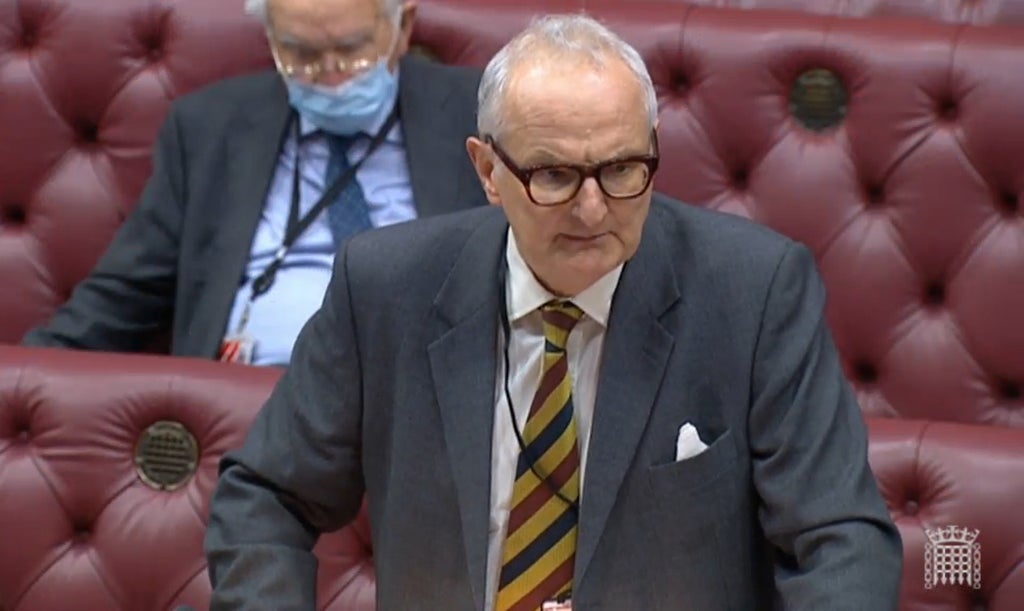

A minister who quit the Government over the “schoolboy” handling of fraudulent Covid-19 business loans said of his resignation during a speech at the despatch box in the House of Lords: “I didn’t want to blow my top, but I was very angry.”

Lord Agnew of Oulton, who was the Tories’ anti-fraud minister, says he felt he had to resign from his Cabinet Office and Treasury posts because of the Government’s “egregious” failure in its handling of bounce-back loans.

He told The Times that ahead of his speech, “I was nearly sick going into the chamber”.

“This isn’t natural for me, I took no pleasure from it but the failure of Government to tackle fraud felt so egregious, and the need for remedy so urgent, that I felt my only option left was to smash some crockery to get people to take notice,” Lord Agnew added.

“In life one should try to stay inside the tent to win the arguments but ultimately there comes a breaking point.”

Parliament has heard the Treasury expects to write off about £4.3 billion of Covid loans, with money having gone to “fraudsters”. The Treasury has since disputed this figure.

After Lord Agnew’s dramatic exit Chancellor Rishi Sunak tweeted: “I’m not ignoring it, and I’m definitely not ‘writing it off’”.

Lord Agnew, who feels his resignation was “worth it”, said there has been “not a zippo” of detail about how Mr Sunak plans to change the situation.

During the lockdown periods of the pandemic, companies were able to get loans from commercial lenders, including high street banks, which had a state-backed guarantee against default.

On what steps the Treasury should now take, Lord Agnew told the newspaper: “First, there should be no more payouts on the state guarantee until there is clarity on the work banks are doing to tackle fraud.

“Second, there should be no more grant, loan or state assistance packages without pre-clearance by counter-fraud experts. Finally, the Economic Crime Bill to fill the regulatory gaps shouldn’t have been dropped. It was such a foolish decision.”

No 10 has insisted the Government had been clear that fraud is “unacceptable” and it is “grateful” to Lord Agnew for his “significant contribution” over the years.