/Palantir%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock.jpg)

A cash-secured short-put option play in Palantir Inc. (PLTR) yields over 4.2% over the next month. This is for a strike price that is 10% below where PLTR closed on Friday. Moreover, PLTR stock has a price target that is 23% higher.

PLTR closed at $178.15 on Friday, October 17, up from a recent low of $153.11 on September 5. However, it remains below a recent peak of $186.97 on August 12. It's been flat for the last month, which is ideal for out-of-the-money cash-secured short-put plays.

Now, my new price target is $219 per share, up 23% from Friday's close at $178.15. That is also up from my prior target of $217 per share in my Sept. 23 Barchart article on Palantir: “Palantir Stock Could Still Be 20% Undervalued as Analysts Raise Their Forecasts.”

Updated Price Target for Palantir Stock

I will use the same valuation model as in my last article, based on free cash flow (FCF) estimates, FCF margins, and FCF yield valuation metrics.

For example, analysts now forecast that revenue next year will be $5.62 billion, up over +35% from $4.16 billion forecast for 2025.

Last quarter (Q2), Palantir's adjusted FCF margin, as reported on Aug. 4, was 57% of sales (i.e., $569 million / $1,004 million sales).

Moreover, in Q1, it was 42% of sales, and over the trailing 12 months, it has averaged 54.9% (i.e., $1.891 billion adj. FCF/$3.442 billion in TTM sales).

So, just to be conservative, let's assume that Palatir's next 12-month (NTM) FCF margin will be 50% of sales:

$5.62b x 0.50 = $2.81 billion NTM adj. FCF

How will the market value this? In my last article, I assumed that the FCF yield (i.e., adj. FCF / market value) would be 0.52% (i.e., a FCF multiple of 192x).

Just to be conservative, again, let's assume that the multiple will be lower at 185x (i.e., a FCF yield of 0.54%, since 1/0.0054 = 185x):

$2.81 NTM FCF x 185 = $519.95 billion market cap

This NTM valuation is +22.9% higher than today's market cap of $423 billion, according to Yahoo! Finance. In other words, PLTR stock is worth +22.9% more:

$178.15 x 1.229 = $218.95 per share, or $219 per share rounded up.

One way to play this is to sell short out-of-the-money (OTM) put options in near-term expiry periods. That way, an investor can set a lower potential buy-in and get paid while waiting.

Shorting OTM Puts

I discussed this in my Sept. 23 Barchart article, where I suggested a cash-secured short-put play with the $165.00 put option expiring this week on Oct. 24.

At the time, PLTR was at $181.07, and the $165.00 put option, which was 8.8% lower, had a midpoint premium of $4.15. That provided an immediate short-put yield of 2.515% (i.e., $4.15/165.00).

This play has been successful, as the premium is now lower at $1.40 with just 1 week to go.

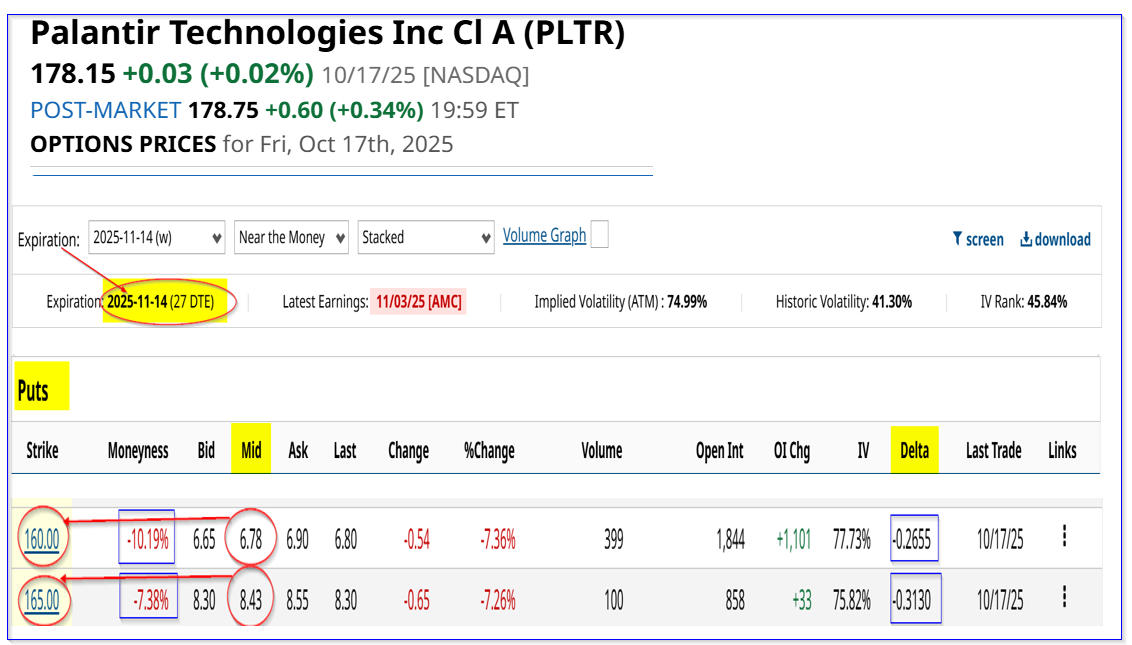

It makes sense to either roll this over or make a new short-put play. For example, the Nov. 14 expiry period shows that the $160.0 strike price, 10% lower than the Friday closing price, has a midpoint premium of $6.78.

That represents a short-put yield of 4.2375% (i.e., $6.78/$160.00 = 0.042375). That is for an expiry period of just 27 days.

Moreover, for less risk-averse investors, the $165.00 strike price put has a $8.43 midpoint premium. That strike price is 7.4% below today's price, and the short-put play yield is 5.109% (i.e., $8.43/$165.00) for just 4 weeks (i.e., Nov. 14 expiry).

So, on average, doing one contract at both strike prices, the investor could make a 4.68% yield shorting puts (i.e., $7.605/ $162.50) that are 8.7% below the closing price. That is similar to the 8.8% out-of-the-money (OTM) play last month with a lower 2.5% yield.

Downside Risks and Protection

The downside risk is that PLTR could fall below the strike price. In that case, the investor may incur an unrealized loss, since the collateral secured cash to do this is used to buy PLTR shares at the strike price.

However, the downside is protected, since the delta ratios are between 27% and 31%. That implies a low chance that PLTR will fall to these strike prices over the next four weeks.

However, even if it does, the investor has mitigating downside protection elements. For one, the accumulated income from shorting puts for the past two months is $11.755 (i.e., $7.605 + $4.15). that represents an average yield of 7.233% (i.e., $11.755/$162.50) for the past 2 months

Even after paying for the “Buy to Close” cost of $1.40 to roll over the Oct. 24 expiry put play, the net premium is $10.355 (i.e., $11.755-$1.40), or a yield of 6.372% (i.e., $10.355/$162.50) for 2 months.

Second, this lowers the breakeven cost even if an assignment is made. For example, the Nov. 14 short-put play has a breakeven point of $160-$6.78, or $153.22. That is 14% below Friday's close.

Third, the upside is even greater if an assignment is made. For example, at my target price of $219, the potential upside from the Nov. 14 breakeven point is +43% higher:

$219/$153.22 = 1.429 -1 = +42.9%

That is almost twice the 22.9% upside from buying PLTR shares at Friday's close. And, even if that occurs, the investor can sell short OTM calls to mitigate any unrealized losses.

The bottom line is that PLTR stock looks cheap here. Shorting puts each month is an attractive way to play the stock.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.