/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

A large, unusual volume of activity in Broadcom, Inc. (AVGO) put options highlights the value of AVGO stock. Investors have jumped into out-of-the-money AVGO puts expiring Friday. Its recent strong results and a deal with OpenAI show that AVGO could be worth more.

AVGO is $369.77 in midday trading on Wednesday, Sept. 10. This is up 24% from Sept. 2 ($298.24), right before its Q2v results on Sept. 4.

Moreover, on its earnings call, according to CNBC, Broadcom said it's partnering with OpenAI to provide them with AI semiconductor chips.

Updated Price Target for AVGO

I discussed the earnings, free cash flow (FCF), and FCF margin results from Broadcom in a Sept. 5, Barchart article ("Broadcom's Free Cash Flow Surges With Higher FCF Margins, Implying a 25% Higher Value for AVGO Stock.")

I set the price target at $386.30 based on analysts' revenue forecasts, a 43.5% FCF margin estimate, and a 1.85% FCF yield metric. AVGO stock is almost there now.

But since then, analysts have raised their revenue forecasts. For example, now analysts have set their FY 2026 (ending Oct. 2026) revenue estimates at $83.68 billion.

So, using a 43.5% FCF margin, that implies FCF could reach $36.4 billion (i.e., $83.68b x 0.435). Using a 1.85% FCF yield, that sets the market cap estimate at almost $2 trillion:

$36.4b / 0.0185 = $1,968 billion (i.e., $1.968 trillion) mkt cap

That is still $230 million higher than today's market cap of $1,738 billion, according to Yahoo! Finance. In other words, it could be worth +13.2% more:

$369.77 x 1.132 = $418.58 target price

This is the new target price. Analysts are not there yet. For example, AnaChart.com says that 28 analysts have an average price target of $370.90, just above today's price.

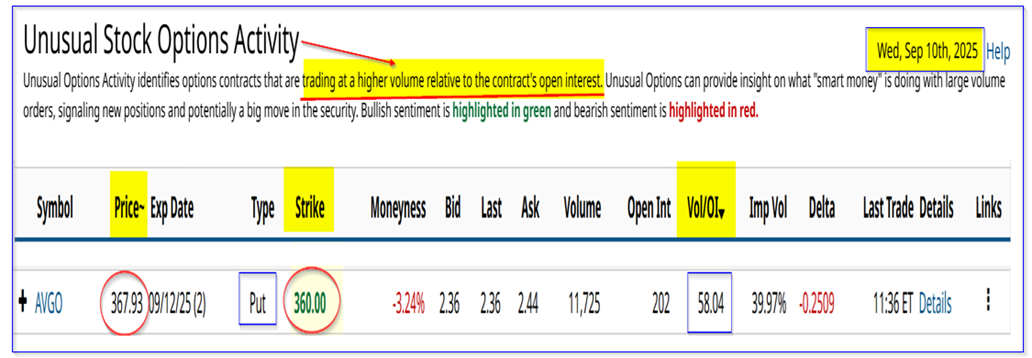

Unusual Put Options Activity

That could be why there is so much activity in AVGO put options today. It may be that some investors feel the stock has topped out.

For example, the Barchart Unusual Stock Options Activity Report shows that over 11,700 put options have traded at the $360 exercise price for a contract expiring this Friday, Sept. 12.

This means that the buyers of these puts expect AVGO stock to fall below $360.00.

In fact, the premium they paid of $2.36 implies they expect AVGO to fall below $357.64, or -3.28% below today's price.

On the other hand, short-sellers of these out-of-the-money (OTM) puts can make a 3-day yield of almost 1% (i.e., $3.26/$360 = 0.09056 = 0.9056%).

That's a pretty good return for just 3 days, especially if the stock stays over $360.00 by Friday's close.

Even if it doesn't, the investor gets to buy in at a lower price (i.e., $357.64 breakeven).

The point is that if AVGO is going to be worth $418.58 over the next 12 months, that presents a potential upside of +17%.

Downside Risks

Keep in mind that this put option has a relatively low chance of falling to $360.00. The delta ratio is only 0.25, implying just a 25% chance of that occurring.

However, it could still result in an unrealized capital loss if AVGO falls below $360.00; the short-put collateral is assigned to buy 100 shares per contract shorted.

If the stock falls below the breakeven point, that might result in an unrealized loss.

Investors should study the associated risks with this kind of play by studying the Barchart Options Education webinars.

The bottom line is that AVGO stock, even though it's at a peak, still looks cheap here. However, some investors are hedging their bets by buying short-dated puts here. Other are shorting these puts for income.