Personal finance tech companies are most successful when they meet consumer needs through products traditional banks don’t offer. Square and Venmo offer more seamless ways to exchange payments between friends, Affirm and Klarna offer fast alternative credit methods for online purchases, and the list goes on.

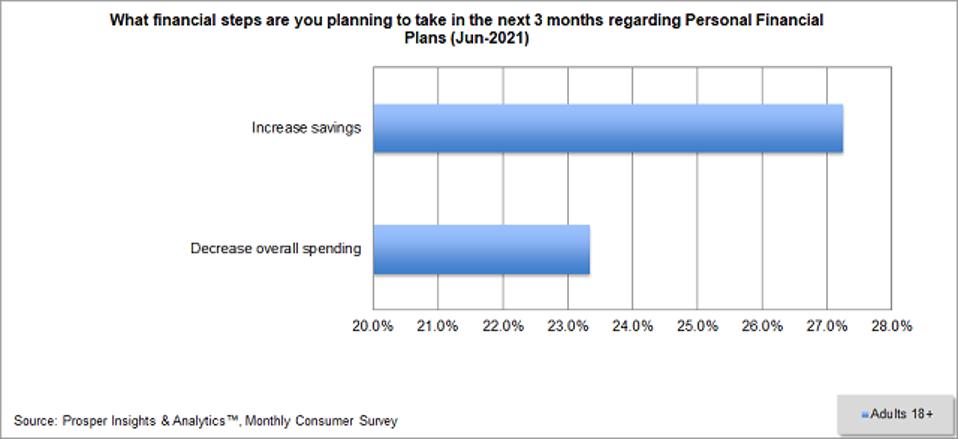

Qapital offers science-backed, goal-oriented ways to save, spend, and invest. According to a recent Prosper Insights & Analytics Survey, 27% of people want to be saving more than they currently are. The report also found that 23% want to be spending less money overall. Savings accounts offered by traditional banks lack capabilities for people to incentivize and customize their savings.

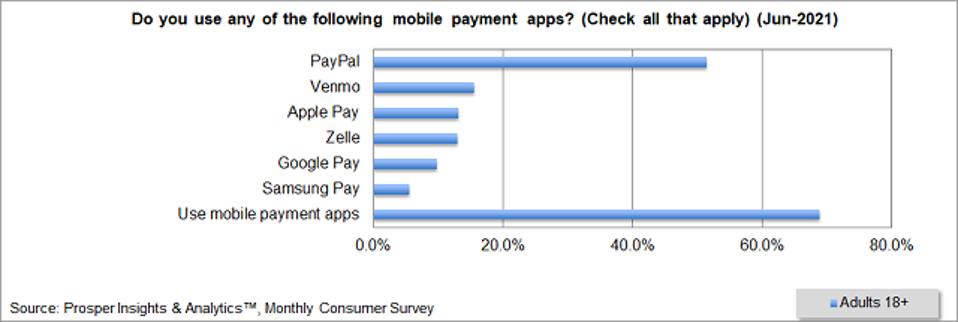

Qapital wants to fill this gap within the industry and address the savings problems Americans are experiencing. The NY and Stockholm dual-based company was built to help turn savings into a seamless experience. They aim for users to achieve goal-based savings, and they use behavioral science to incentivize the right financial decisions. With 69% of consumers already using some form of mobile payment apps according to a recent Prosper Insights & Analytics Survey, the market opportunity to also use an app for savings (not just spending) is clearly quite large.

I recently spoke with Katherine Salisbury, the Co-founder & Co-CEO, to talk about Qapital and where the broader industry is headed.

Gary Drenik: Tell me about Qapital and how the product works.

Katherine Salisbury: An edge that Qapital has in the personal finance space is that it incorporates behavioral science to guide our users. And the research-backed methods we employ really do help our user’s money grow—we’ve helped people save over $2 billion since we started. What I love about the Qapital experience is that it doesn’t start by asking you to set up accounts or direct deposits, but it asks what your goals are. Everyone has something to save towards—whether it’s a big goal like a down payment on a home, or smaller things like concert tickets. Qapital helps you manage savings, spending, and investing with tangible goals in mind—ones that you can visualize and feel excited about.

We’re also really excited about a new feature called Dream Team, which is in Beta testing now. We’ve seen that fewer couples want to completely combine all of their finances into one traditional bank account, so we’ve provided a modern alternative that lets partners customize how they collaborate on finances and save toward goals together.

Drenik: You mentioned the app being backed by behavioral science. What role does behavioral science play in personal finance tech?

Salisbury: Research has shown that a person is more likely to save money when they can visualize their goal and see it right in front of them. That’s why we let users add images to their savings and investing accounts, so they can connect with them, but also feel happy and associate money management with a positive experience. For example, a couple using Qapital can share a goal for buying a house, see a picture of their dream home on the app, and feel more connected to that. Then, they’re more motivated to save for it.

Also, Dan Ariely joined Qapital as our Chief Behavioral Economist back in 2015. He’s been instrumental in shaping our product. He is an accomplished professor and author with groundbreaking research on how people make decisions. He’s helped us build features that help people hack their own psychology in order to save money without even noticing or having to actively work for it. A great example is our Payday Divvy feature, which automatically divvies up your paycheck as soon as it hits your bank account. It basically automates your budget, so you can split up your money into different categories and take care of your priorities instantly.

Drenik: What is next for personal finance tech? Where is the industry headed?

Salisbury: Personalization is so important in this field—even the term “personal finance” emphasizes that it’s all about the individual. Fintech products should no longer be one-size-fits-all, instead, they should be customizable—built for the different people that they serve.

On the consumer side, this can mean asking users about their lifestyle, life stage, money habits, and more, just to get a better sense of them and how we can make money work best for them. At Qapital, we’re very focused on serving couples and so we’re building our product around how couples interact naturally. Every couple is different, and we want to honor that. For example, Dream Team lets couples decide how much they want to share with one another in terms of transaction history, account balances, and more. We know some couples like to share absolutely everything, and others like to mix up who’s in charge of each responsibility (i.e. one person takes care of the phone bill, the other does the groceries, and so on). We give people the freedom to do that.

Drenik: What led you to build a product that aims to help couples specifically? How big is the market addressed with Dream Team?

Salisbury: My partner George Friedman is also my co-founder and co-CEO. We had a growing family, which led to more conversations around money and decisions we needed to make. We wanted a joint overview of our finances, as well as a way to automate how our money moved to savings, investments, bills, and spending accounts. We didn’t necessarily want to merge all of our finances together into a joint account. The options that banks offered were limited and rigid, so we decided to build the solution for ourselves.

Data shows that about half of American adults are either in a relationship or married, which represents about 100M people. 76% of Americans already use mobile apps to manage their finances (usually through their bank’s app) so we think the addressable market is around 76M Americans. This represents the market for Dream Team alone, as there are other Qapital products that may appeal to other groups, including individuals.

Drenik: What do couples use your product for most commonly? Are there any stories you can share?

Salisbury: A lot of couples like to use our product when saving for a goal together. Instead of sharing a regular bank account and both throwing money into it, Qapital lets couples contribute to the same goals using individual accounts, so their money isn’t melded if they don’t want it to be. This helps couples better track their individual progress, and they can always send money to one another if needed. Couples can venture into budgeting and investing together through the app too.

Most couples contribute to expenses related to children, the home, and vacations or trips. We’ve seen couples saving for big milestones like weddings, which can often become very stressful. So many users have written to us saying that Qapital made financial planning one less burden to deal with during situations like that.

Drenik: It’s been a pleasure to learn more about Qapital and its unique approach to personal finance. It’s clear that while so much has already been built in the personal finance space, there’s still tons of opportunity to further innovate as consumer habits and behaviors continue to evolve.