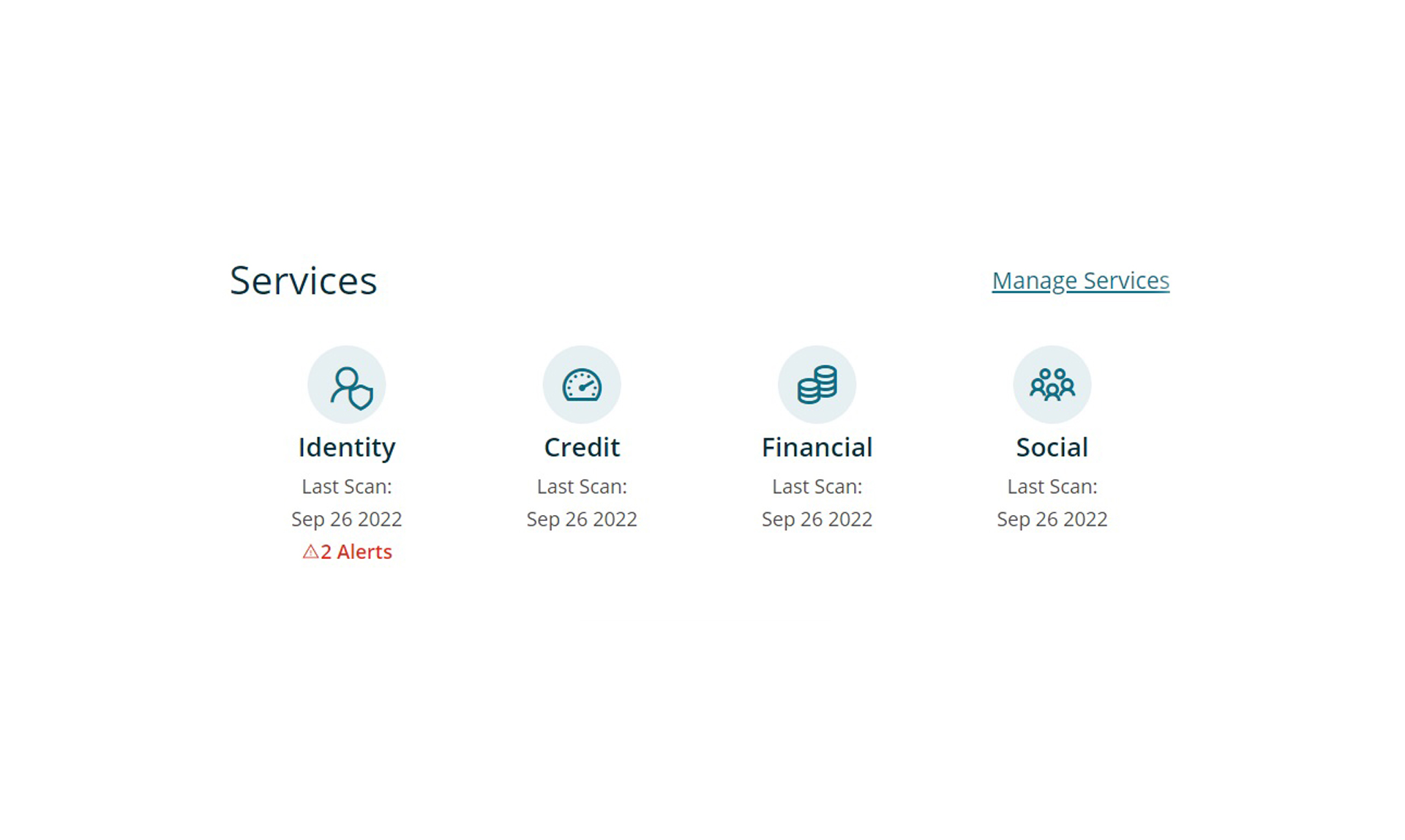

After registering my accounts, IdentityForce monitored them for bizarre activity, like large sums being moved. The service keeps an eye on medical ID numbers as well as action at payday loan companies. It can let you know if someone has applied for an address change, but it lacks the ability to warn of a title change.

IdentityForce is one of the easiest services to start a credit freeze, makes it easy to opt out of junk-mail lists and rates the hazard of breaches that might have involved your data. The service’s BreachIQ is also used by Bitdefender’s Ultimate Security Plus plan and helps show where your information has ended up. At the moment, it’s advisory only although some IdentityForce employer benefit plans have the power and staff to remedy the situation. IdentityForce is trying to add this to its list of features this year.

IdentityForce UltraSecure+Credit: Insurance and services

IdentityForce has up to $1 million of identity-theft insurance, half the $2 million that Bitdefender provides with its IdentityForce-based Ultimate Security Plus plan. IdentityForce provides lawyers, investigators, accountants and more to figure out what happened and get you your life back. It is backed by an AIG insurance policy.

The coverage pays for anything from replacing your documents (like a driver’s license and passport) to making up for lost work. It has a maximum of five weeks of coverage at $2,000 a week. If you need to travel to another city to amend or rectify records, IdentityForce will reimburse you for the cost of the travel.

Its lost wallet protection is middling. It can help cancel your credit and debit cards to limit the damage, but between the issuing organizations and IdentityForce, you should be fully covered against any loss.

IdentityForce UltraSecure+Credit: Notifications and alerts

With a slew of potential alerts that can be sent by text, email or as a notification on the web page or mobile app, UltraSecure+Credit can warn of potential ID dangers. These include your Social Security number or email address showing up in the wrong places online as well as a court action or even a bankruptcy proceeding.

Happily, the bank and investment account protection can be adjusted to set a minimum dollar amount for withdrawal so that the alerts aren’t overwhelming.

On top of an alert if someone opens a credit card or takes out a loan in your name, IdentityForce UltraSecure+Credit can let you know if a registered sex offender moves within a preset distance from your home.

Other alerts can be triggered by actions at payday loan firms or public record changes. If your personal information, such as a Social Security number or an address, show up in court records, bankruptcy proceedings and property-title changes, you’ll get a notification.

Over the three-month test period, I received two alerts, one for a sex offender moving into my neighborhood.

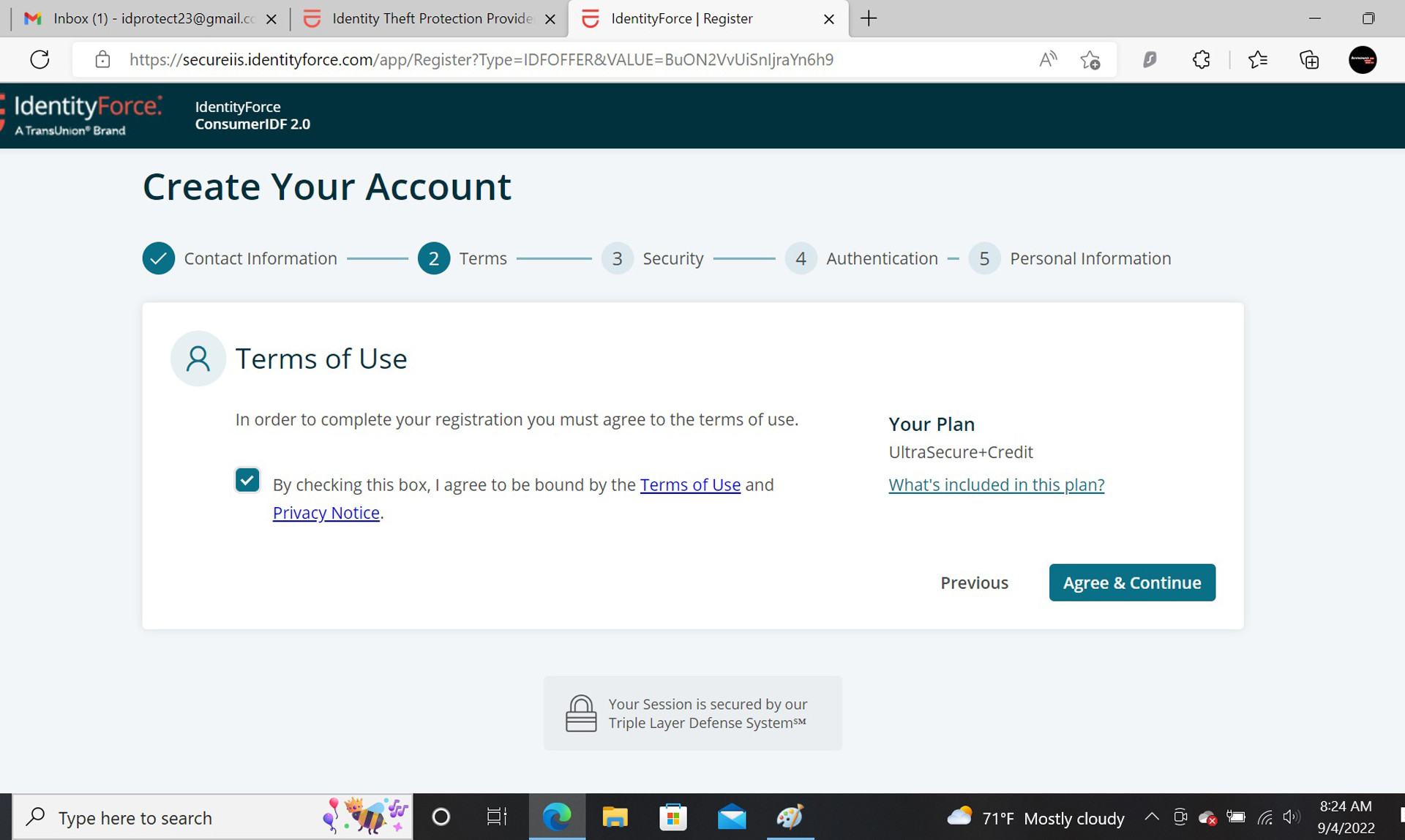

To make sure it isn’t the source of a personal information breach, your data is encrypted on IdentityForce’s servers. All use of the web page or app is done using a secure HTTPS connection and the service has two-factor authentication.

IdentityForce UltraSecure+Credit: Setup

After going to the IdentityForce website, I went to “Sign Up Today” and picked the Ultra Secure+Credit plan. I clicked “Start Protection” and then entered my date of birth, name and email address for the account. Finally, I picked the plan and paid for it with a credit card; IdentityForce doesn’t use PayPal.

The installation sequence took me to the Dashboard page, where I added my phone number, address and clicked to accept IdentityForce’s terms of use. I created a password and answered three challenge questions, followed by signing up for two-factor authentication.

At this point, everything was set up, well, almost. I still needed to authenticate myself by typing my Social Security number twice and answering questions about past employers, loan payments and where my Social Security number was issued. At 10 minutes and 30 seconds, I was done, and the credit scores appeared on-screen. It might not be record time, but it was a relief compared to some of the competition.

I wasn’t really done though because I needed to spend another minute to load the IdentityForce app on my phone. I used the app as well as my phone’s browser.

IdentityForce UltraSecure+Credit: Interface and utilities

IdentityForce combines a web-based interface for notebooks and desktops with an app for phones and tablets. There are iOS and Android versions that have a similar look and feel. This provides the flexibility to use the service at home, the office or anyplace in between. All transactions and storage use encryption.

The browser takes it all in but requires zooming out to 33% to see nearly everything on an HD screen. At 50% it was easy to read and didn’t require too much scrolling. In addition to the current credit scores up top, the Dashboard has IdentityForce’s Credit Score Tracker that looks at the composite VantageScore 3’s changes over time.

In addition to instant access links on the right for an identity crisis and help with a lost or stolen wallet, the UltraSecure+Credit plan provides access to the four major categories up top in the Services box. While Identity keeps an eye on your social media (although not LinkedIn), there’s a place to add new credit or debit cards, up to 10. The Credit section is where I was able to see my scores and a look at my credit history. A bonus is the credit simulator to see if borrowing more money or paying off my outstanding balances was a better approach. There’s also a place to initiate a credit freeze.

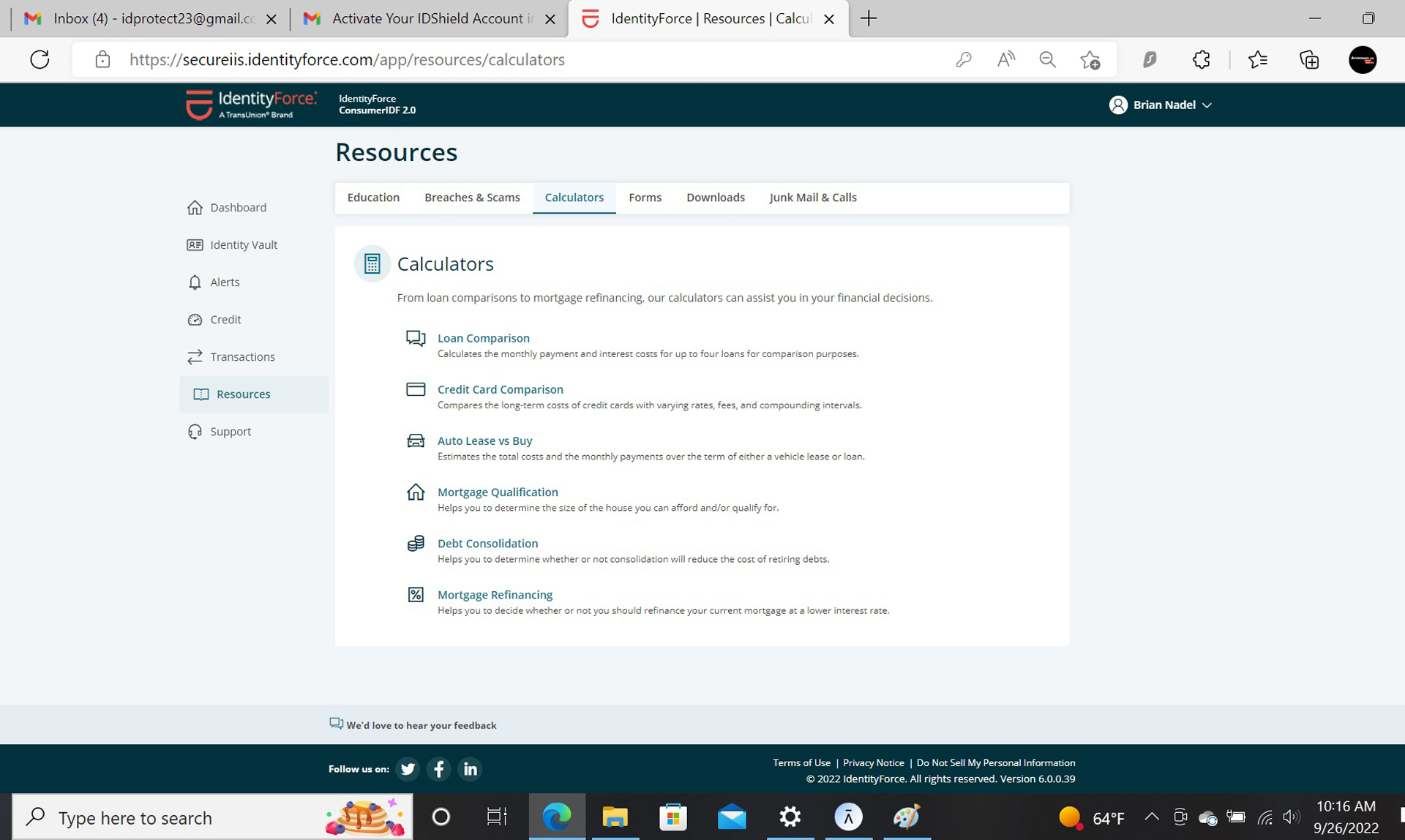

If you click on the Calculators at the top, you’ll be rewarded with simulators and apps for helping you achieve your financial goals. In addition to helping decide if the time is right for a mortgage refinance, there are sections for leasing versus buying a car and comparing credit card offers. They are the same as those offered by Bitdefender.

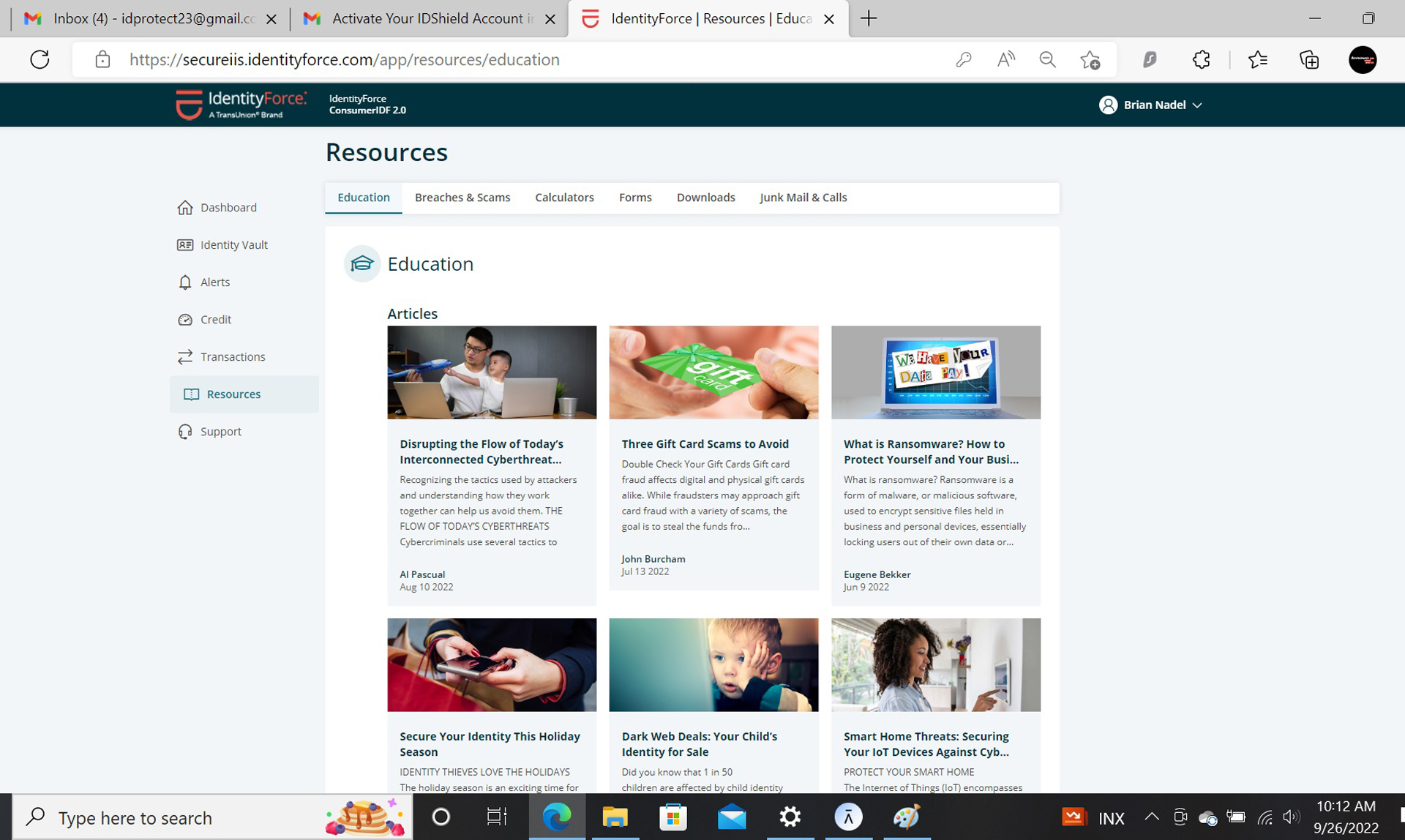

Along the left is a menu for access to the major components of the IdentityForce service. The choices include Identity Vault, Alerts, Credit, Transactions, Resources and Support. Any newcomer to identity protection or credit scores should go to the Resources section link on the left. It has interesting educational articles on threats, how credit works and how to avoid scams, although the most recent item was six weeks old. There are several 15-minute webinars and an excellent glossary at the bottom.

At first, I had problems with the IdentityForce app. It loaded fine but I wasn’t able to log into my account. After contacting tech support several times, it started working, but there’s a backup: using the phone browser worked just as well.

IdentityForce UltraSecure+Credit: Cancellation

One of the easiest ID protection services to cancel, unfortunately it needed to be done on the phone with no online option. Still, it took all of two minutes to talk to the tech support person and end the relationship. Happily, they didn’t try to entice me to stay with the plan at a discount. I got an email confirmation in less than five minutes.

IdentityForce UltraSecure+Credit review: Bottom line

With a good balance of credit monitoring and identity protection and insurance, the Identity Force UltraSecure+Credit plan is a reasonably complete way to keep your identity secure. A favorite of ours over the years, we think that the Bitdefender Ultimate Security Plus is a better deal. It has the same underpinnings, costs the same and adds a password manager, VPN and some of the best malware protection available anywhere. It’s only available in annual plans, however. If you like to live month-to-month, IdentityForce is for you.