Note: This is not financial advice. This is an anecdotal experience of an Android user exploring the world of fin-tech with Apple.

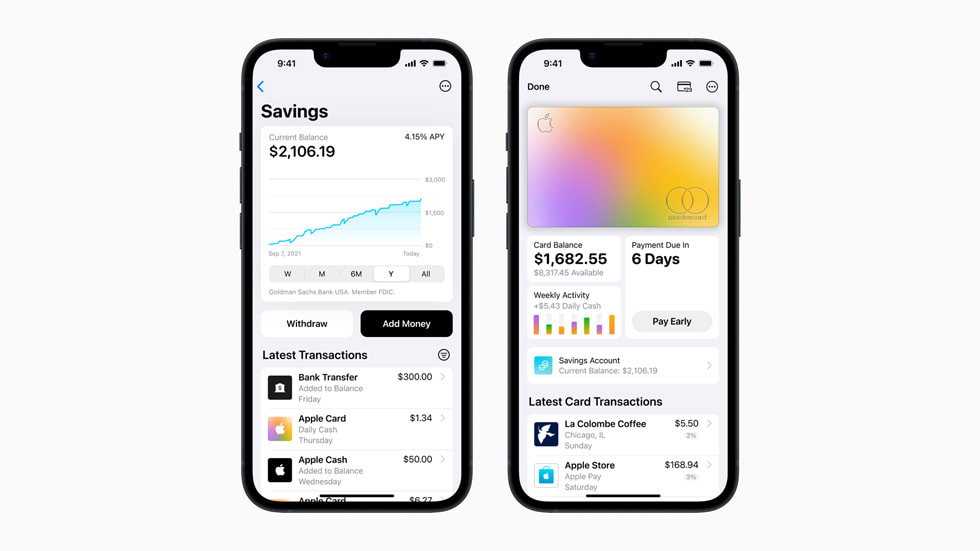

“4.15% APY with an Apple Savings account?! Sign me up!" I thought. “That’s better than the lame 3.9% I’m currently getting.” I’m an Android fan, but when there’s money to be made, I’m an easy convert. “Samsung Galaxy who? Google Pixel what?” All I see is green.

Unfortunately, while trying to sign up for my new Apple Savings account, all I saw was crimson — an angry blood red, to be specific. Is this my karma for attempting to jump aboard the Apple bandwagon? From awkward, frustrating phone calls with Apple Card reps to annoying pop-up errors and inexplicable rejections, I was losing my sanity in exchange for compound interest. The question is, was it worth it? (Hint: no)

Truth be told, I was to blame for some of these issues, but Apple was the culprit behind other setbacks I faced. Follow me through my week-long ordeal of securing an Apple Savings account.

Step 1: I applied for an Apple Card

Before you can get an Apple Savings account, you need an Apple Card, which you obviously cannot get without an iPhone. (Warning: Getting an Apple Card incurs a hard inquiry on your credit.)

My daily driver is the Samsung Galaxy S22 Ultra, but I also have the iPhone 14 Plus. As such, I used the Plus to begin my Apple Savings account journey — little did I know that it was going to be a bumpy one.

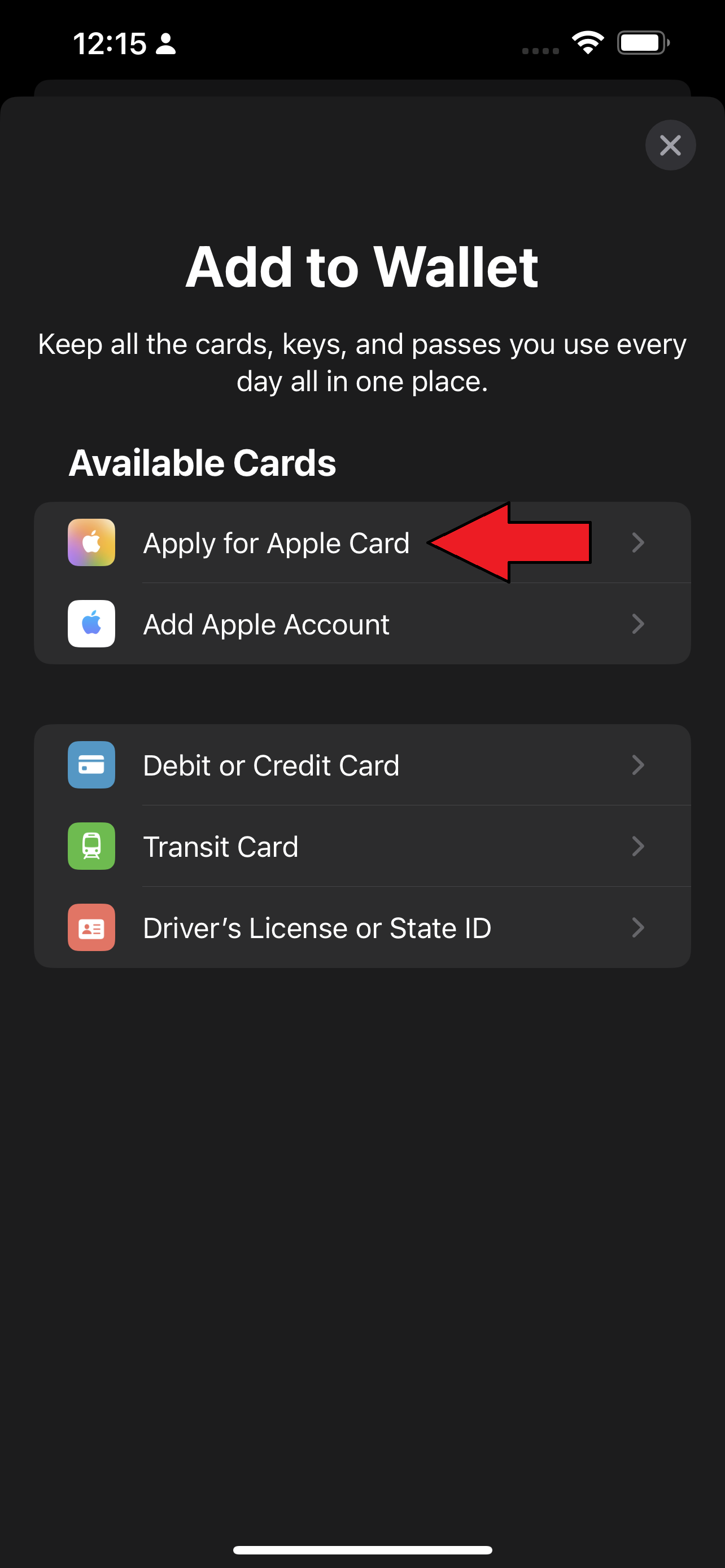

The first thing I did was open the Apple Wallet app and tapped on Apply for Apple Card.

Next, a page with all of my information — my first name, surname, date of birth and phone number — appeared. All of my information was already filled out without me having to lift a finger, so I quickly glanced at it and zipped past it. (This is where I made my first mistake, which I’ll discuss later)

I was also asked to enter my address, full Social Security number (SSN), citizenship, estimated annual income, blood type, a 3D scan of my eyeballs, and my deepest darkest secrets. (I’m kidding about the last three, of course. Requesting prying personal information is par for the course when you’re signing up for any financial service.)

Next, a window appeared explaining the Apple Card’s Terms and Conditions. (Don’t be lazy and skip this part — it tells you how to avoid paying interest on purchases.) I hit Agree and that’s it. My application was submitted.

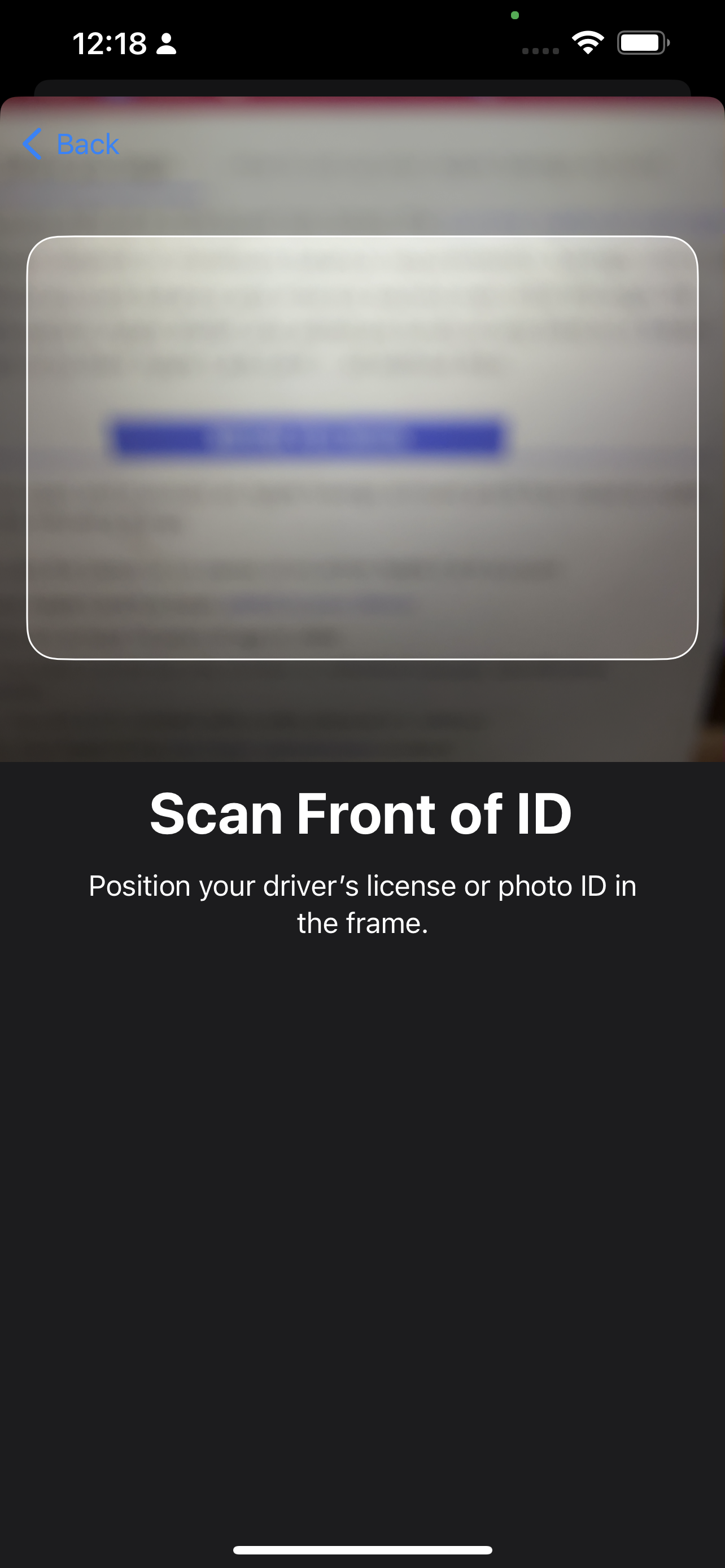

Step 2: I uploaded my photo ID

To make sure that I’m not an imposter, Apple required me to upload my photo ID (either a state ID or a driver’s license). A viewfinder popped up and I scanned the front and back of my ID. The first time I did it, I received an error message that my scanned ID wasn’t clear enough. However, I got the thumbs up after submitting the photos a second time.

Finally, I landed on the “Review in Progress” page, which told me that my Apple Card application is currently being vetted and I’ll receive an update via email once a decision is made.

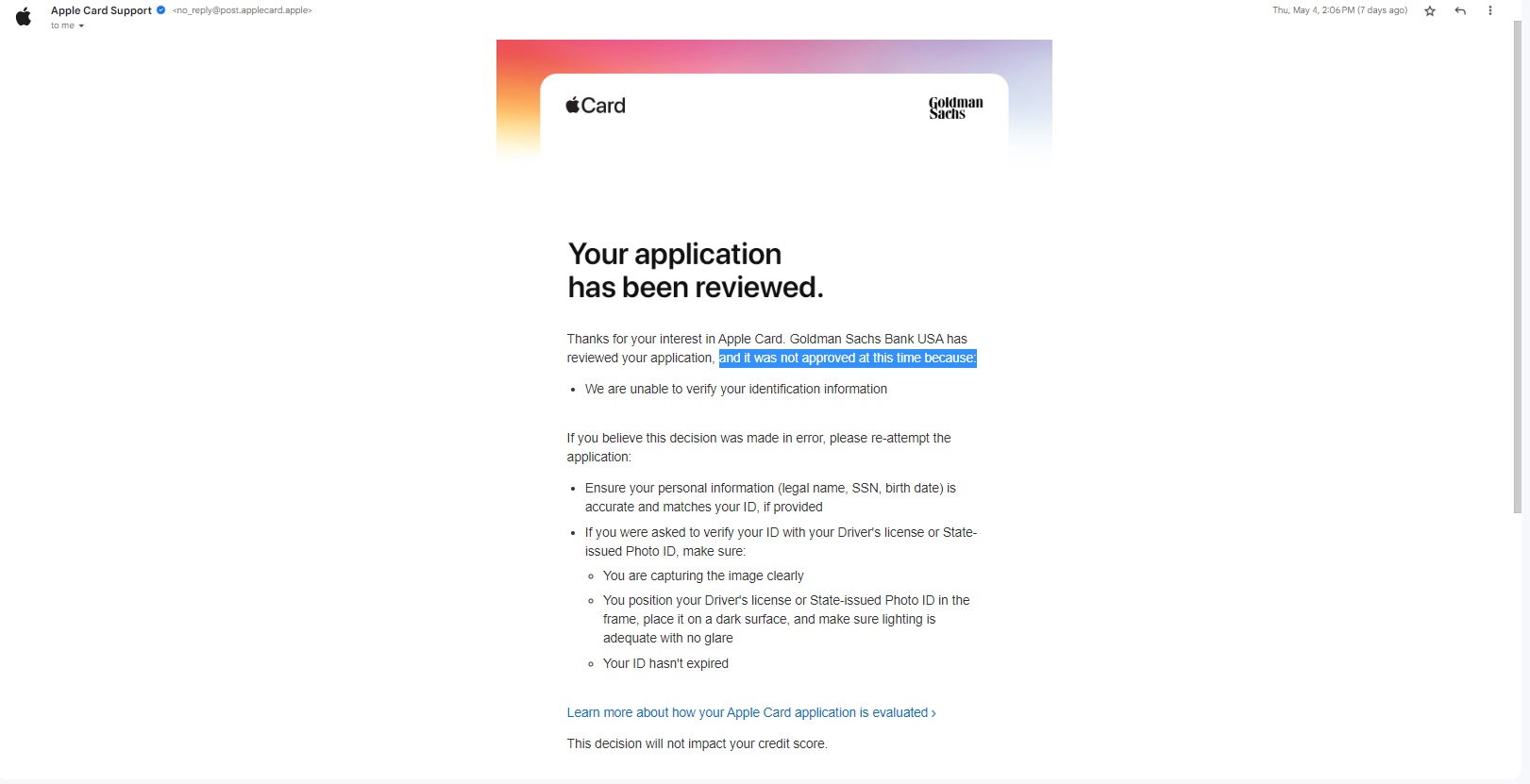

Step 3: I got an update on my Apple Card application — and I got rejected

I applied for my Apple Card on May 2, and two days later, I got a call from Goldman Sachs, the institution that partners with the Cupertino-based tech giant for Apple Card and the Apple Savings account. Unfortunately, I missed it. I tried to call back, but it led me to a robocall menu.

Just as I was trying to figure out how to find a human to say, “Hey, I’m returning a call from a Goldman Sachs rep,” I received an email that said, “Your Apple Card application was not approved.” What?! They were “unable to verify my identification information."

How dare they! I’m an upstanding American citizen who pays her taxes. Why would they deny my application? I called the number on the bottom of the email — 1-877-255-5923 — to understand why the hell they rejected me. An Apple Card rep named Daniel picked up; I told him I wanted to know why my application was denied. He then asked for my full SSN. I hesitated and felt uneasy; I double checked the number I called and looked at the email. It’s an official number and I saw no signs of phishing. “You mean my four digit social security number?” I responded. “No,” he said. “Full.”

I YOLO’d and told him my SSN — yay for identity theft. Daniel put me on hold, adding that his department doesn’t handle my issue. Soon after, another agent appeared and asked, “So you’re having an issue verifying your Apple ID? Not really sure what [Daniel] is talking about, so I thought I’d get you to explain it.” I told her that I applied for the Apple Card, but got denied because they were unable to ID me — and I wanted more information on what went wrong.

Dispelling her confusion, she said, “Ooh! I see!” She then asked me for my Apple ID. In seconds, a notification came to my iPhone and she asked me to tap on it. Unfortunately, two minutes into the call, we were suffering from poor reception issues, and suddenly, the call dropped. The agent didn’t bother to call back.

Step 4: I reapplied for the Apple Card

I decided to re-read the rejection email — perhaps I could find what went wrong there. The message rattled off some reasons why I didn’t get approved and one statement stood out to me: “Ensure your personal information matches your ID.” Bingo! If you recall, when I applied for the Apple Card the first time, my information was already filled out. However, in the legal name field, it said “Kim” instead of “Kimberly,” which didn’t match my photo ID. That alone led to a swift rejection.

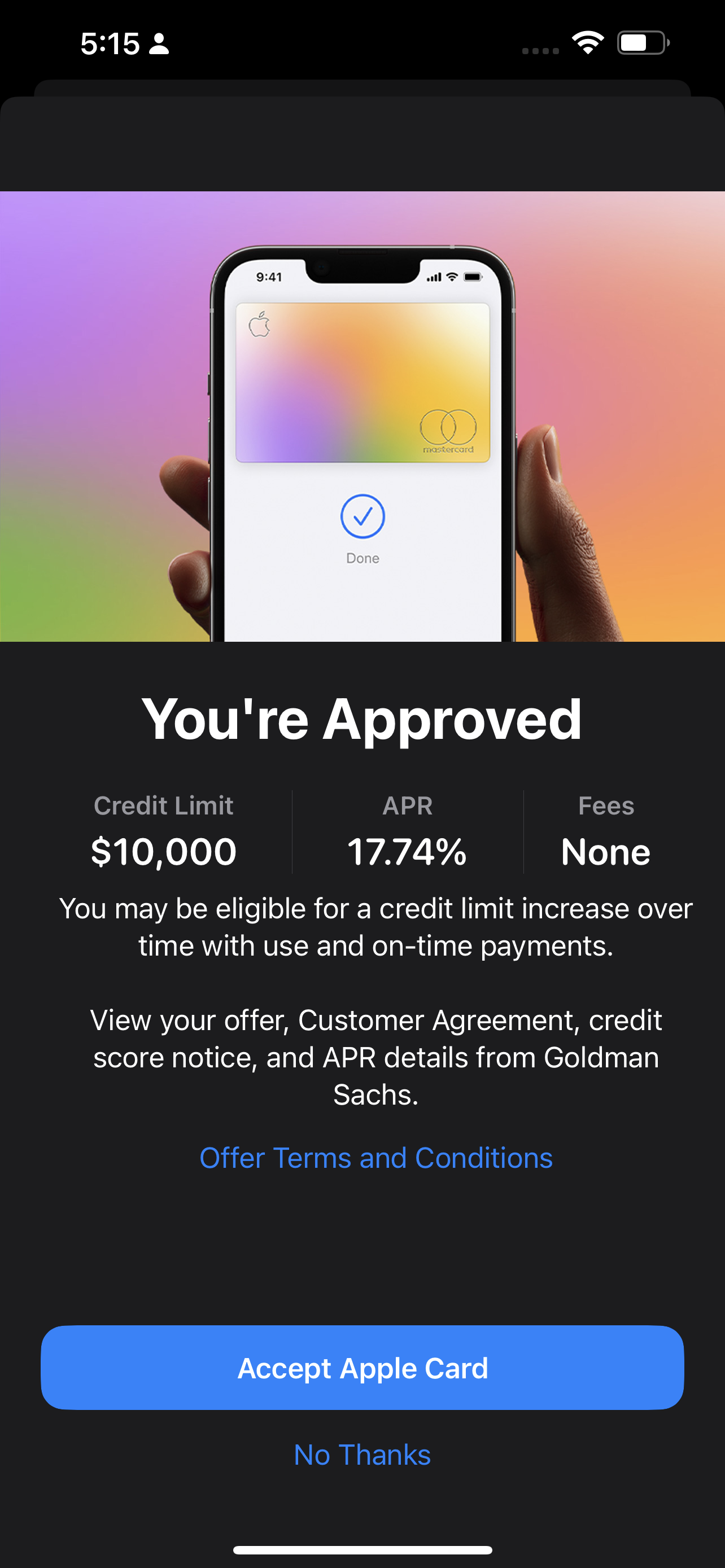

I reapplied for the Apple Card — full name on deck — and waited one day. On May 7, I got an Apple Wallet notification that said, “You’re approved. Accept your Apple Card offer to start using your card today.” I’ve finally got my Apple Card, baby!

(Truth be told, I probably won’t be using the Apple Card any time soon — it’s just a means to an end so I can get an Apple Savings account.)

Step 5: I had to update my phone; the Apple Savings account option was missing

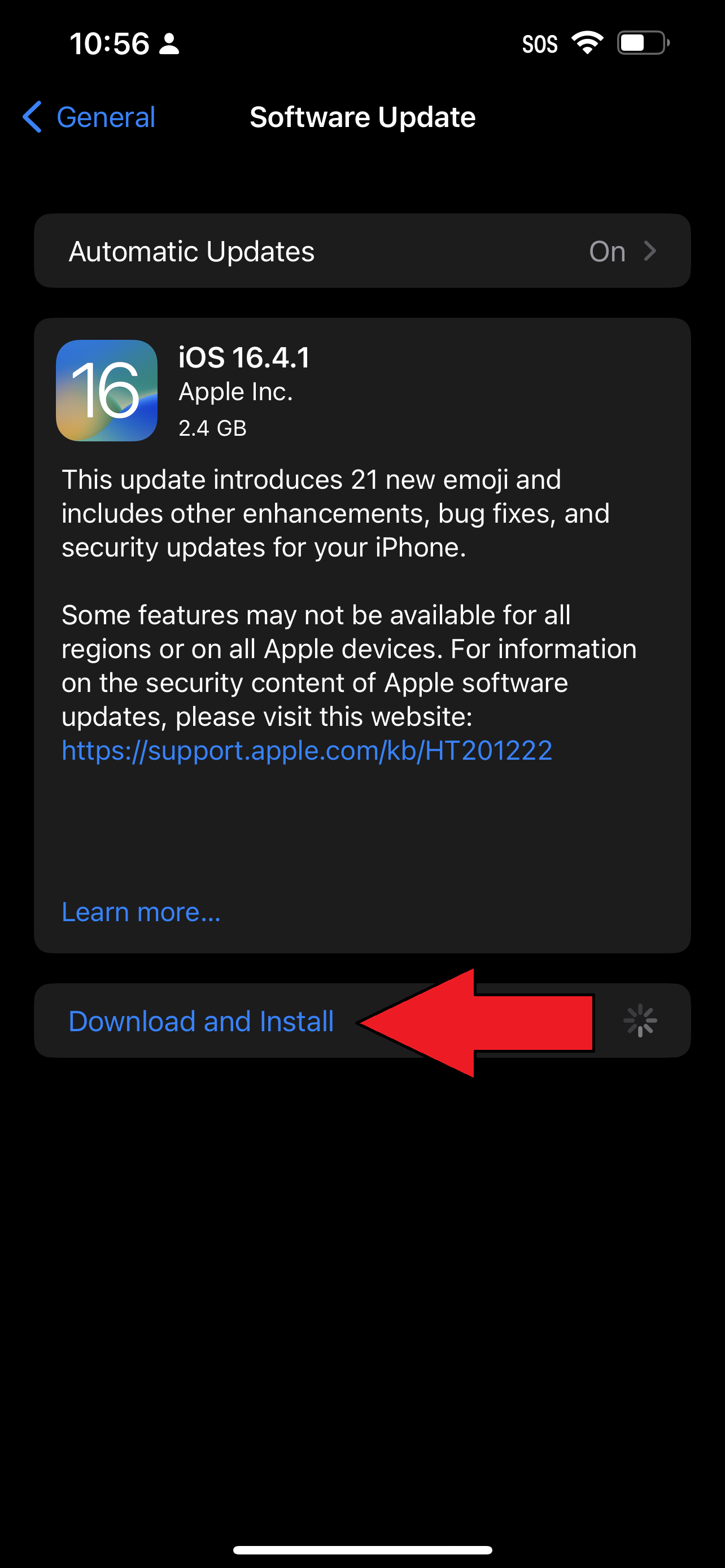

Using our very own “How to set up an Apple Savings account in 3 easy steps” guide, I stumbled upon a roadblock. I could not — for the life of me — find the “Set Up” button for the Apple Savings account.

After Googling the issue, I realized the problem: I didn’t update my phone to the latest version of iOS. Duh! I went to Settings > General and tapped on Download and Install for the iOS 16.4.1 update. It took about five minutes for the installation.

And finally, yes, I could spot the Apple Savings account set up button.

Step 6: I applied for the Apple Savings account (finally)

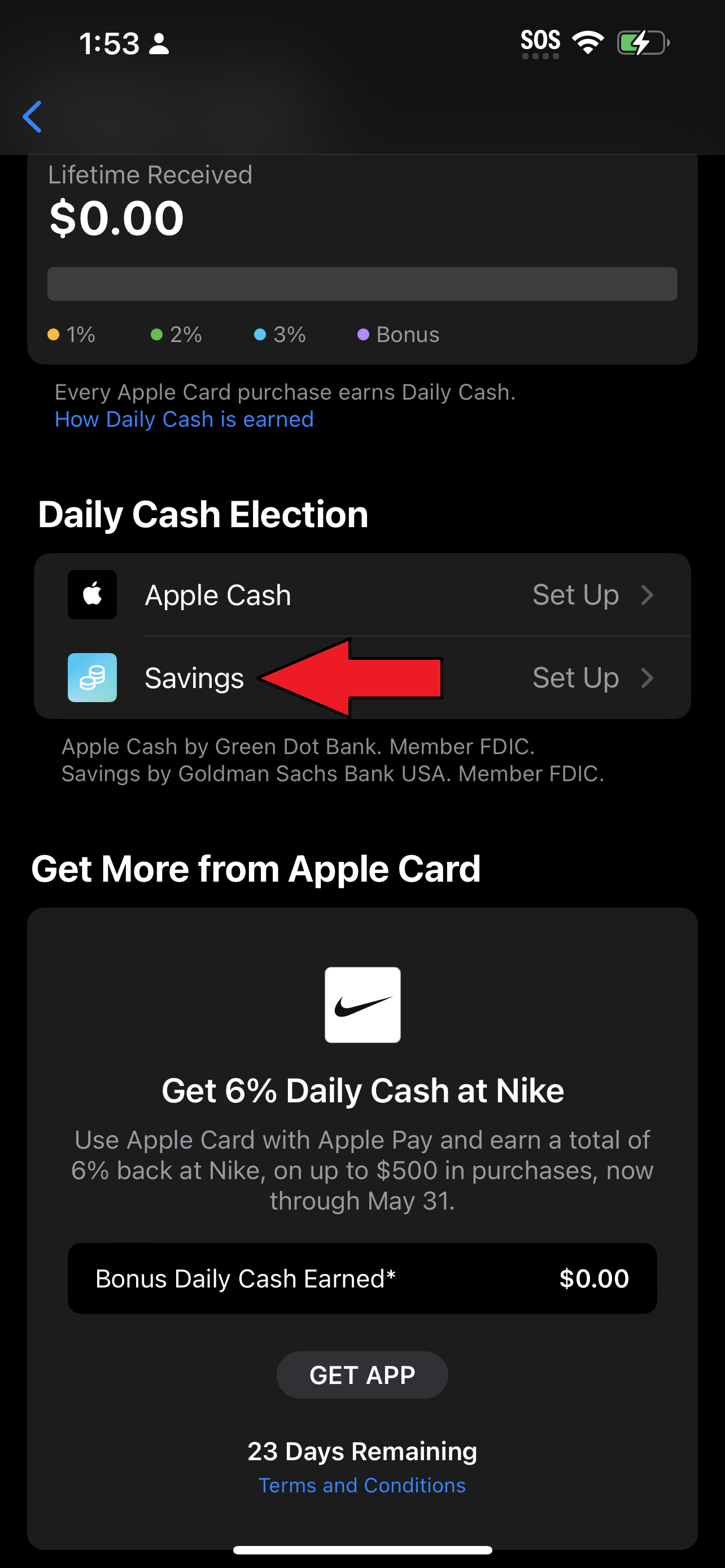

In Apple Wallet, I tapped on Apple Cash followed by the three-dot icon before tapping on Daily Cash. Next, I tapped on Set Up next to the Savings tab. I landed on a page with Apple boasting about its 4.15% APY.

I was then prompted to type in my full SSN and agree to a Terms and Conditions document. I hit Confirm and Open Account.

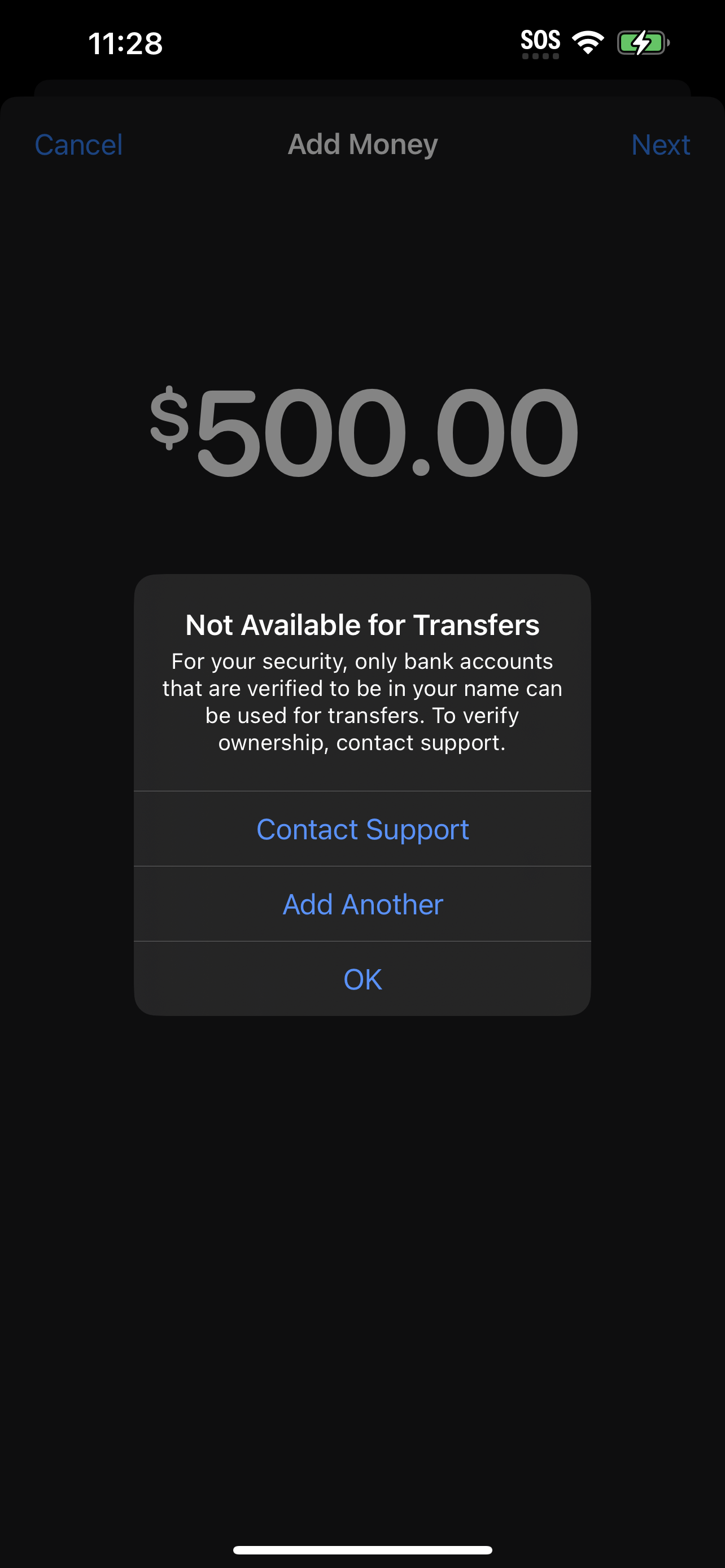

When I tried to add money to my Apple Savings account, however, the app caught on that I didn’t have a bank linked to it. As such, it prompted me to enter my bank account information. It seemed like everything went well, and again, I tried to add money into the Apple Savings account — until I got an error message:

“Not available for transfers,” the pop-up said. “For your security, only bank accounts that are verified to be in your name can be used for transfers. To verify ownership, contact support.”

Oh come on! Is the universe conspiring against me? And what irked me about this message is that Apple wasn’t clear about how one should go about verifying one’s bank account. What do I even do next?

Step 7: I sat through an awkward three-way call

When I got the irksome error message, I breathed a sigh of annoyance and tapped on the provided Contact Support button. This led me to an Apple chatbot via iMessage that, of course, failed to be of any help. Out of frustration, I asked, “Can I speak to a human?”

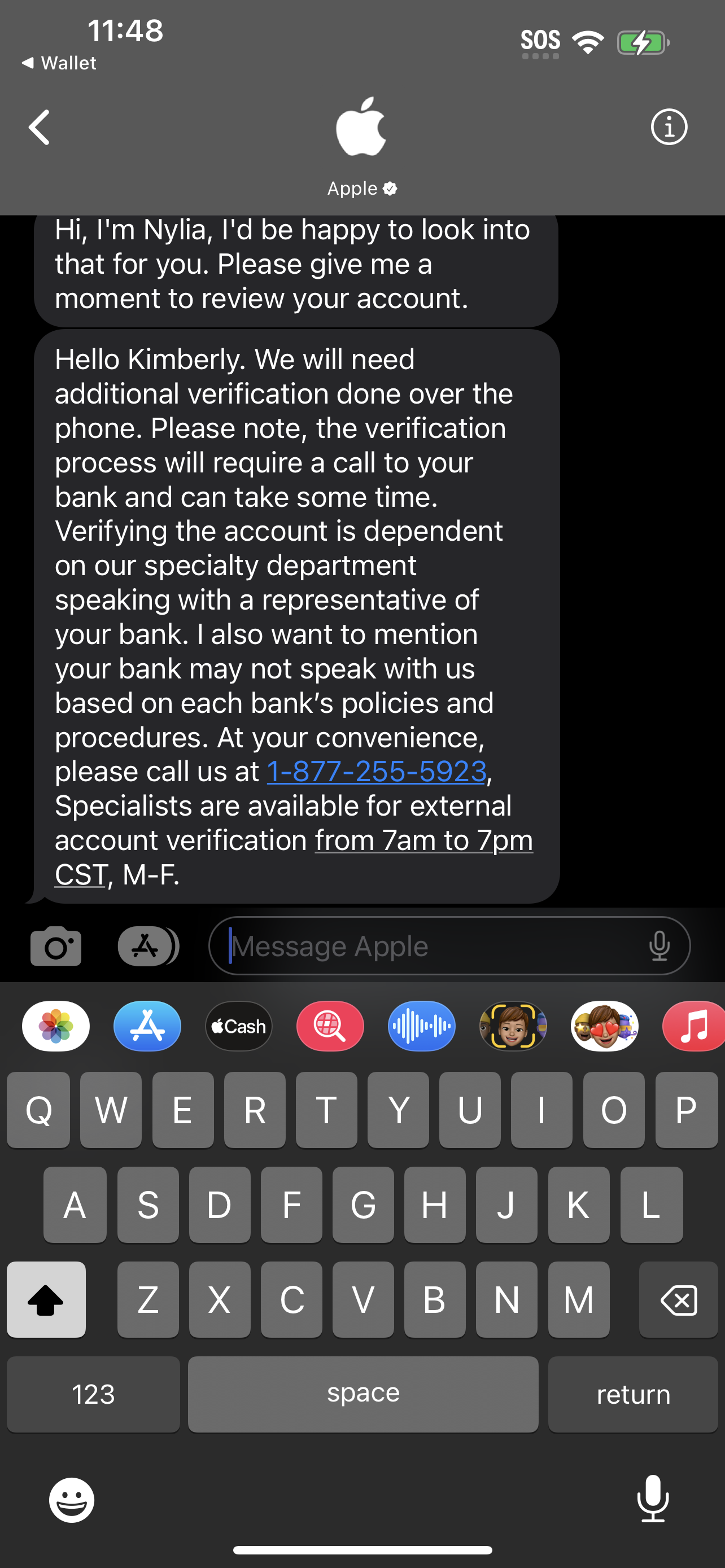

The chatbot said it would agree to my request, but it would take 20 minutes for me to speak to a living, breathing person. Finally, a rep named Nylia hopped on the chat, and finally, I got clear instructions. She provided me with a specific number that would help me verify my Apple Savings account. Thank you!

I called the number, and I was already annoyed to high hell with this arduous process, but an Apple Card rep named Aria hopped on the line — and had the audacity to laugh at me when I told her my last name, “Tee-hee! I’m sorry — your last name sounds like a cartoon character.”

“What?” I was so flabbergasted by the comment. Seeing that I was taken aback and unamused, Aria readjusted her tone into a more professional one and carried on with asking for my SSN. Next, she put me on hold to call a representative from my bank. A woman named Elizabeth hopped on the call. (Yes, at this point, I’m on a three-way call with two strangers who are trying to suss out whether I’m a charlatan.) She asked for my name, SSN or bank account number, and a one-time passcode that was sent via SMS. The Apple Card rep stepped in to say, “I just want to confirm that she has ownership of the account ending in [redacted]? After a few suspenseful, heart-stopping seconds, the bank rep finally confirmed that I’m not some wily criminal plotting to commit fraud.

And with that, the rep who made fun of my surname told me that I could transfer money into my account in less than 30 minutes. Now, I appreciate the extra grueling security steps, albeit inconvenient, we must take to create a savings account, but ironically, I felt quite vulnerable and exposed during this phone call with Aria eavesdropping on my conversation — sensitive information and all — with my bank rep.

Bottom line

After a few dimwitted mistakes, a rejected application, possible identity theft, unhelpful chatbots, discourteous Apple Card reps, navigating vague instructions from Apple, and an uncomfortable three-way phone call, I finally have my highly elusive Apple Savings account. And yes, I have transferred money into it, too,

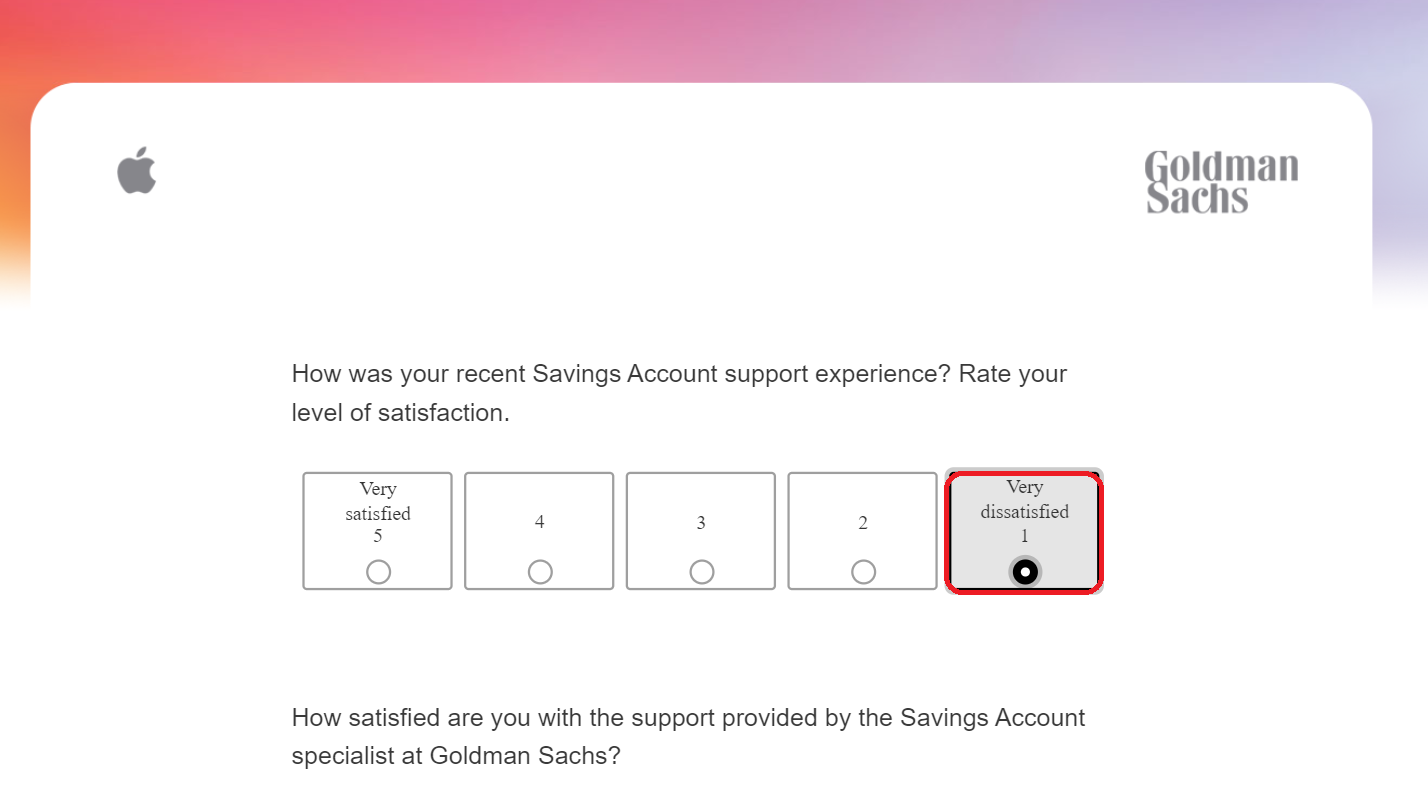

Was it worth it? Not at all.

Shortly after I got my Apple Savings account, my current high-yield savings account, also owned by Goldman Sachs, just emailed me to tell me that the rate jumped from 3.9% to 4.15% APY — the exact same rate that my Apple Savings account is offering. What a waste of time!