/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

In the financial markets, it’s been said that “you can’t fight the Fed.” But in Intel’s (INTC) case, it might be more accurate to say you can’t fight Washington.

With the U.S. government taking a 10% equity stake in Intel this summer, the company isn’t just another semiconductor story. It’s part of the national security portfolio. Uncle Sam now owns nearly half a billion shares in Intel, and that suggests the company isn’t going bankrupt anytime soon. Recent developments have created a de facto layer of downside protection that could help protect the company from sharp downside corrections — at least in the near term.

Intel wasn’t exactly circling the drain before Washington stepped in, but it had fallen from its leadership position in the chip sector, and was playing catch-up with rivals that had executed in superior fashion over the past decade. In that regard, the government’s investment didn’t just inject capital, it helped restore a degree of credibility. Suddenly, Intel’s turnaround effort has the government behind it, and that’s given investors new faith in the future of the company.

The shift in sentiment is evident in the stock chart. Intel shares have gained more than 80% this year, powered in large part by the government’s strong vote of confidence. Whether you view the move as smart industrial policy or corporate favoritism, the market appears to have spoken: Intel is a strategic U.S. asset riding a wave of government investment and industrial policy momentum.

With Intel’s next earnings release scheduled for the afternoon of Thursday, Oct. 23, this developing narrative adds an intriguing element to the trading landscape. The perception of the “government put” could make near-term financial results less critical, potentially softening the stock’s reaction to downside earnings surprises. Moreover, it could amplify the upside response if the company delivers stronger-than-expected numbers.

Options Strategies to Consider Ahead of Earnings

The beauty of the options market is that it allows investors and traders to express a wider range of opinions beyond being simply long or short. And with Intel’s earnings release approaching, there are plenty of ways to structure trades around the event. I see a couple of interesting approaches worth considering, though every trader should choose a strategy that fits their own outlook and risk tolerance.

For traders leaning bullish, especially with the “government put” in the backdrop, the logic is fairly straightforward: If you believe the downside risk in Intel is cushioned by policy support and rejuvenated market sentiment, a defined-risk directional spread could make sense. For instance, a bull put spread or a bull call spread, which offers targeted upside exposure while capping potential losses.

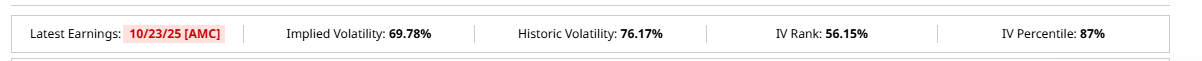

And with implied volatility rank (IV Rank) in Intel rising toward 60% (highlighted below), the bull put spread may be the preferred approach for traders looking to take advantage of elevated option premiums while maintaining a bullish-to-neutral stance. The bull put spread theoretically benefits if the stock holds above the short strike, allowing the sold premium to decay. For those with a stronger directional conviction in Intel’s near-term upside potential, the bull call spread might be more appealing. The bull call spread is a debit trade that profits from a cleaner move higher, while also maintaining a defined risk profile.

Options data for Intel weekly options expiring October 24, 2025:

Another possible approach is the long calendar spread, which can be deployed by selling near-term options premium (using the October 24 weekly expiration that captures the earnings event) and simultaneously buying a longer-dated November options premium with the same strike. This structure represents another way to express a neutral-to-bullish outlook, aiming to capitalize on elevated implied volatility ahead of earnings, and the ensuing volatility contraction that typically follows, often referred to as a “volatility crush.”

The long calendar spread is a debit trade, meaning the most you can lose is the amount paid to enter the position (assuming there’s no stock position). If there’s an accompanying stock position, that will possess the typical directional risk associated with any equity holding. As a standalone options trade, however, the long calendar spread is a defined-risk position that performs optimally when the stock trades in relatively muted fashion during the life of the short option, allowing time decay to work in the favor of the position.

Takeaways

Intel’s Oct. 23 earnings event isn’t just another date on the Q3 semiconductor calendar — it’s a test of America’s newest industrial experiment. With Washington now a part-owner in Intel, the stakes are less about headline EPS, and more about whether political capital can help jump-start a corporate revival.

The so-called “government put” certainly doesn’t remove risk from the equation, but it does change the complexion of it. In my opinion, it dampens downside risk in the stock, and boosts upside potential if Intel delivers a surprise beat. What that means for investors and traders will vary. The key is choosing a strategy that fits your outlook, time horizon, and tolerance for risk.