StockNews.com developed the POWR rating system for stocks several decades ago. It incorporates 118 different factors that identify individual equities that are likely to outperform the overall market. The POWR rating system also uncovers stocks that are poised to underperform.

Since 1999, the highest rated stocks have beaten the S&P 500 by over 4x with a gain of over 28% annually. The lowest rated stocks lost just over 20% in that same time frame.

I guess you could say that StockNews was at the forefront of the AI revolution with this proprietary POWR ranking system going on nearly 25 years since inception.

StockNews has recently taken the POWR rating system a step further by using it to power option strategies with the POWR Options program.

POWR Options looks to buy bullish calls on the highest rated stocks in the POWR ratings and buy bearish puts on the worst rated names. Then it uses technical and implied volatility (IV) analysis to further optimize the best potential candidates for both bullish and bearish trades.

One of the cornerstone strategies of the POWR Options program is the POWR Pairs trade. This combines a bullish call on Buy rated names that have been underperforming recently along with bearish puts on Sell rated names that showed outperformance lately. These trades are put on simultaneously, or “paired” together.

The expectation is for the higher rated stock to outperform the lower rated stock over the upcoming weeks. The bullish calls would outperform the bearish puts resulting in a net profit.

A quick walk through a recent POWR Options POWR Pairs trade may help shed some light on the process.

On Monday, March 18th POWR Options identified a situation where Buy rated Zoetis (ZTS) had been dramatically underperforming Sell rated Air Products (APD).

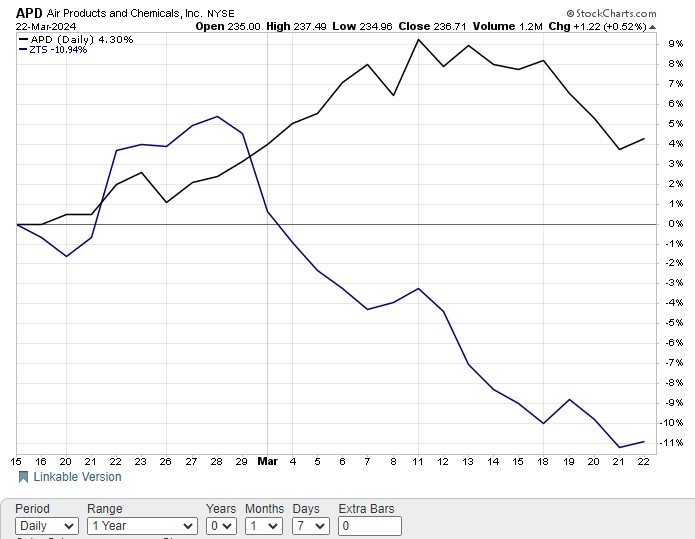

The comparative chart above shows that over the past month Sell-rated APD stock had risen nearly 8% while Buy-rated ZTS shares had dropped just over 9%. The comparative price difference stood at 16.80%.

The individual charts above indicate that APD stock had gotten to overbought technical levels but was finally weakening. ZTS stock had reached deeply oversold technical readings that corresponded to bottoms in the past.

Implied volatility (IV) on both APD options and ZTS options was comparatively low at only 4% and 16% respectively. This means options prices were getting very cheap.

POWR Options put out a trade recommendation to buy bullish calls on ZTS and bearish puts on APD. The expectation was for higher rated ZTS to outperform much lower rated APD over the short-term and close the relative performance gap, resulting in a net profit.

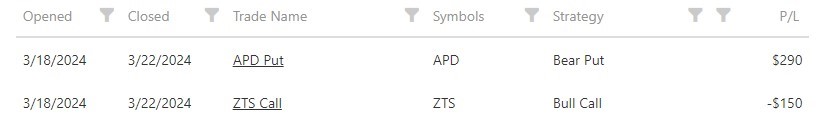

The actual trade was buying the May $185 ZTS calls at $3.60 ($360 per option) and at the same time buying the May $230 APD puts at $4.30 ($430 per option). Total cost was $790 per pair.

Four days later, on March 22, the comparative price performance between APD and ZTS had narrowed sufficiently to close out the trade for a quick profit. The comparative price difference was now 15.26%-or about a 1.50% reversion from the prior 16.80% level.

Even though ZTS stock dropped 1.93% since trade inception, APD stock sank more with a loss of 3.49%.

The ZTS calls were closed at $2.10 and the APD puts were exited at $7.20. Total net credit received for closing out the pair was $9.30-or $930.

Total net gain on the trade was $140 per pair. Loss of $150 on the calls but a gain of $290 on the puts. This equates to just under an 18% overall return ($140/$790) in less than a week. Not bad for a fairly neutral trade. And for a small reversion of 1.5%.

Not all POWR Pairs trades will work out this profitably-or this quickly. Trading is all about probability and not certainty. But those traders looking to add a new and different trading tool to their trading toolbox may want to consider a POWR Pairs approach.

POWR Options

What To Do Next?

If you're looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

ZTS shares closed at $168.90 on Friday, up $0.58 (+0.34%). Year-to-date, ZTS has declined -14.23%, versus a 10.00% rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles.

How To Painlessly Put Together A Profitable POWR Pairs Trade StockNews.com