/Huntington%20Ingalls%20Industries%20Inc%20logo%20and%20chart-by%20IgorGolovniov%20via%20Shutterstock.jpg)

Huntington Ingalls Industries, Inc. (HII) is a leading U.S. military shipbuilding company and a prominent provider of professional services to government and industry clients. Headquartered in Newport News, Virginia, HII was formed in March 2011 following the spin-off of Northrop Grumman’s shipbuilding operations.

Its operations span three main divisions, Newport News Shipbuilding, Ingalls Shipbuilding, and Mission Technologies, encompassing design, construction, overhaul, maintenance, and services across naval platforms and defense systems. The company has a market capitalization of $10.8 billion.

Companies with a market cap of $10 billion or more are typically recognized as “large-cap stocks,” a designation that highlights their financial strength, resilience, and influence within their industries. Huntington Ingalls comfortably falls into this bracket, underscoring its scale, stability, and competitive advantage. The company’s trusted expertise, long-standing defense contracts, and strategic role in national security reinforce its prominence and growth potential among peers in the defense sector.

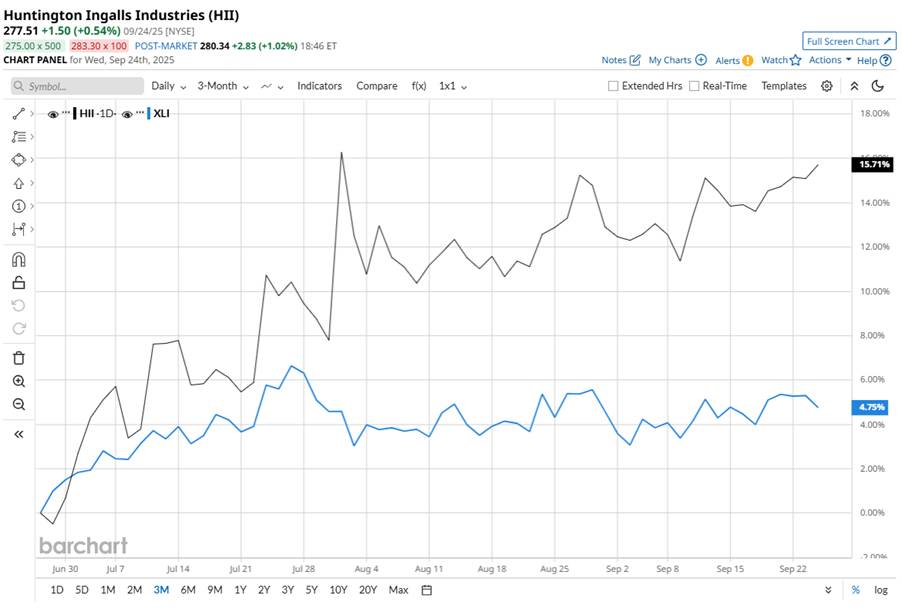

HII stock is just 5.3% below its 52-week high of $293.14, reached on July 31. Shares of Huntington Ingalls have gained 19.8% over the past three months, outperforming the broader Industrial Select Sector SPDR Fund’s (XLI) 5% rise over the same time frame.

Also, in the longer term, HII stock has surged 46.9% on a year-to-date (YTD) basis compared to XLI’s YTD gains of 15.6%. However, over the past 52 weeks, HII delivered 7.9% returns, below the 13.1% rise of XLI.

To confirm this bullish trend over the past few months, HII has been mostly trading above its 50-day moving average since early March. Also, the stock has been trading above its 200-day moving average since late April.

HII stock is rallying amid steady financial performance, signaling that operational headwinds such as supply constraints and labor shortages are easing. Also, Huntington is aggressively expanding its shipbuilding capacity and pushing into unmanned maritime systems, including strategic partnerships and new autonomous vessels like the ROMULUS project, which are reshaping investor expectations about its growth trajectory.

Additionally, the U.S. political and defense climate is favoring domestic shipbuilding. The administration’s push to revitalize the naval industrial base is giving defense contractors like HII a favorable backdrop.

HII has also outpaced its rival, General Dynamics Corporation’s (GD) 22.8% gains YTD and 6.2% surge over the past year.

Wall Street analysts are moderately bullish on HII’s prospects. The stock has a consensus “Moderate Buy” rating from the 11 analysts covering it, and the mean price target of $284.60 suggests a potential upside of 2.6% from current price levels.