/Tesla%20car%20with%20symbol%20by%20Michael%20Fortsch%20via%20Unsplash.jpg)

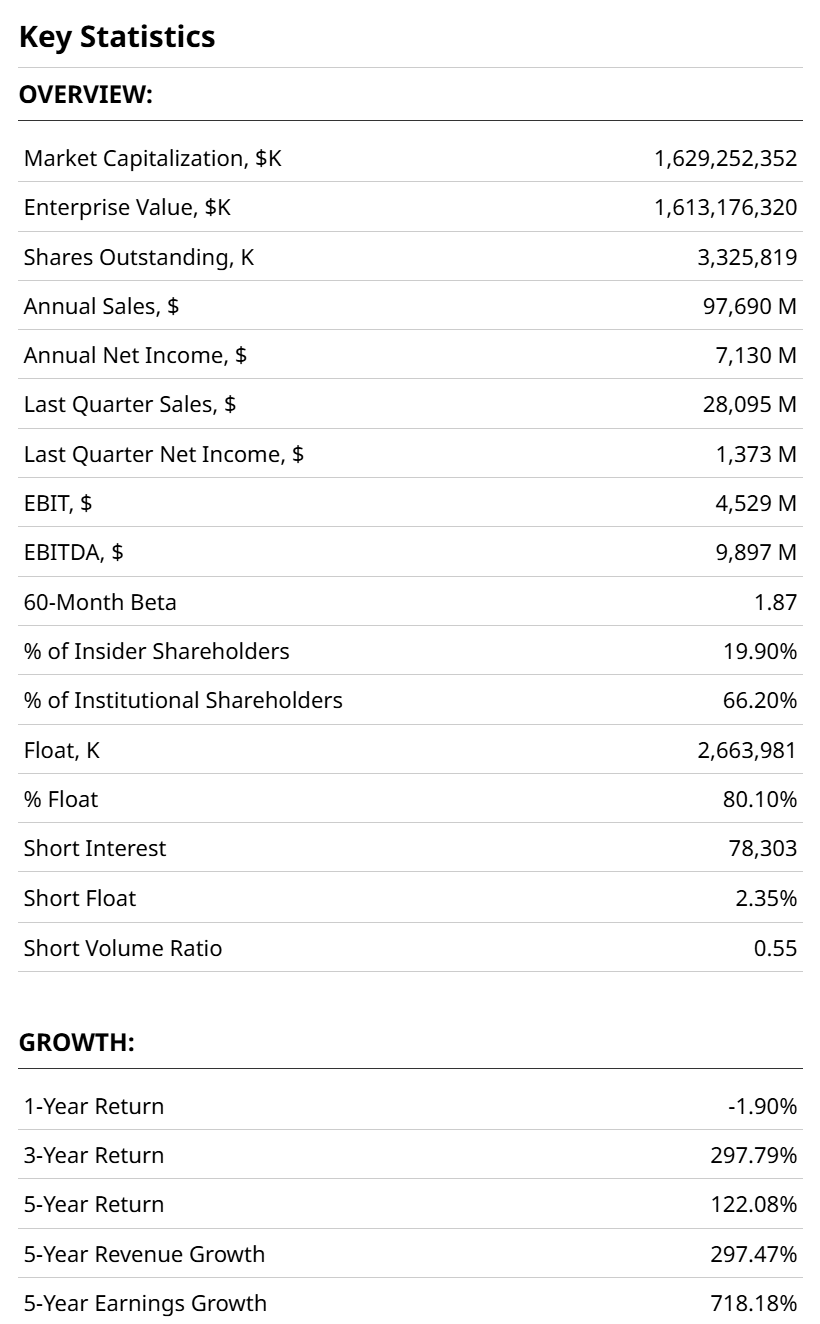

Tesla (TSLA) is on another run. It has more than doubled since April, and recently shrugged off a 20% decline. In other words, nothing out of the ordinary for Elon Musk’s $1.6 trillion market cap baby.

To say that TSLA is a great trading stock is the understatement of the year. When a stock essentially moves like a 4x ETF, there’s plenty of opportunities to get in. And out, in, and out again. Often all within a matter of months, if not weeks, depending on a trader’s time frame.

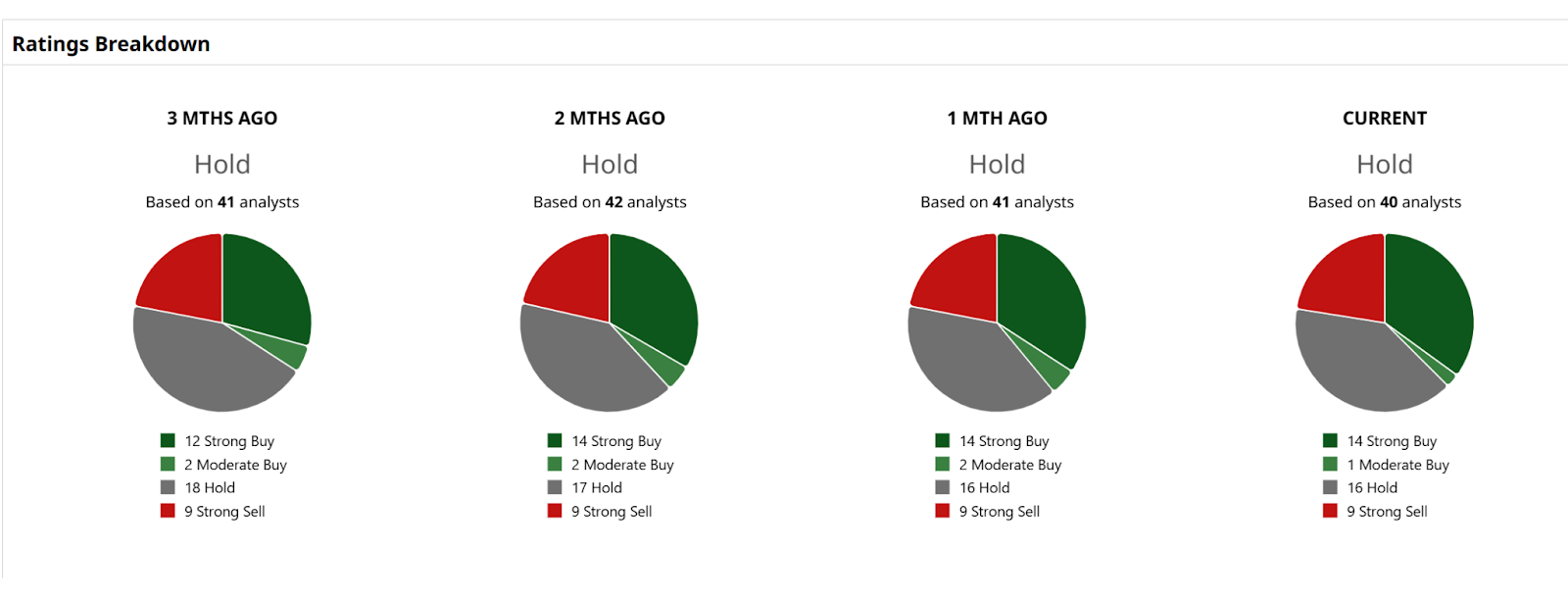

Yet Wall Street, perhaps finding difficulty in taming the beast that is TSLA’s stock price, much less its forward-looking fundamentals, has a net “Hold” rating on it. And has for a few months now. With a stock like this, there are uber-long-term holders, who embrace the vision of Musk, and traders who have made a nice living buying and selling it on every 10%-30% wiggle.

The company has had a tumultuous year, which started with the Department of Government Efficiency (DOGE) in DC, continued with a pay package for the ages, and currently could be described as a double top. As in, the stock price’s return to the $490 area.

One of the math games I like to use in coaching investors and traders goes like this: Which would you rather own?

- A stock up 50% in less than 4 months?

- A stock flat for 12 months?

The good news for Tesla fans is that they get both! The returns for different time frames below add up to chaos, for long-term holders.

And we should assume TSLA will not go quietly into the future. So let’s examine the charts and consider one possibility that probably does not make the headlines.

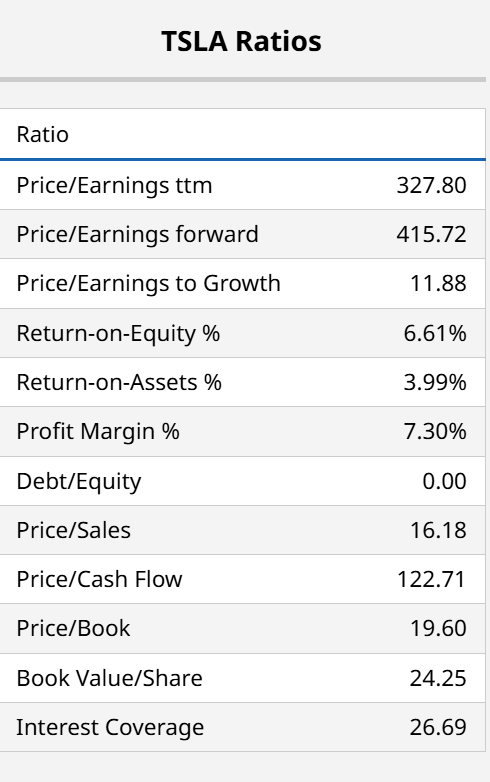

A darling stock selling at more than 400x forward earnings is going to be volatile. And 16x sales is pretty elevated, to put it mildly. So let’s go with the idea that for some investors, while they are comfortable holding some shares of TSLA stock, they’d consider having a portion of it act more like a bond. Or perhaps a buffer note ETF.

TLSA bulls will point to this and see “breakout coming.” And they might be right. But bears might see a retrenchment from around these levels.

What Risk Manager Rob Sees

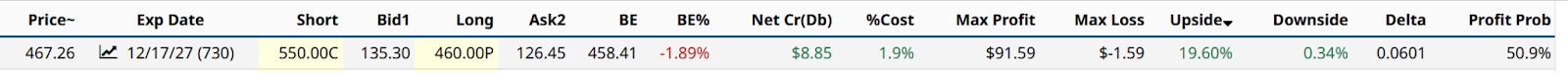

I see, from among many TSLA collar combinations, a way to own TSLA, write calls and buy puts on it, go out 2 years, and set myself up so that the worst case is I break even. My upside? About 10% a year, or close to 20% over 2 years. My stress level? Very low.

And as I see it, if the stock, which I’m daring to go above $550 during that time, does so, I can just buy some more shares. Or rebalance the collar levels. 20% upside, and 0.3% downside over 2 years, on this stock? THAT is turning volatility into opportunity.

Rob Isbitts, founder of Sungarden Investment Publishing, is a semi-retired chief investment officer, whose current research is found here at Barchart, and at his ETF Yourself subscription service on Substack. To copy-trade Rob’s portfolios, check out the new Pi Trade app.