I’m a devout risk-manager. When I trade, I am far more concerned with not losing a lot than I am making maximum profit. And I see the pros and cons of that posture, over and over again. That’s why, when I coach traders and investors, the first thing I emphasize is for them to personalize their trading in every way possible. They are not me, and vice-versa.

A good way to test where you sit on that risk management spectrum is to present you with what I’d consider to be a high-flying option collar scenario. Based on what appeals to you or doesn’t about this timely example, you’ll likely learn a bit more about your risk tolerance. At least, that’s my hope.

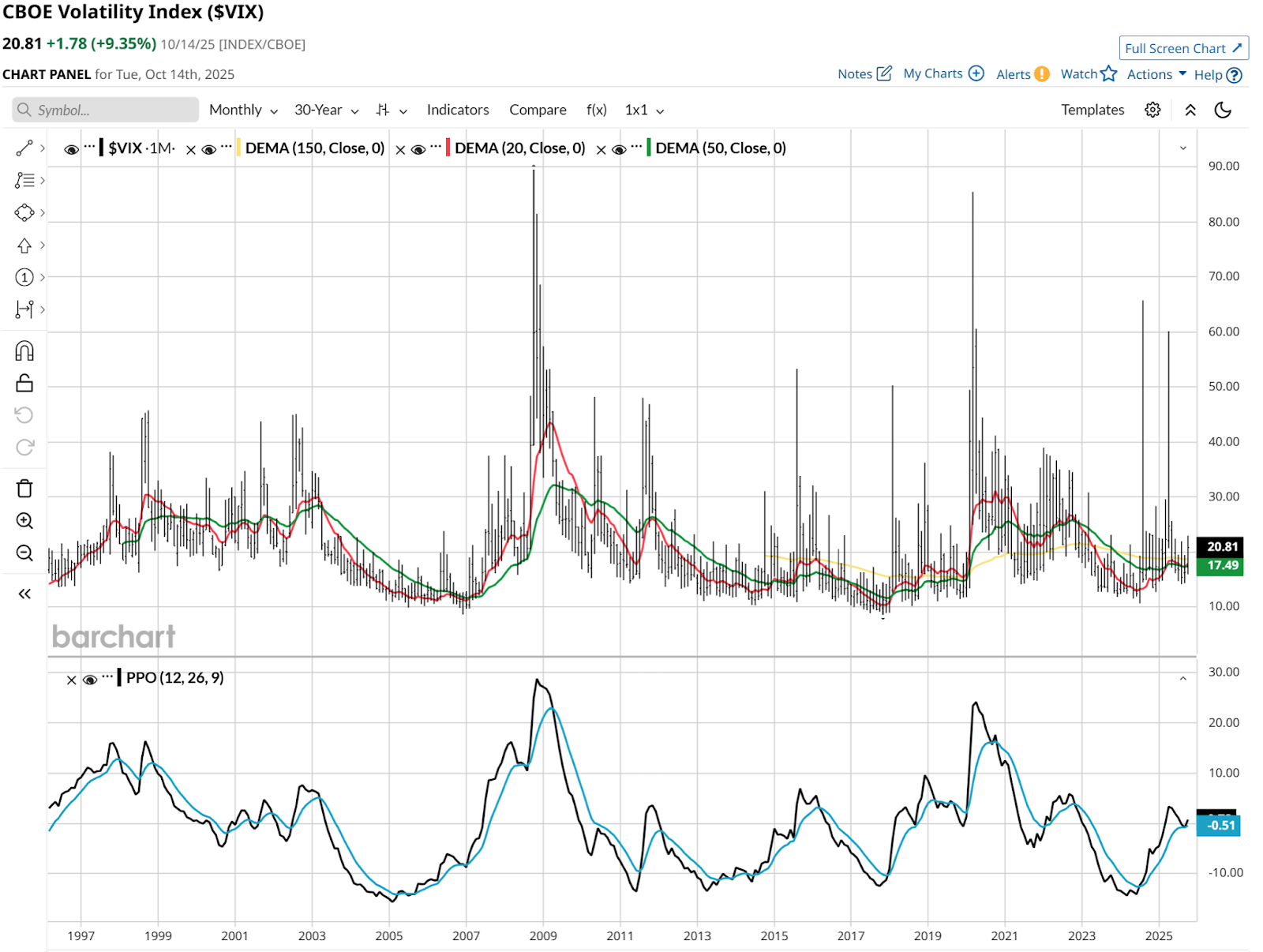

Volatility is measured by the CBOE Volatility Index ($VIX). The “VIX” has been around for a long time. And while it might not be well known to some newer traders and to many long-term investors, when it has its “moment,” it tends to move front and center in market headlines.

You can see from this 30-year history that the VIX spends a lot of time around the 10-20 level. That’s considered a normal range. It has also seen 40, 50, 60 and nearly 90 in the past.

VIX recently peeked its head above the 20 mark, after spending most of the year below that, signaling that some unsettling feelings have crept into the market’s psyche.

The VIX is a forward-looking indicator of sorts, as it uses past data to project the degree to which the S&P 500 Index ($SPX) is likely to fluctuate in the 30 days just ahead. So the recent move higher is worth noting.

And in my book, when something is worth noting, the immediate follow-up question is “how can I profit from it?”

First, by having VIX continue to rise into Halloween and perhaps Thanksgiving, as it has done at some infamous moments in the past, coinciding with major market crises and memorable stock market pullbacks.

And second, by proactively seeking ways to exploit a spiking VIX, if it were to occur.

Thinking Big (Gains in a Stock Market Crash) with UVXY

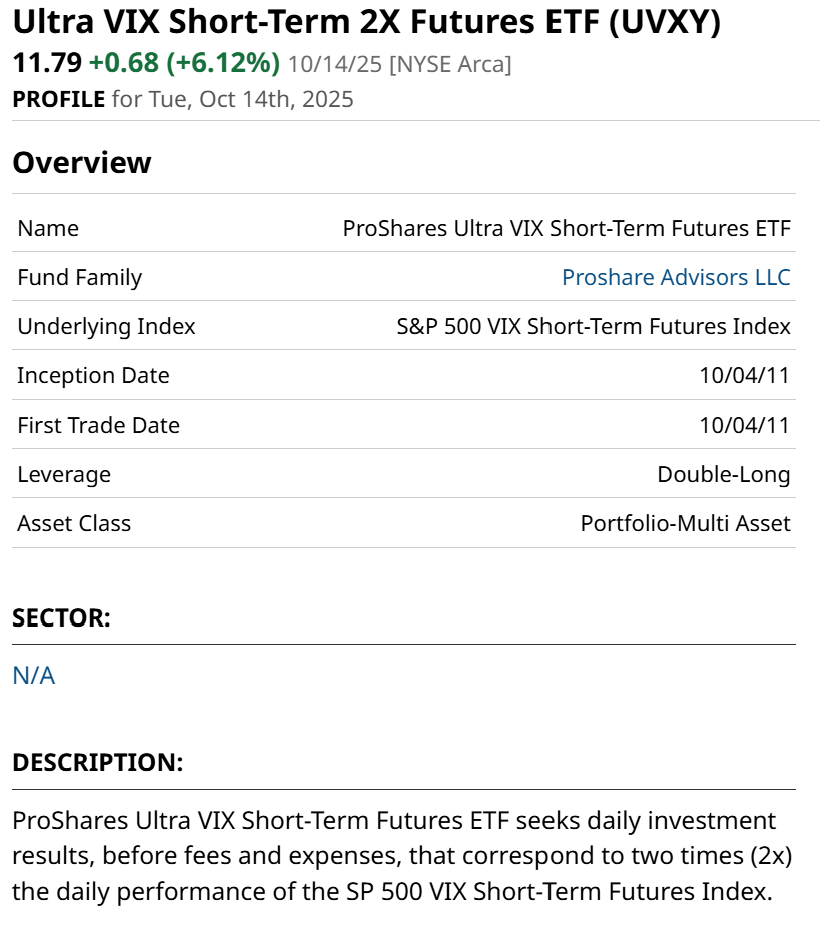

There are a couple of ETFs that track the VIX, but I’m skipping right past those here, other than listing one in a table just below. The main subject of this article, the Ultra VIX Short-term 2X Futures ETF (UVXY), aims to deliver twice the movement of the VIX. That said, in my experience trading it, I note that 1.5-2.0x has been a more expected range.

Either way, UVXY takes the idea of a down stock market, say the S&P 500, augments it by the volatility aspect (VIX), then adds leverage. That is one wild and crazy ETF! One, however, that has a 14-year track record of both blowing up when markets rise quickly, and acting more like a slightly in-the-money or out-of-the-money put option when stocks take a sudden dive.

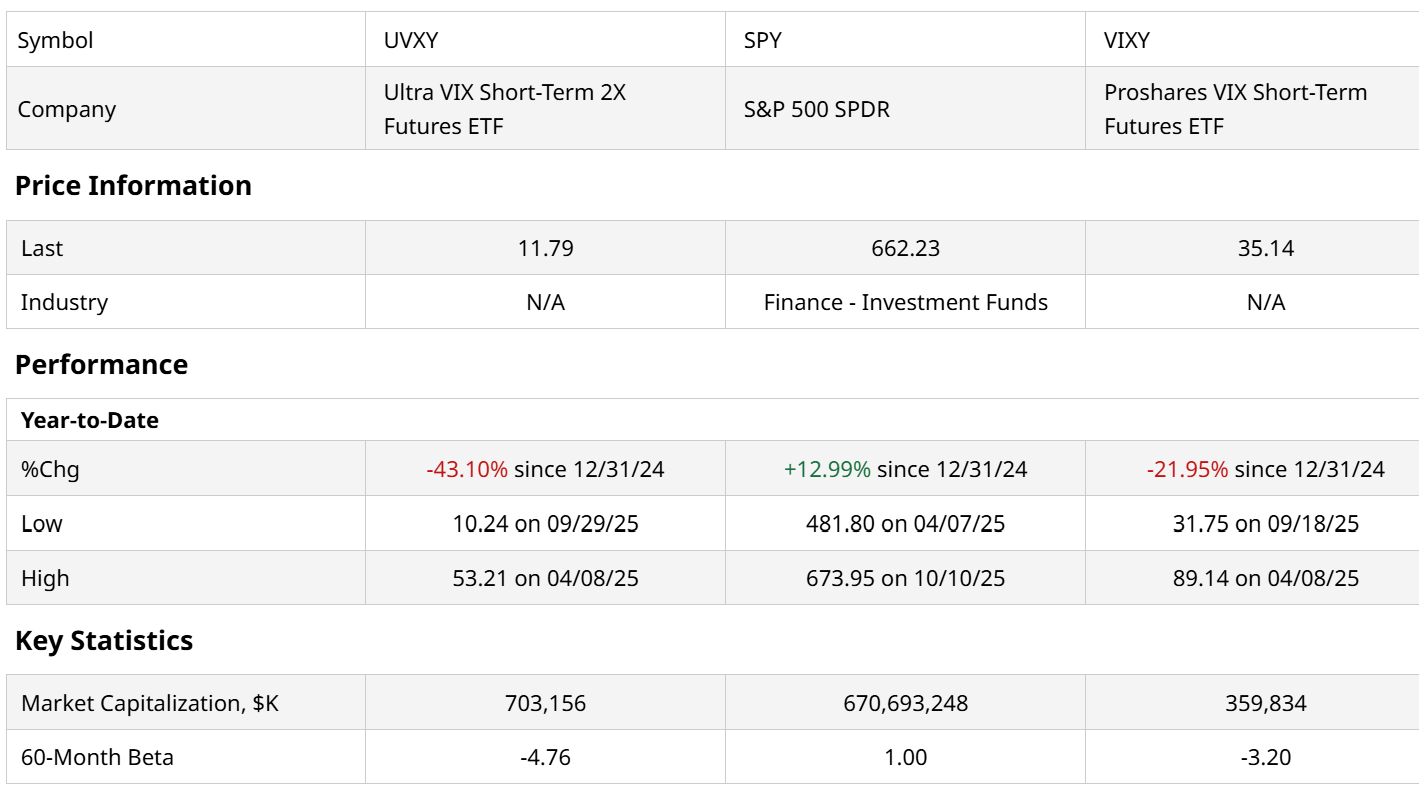

That latter part is my interest here. We can see in this table that UVXY is going to cost traders when the market goes up. That’s the nature of the beast. That’s why it is off 43% year to date, while the S&P 500 is up about 13%. Par for this course. However, it is that -4.76 beta I’m after, the next time the market tanks.

That can cover a lot of risk elsewhere in my portfolio, essentially serving as the ETF version of a fire insurance policy. As long as it functions as it has in the past, and as long as the market doesn’t take its sweet time dropping. Time is the enemy of anything VIX-related, as it is with options.

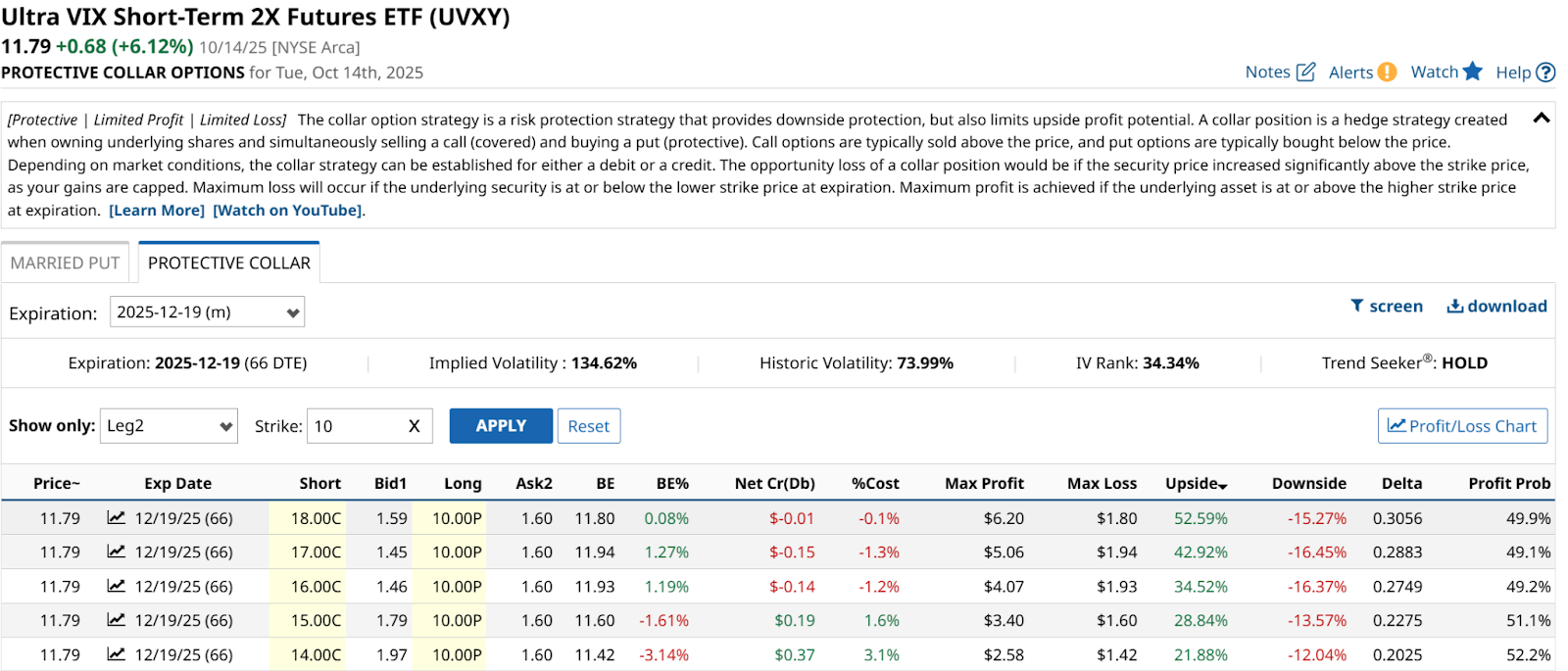

And let’s skip the straight purchase of UVXY. And go straight to collaring it! Here’s a table with some possibilities.

There are a few interesting ones here, but I’ll focus primarily on that first one at the top. UVXY closed Tuesday, Oct. 14 at $11.79. Going out to Dec. 19, a collar with a covered call struck at $18 and a protective put at $10 nets out the cost to near zero. That’s excellent.

The upside is 52% and the downside is around 15%, so a 3.5:1 ratio. Also solid. Especially considering the wild animal that is UVXY.

“Honorable Mention” to These Collar Trades

I also note from that table above that by knocking down the call strike price (shown in the “Short” column to the left), the downside risk does not change much, the upside potential declines, but the cost drops too. In fact, that next to last combination ($14-$10 for call and put strikes, respectively) actually pays the collar investor 1.6% up front, as the calls bring in more cash than the puts cost to take out. Yet there’s still more than a 2:1 up/down ratio there.

The key for me is position size. I don’t usually show you 15% downside as a worst-case scenario with a collar. But in this case, with a lower-priced ETF like UVXY, every 100 shares of underlying I own cost under $1,200 as of Tuesday end of day. Compare that to many examples I’ve shown here where 100 shares might be $10,000-$70,000 invested. So there’s more flexibility with UVXY’s lower share price.

In addition, while I may be a risk manager first, some risk comes with the territory. This is not T-bill investing. It is essentially stock market risk to the third power.

And that’s why I like this, and why UVXY is part of my “short list” of ETFs for tactical trading. Ironic when we recall that buying UVXY is a surrogate for shorting the S&P 500. But adding the collar can remove some of the poorest outcomes.