/Tesla%20car%20with%20symbol%20by%20Michael%20Fortsch%20via%20Unsplash.jpg)

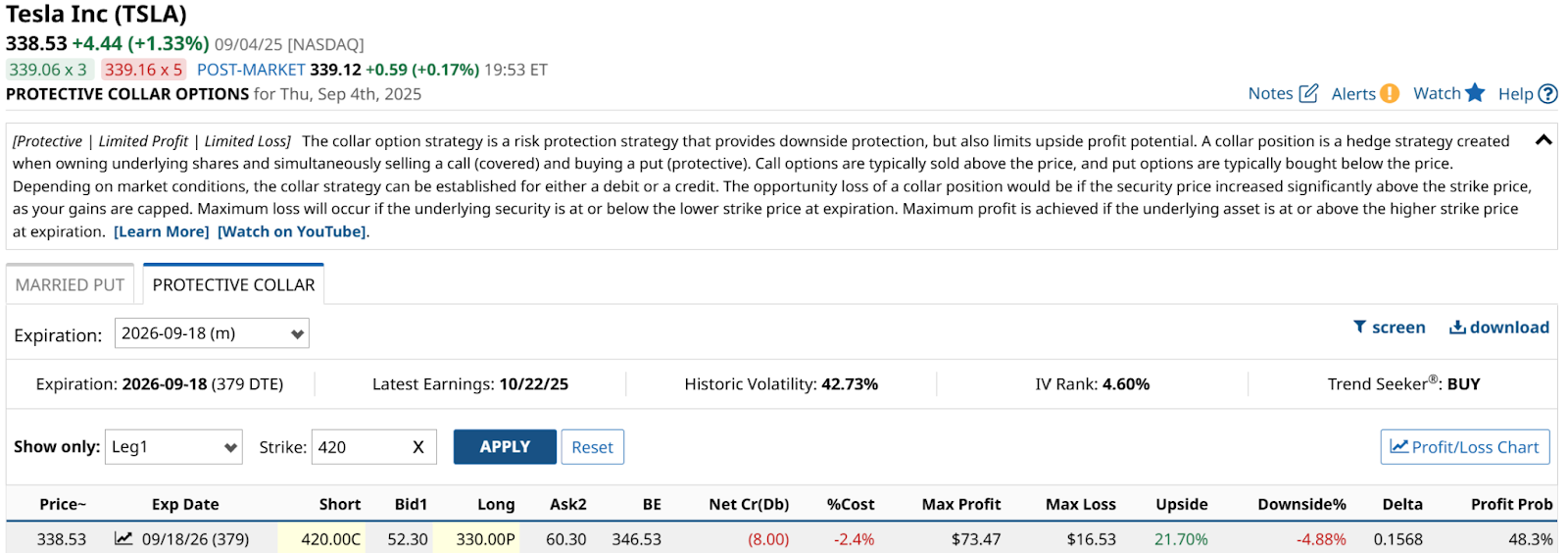

I last wrote about Tesla (TSLA) back on Sept. 5, when the stock was selling at around $338 a share. My conclusion was that it was a good time to consider an option collar, given a combination of a helpful chart pattern and the stock’s persistent high volatility. That makes option prices more buoyant, even when a stock like TSLA is moving in a tighter range than usual.

I’ve included the collar analysis snapshot from that article here. Because I think TSLA is again presenting a good setup for a collar, but for different reasons. So, I figure it’s time to play the TSLA card again.

That previous collar did the trick. It protected the stock just below the stock’s price at the time, while affording upside to $420 through next year. I will not in this article assume that anyone collared TSLA right then and there, but simply mention that if they had, they’d be up a lot, but have a high-class problem now.

They could get called, but more likely they will be looking at a “dead money” situation for another year. That’s because the stock closed Friday, Sept. 26 about $20 a share higher than the call price from that Sept. 5 article. And, they would still have the downside risk to that original put strike at $330.

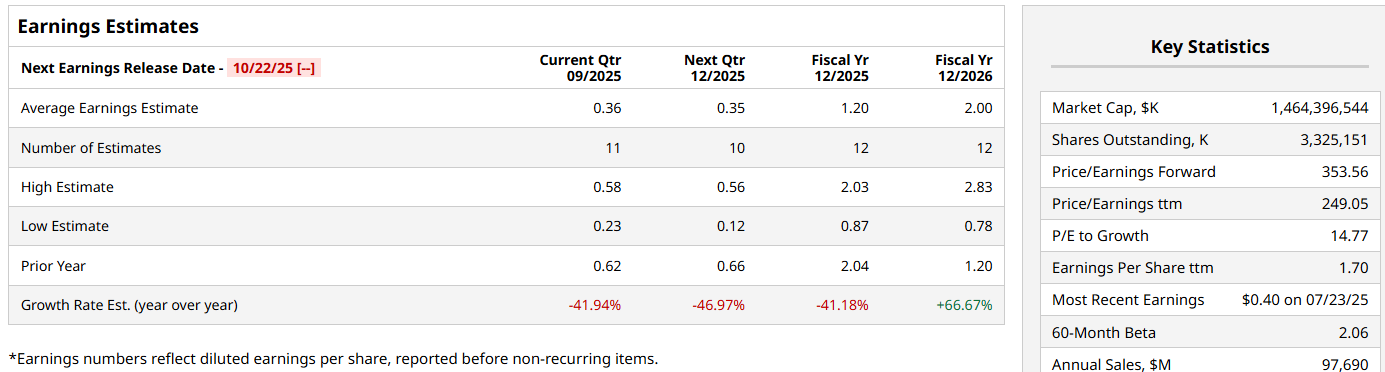

Before looking at TSLA’s chart and updated collar scenario, let’s take note of a key event coming up in about three weeks. Earnings for the latest quarter are due on Oct. 22 after market close, and are set to be a head-turning event. But part of why a collar can make sense now is that if the broad market continues to drift higher into that TSLA earnings date, the stock could benefit from the old “buy the rumor” scenario.

But a collar holder would already be protected from some portion of an earnings disappointment. Indeed, if the stock were to rocket higher in the coming weeks the way it did recently, that could even present an opportunity to “roll” the collar forward, setting a fresh and higher low than the one I point out in the example below.

I’ve put on more than my fair share of collars just before earnings releases. If the stock pops, great. If it craters, no big deal, I’ve already set my low price, and taken my shot.

Setting Up the Next TSLA Collar Trade

Here’s the stock now. It is showing signs of tiring after that 30% move, and has doubled since its April lows. We never know with Tesla, but this seems like the right time to take a fresh look. Not only to hedge via the put side of the collar, but to reach for more upside in the months ahead.

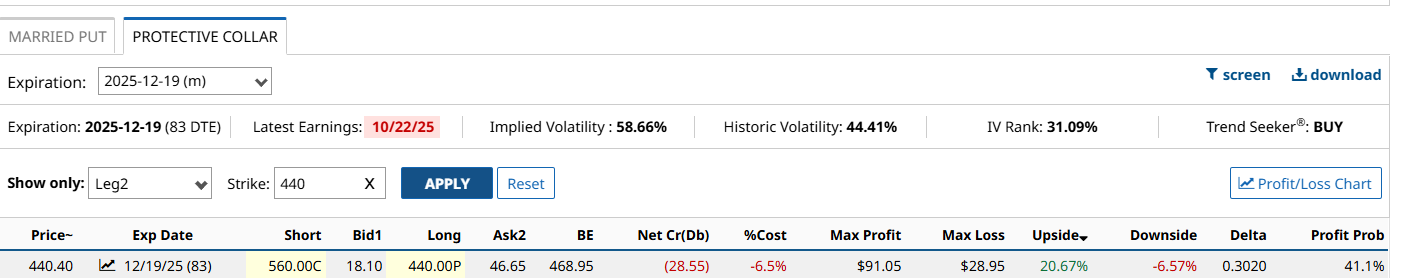

Here is the updated TSLA collar analysis. Friday’s close was around $440, and if I go out to the Dec. 19 expiration (2025, not 2026 as in the September example), I can get upside to $560. It costs a bit, but the cost is just about equal to the downside.

In other words, I’m locking in that very recent price as a low, and with a stock like TSLA that whips around so much, I’m OK with it. And I get nearly 21% upside so more than a 3:1 up/down ratio here.

TSLA is a great stock to collar, even when I’m less sanguine about the upside potential, as I am now. That’s when having that worst-case scenario defined is so valuable. At least, if you’re a risk-management type like me.