/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

Out-of-the-money (OTM) Alphabet, Inc. (GOOGL) put options can give a 1.77% to short-sellers over the next month. Moreover, GOOGL stock has +32% upside based on an FCF-based target. Buying in-the-money calls is another play.

GOOGL closed at $309.29 on Friday, Dec. 12. It's slightly below a recent peak of $323.44 on Nov. 25. But it could be worth as much as $408.27 over the next year, as I recently wrote.

Today's article will discuss ways to play GOOGL stock's upside on a relatively safe basis using leverage with out-of-the-money (OTM) put options and in-the-money (ITM) calls.

I discussed shorting the $275.00 strike price put option expiring Friday for a 1.764% yield in a Nov. 11 Barchart article ("Alphabet Generates Strong FCF and If It Continues GOOGL Stock is 40% Undervalued").

As GOOGL closed above this strike price, the short-put investors would not have had their account assigned to buy 100 shares of GOOGL at $275.00. So, this was a successful short play with good income.

However, when the play was initiated on Nov. 11, GOOGL was at $289.58. So, it's up +6.8% over the last month. That's better than the OTM short-put return of 1.764%.

So, why not use the income from shorting OTM GOOGL puts to participate in GOOGL's upside using in-the-money (ITM) calls? This article will show how to do this.

First, let's review the upside price target in GOOGL stock.

GOOGL Price Targets (PT)

In my last article, I showed that based on Alphabet's strong free cash flow (FCF) margins, it could be worth over $408 over the next 12 months.

For example, last quarter its FCF margin (i.e., FCF/revenue) rose to 23.9% from 19.98% a year earlier. Its average over the last year was 19.08% but that included one quarter with a low outlier.

Therefore, assuming Alphabet generates 22% of revenue as FCF, it could generate about $100 billion in FCF in 2026. But, just to be conservative, let's assume it might make as low as $90 billion in FCF.

Therefore, using a 2.0% FCF yield, i.e., 50x FCF, GOOGL stock could be worth between $4.5 trillion and $5 trillion over the next year:

50 x $90b FCF = $4,500 b; 50 x $100b FCF = $5,000 billion

Today, Alphabet's market cap is just $3.746 trillion, according to Yahoo! Finance. In other words, Alphabet could be worth about $1 trillion or +26.8% more($4.75 trillion/$3.746 trillion = 1.268).

That implies that the price target (PT) is 26.8% higher:

$309.29 x 1.268 = $392.18.

And the peak PT could be as high as 33.5% above the current market value (i.e., $5tr/$3.736tr), or $412.90 per share.

So, on average, we could expect a PT of over $400 per share (i.e.,$402.54 per share).

Moreover, 33 analysts surveyed by AnaChart show that the average price target (PT) is $343.47. The bottom line is that GOOGL stock looks undervalued.

Shorting OTM Puts

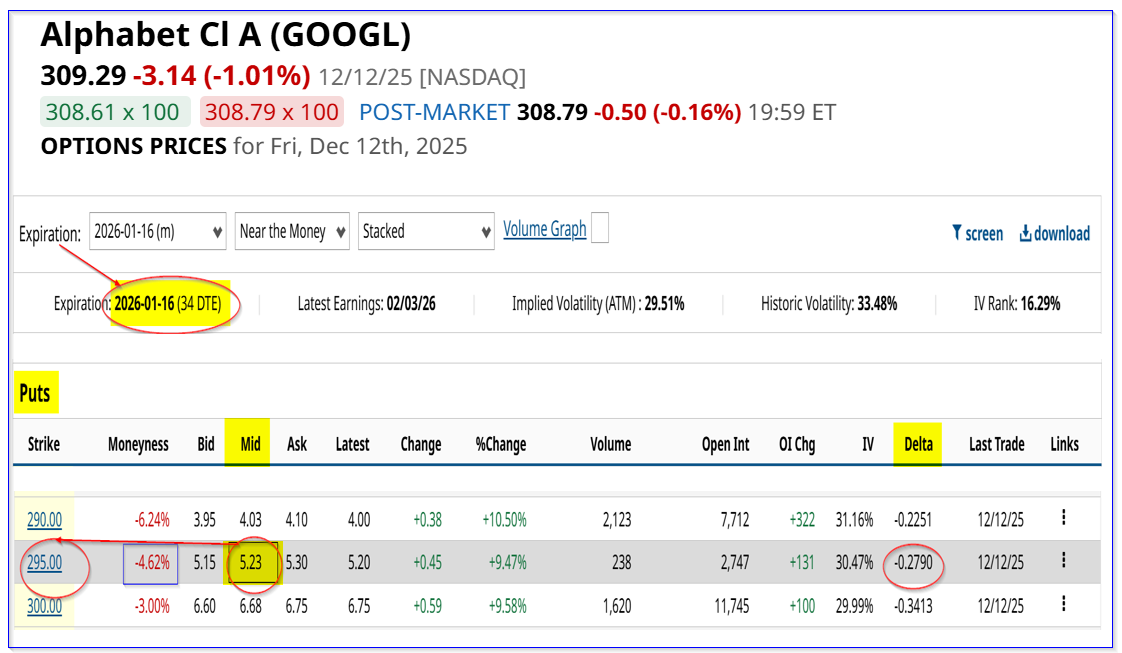

One way to play this, as discussed earlier, is to sell short out-of-the-money (OTM) puts in near-term expiry periods. For example, the Jan. 16, 2026, expiry period shows that $295.00 strike price put option has a premium of $5.23 per put contract.

That provides a short-seller of this strike price, which is 4.62% below the closing trading price, provides a short-seller an immediate yield of 1.77% (i.e., $5.23/$295.00 = 0.0177).

This means that an investor who secures $29,500 with their brokerage firm can immediately make $523.00 (i.e., 1.77%).

As long as GOOGL stays over $295.00 for the next month, the $29.5K collateral will not be assigned to buy 100 shares of GOOGL at $295.00.

Moreover, as discussed earlier, this income can be used to partially fund buying in-the-money (calls) at a later expiry period. That way, an investor can gain leveraged exposure, in a relatively safe manner, to any upside in GOOGL stock.

Buying ITM GOOGL Calls

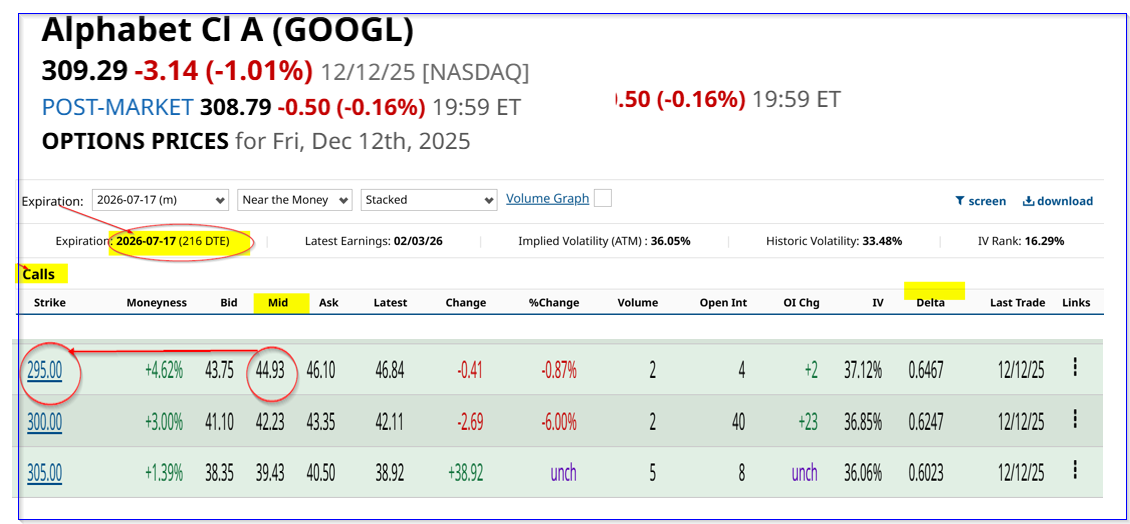

For example, the $295.00 call option expiring on July 17, 2026, shows that the midpoint premium is $44.93. Note that this strike price is in-the-money (ITM) by $14.29 (i.e., $309.29-$295).

That provides some downside protection for an investor, in case GOOGL stock stays flat or falls.

Moreover, if the investor can repeat this one-month OTM short-put play 7 times until July 17, the potential income is $36.61 (i.e., 7x $5.23 received each month, including Jan. 17).

That covers much of the $44.93 price paid for the $295.00 July 17, 2026, call option:

$44.93 call price - $36.61 put income received = $8.32 net cost

Just to be conservative, let's assume the net income received is just $29.93 over the next 7 months:

$44.93 call price - $29.93 put income = $15.00 net cost

And if GOOGL stock rises to just $370 over the next 7 months, the intrinsic value of the $295.00 calls will be:

$370-$295 = $75.00 per call

That implies that the net return will be

$75/15 -1 = 5-1 = 4 = 400% upside

Moreover, just to be conservative, let's say that GOOGL stays flat in 7 months at $310 per share. The intrinsic value of the call option is just $15 (i.e., $310-$295).

So, the investor paid $44.93 for the OTM calls, received income of $29.93 from OTM puts, but could potentially sell the 7/17/26 call at $15.00 in 7 months. Here is the net result:

$44.93-$29.93 = $15.00 ITM call option cost; $15.00 received from call at its intrinsic value = $0 profit.

In other words, there is no loss, and this play has good downside protection. Any net price increase over $309.29 could result in a potential profit.

That shows that shorting OTM GOOGL puts and also buying ITM calls may be an attractive leveraged way to play Alphabet.