/Synopsys%2C%20Inc_%20HQ%20sign-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

It is not often that a pair of $100 billion-plus stocks have a 70% difference in daily price. Actually, I’m not sure it has ever happened before Wednesday. While Oracle (ORCL) gained 36%, the lesser-known but still quite prominent electric design automation firm Synopsys (SNPS) blew both its earnings and forward guidance. SNPS shares closed down 36%.

SNPS was the 150th-largest S&P 500 Index ($SPX) stock before Wednesday’s sudden financial tragedy. But that’s potentially what great collar trades are made of. So I took a look.

As a review, what makes a collar intriguing is a combination of factors. While any stock with a liquid options market can be collared at any time, the key to me, if it’s a stock I don’t yet own, is that it has a chance to rise aggressively in price. It follows that in this buy-the-dip frenzy of a market, any stock down by more than one-third of its value in a single day is fair game for a collar analysis.

The reason that fallen angel types like SNPS make good collar candidates is enhanced by the fact that volatility spikes when a stock tanks in this way. Higher volatility means higher option prices. That, in turn, may produce a hefty option premium on the call side of the collar, which can pay for the likely steep cost of the put protection. It is always a calculated risk, but I get to define where that risk ends. That’s the key to me as a devout risk manager.

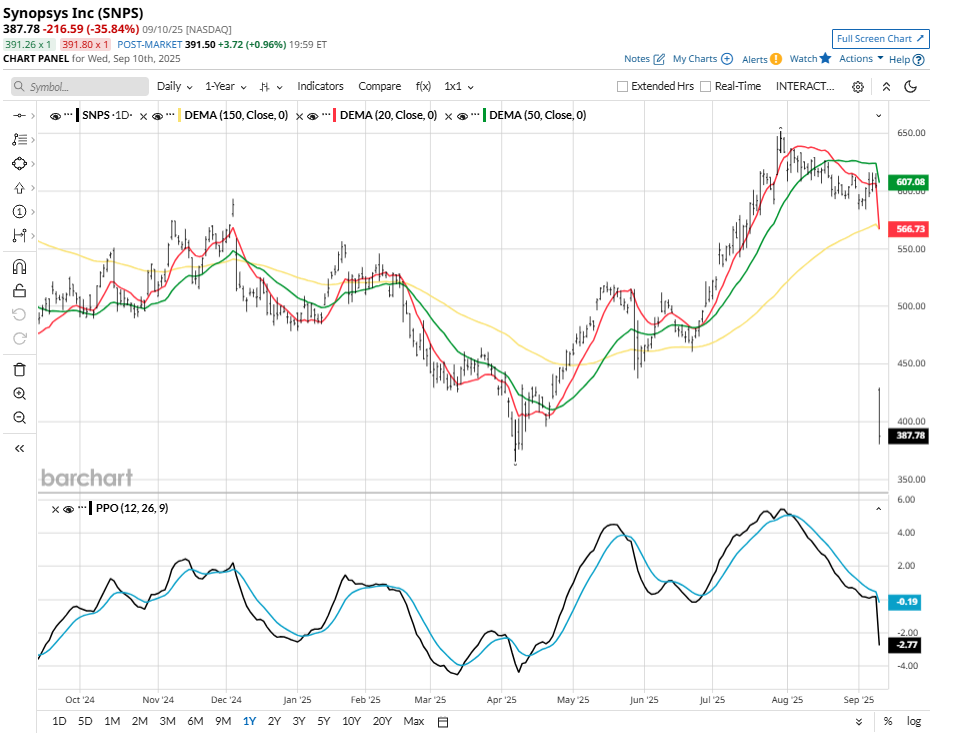

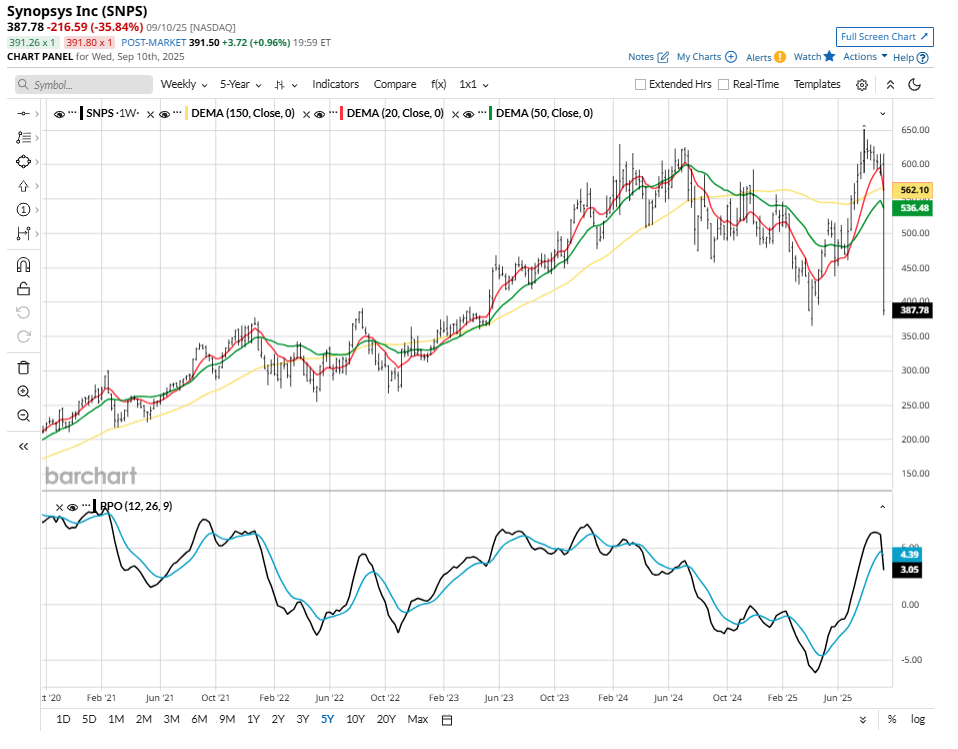

The daily chart of SNPS is as messy as you’d expect. If you are looking for Wednesday’s closing price in the chart here, look down. Way down. The stock fell from over $600 to under $400 in a single day.

The weekly chart shows an extreme example of something I see all the time these days. While the biggest stocks continue to mask the weakness underneath, the number of stocks whose prices are getting knocked back to levels they traded at in 2021 or 2022 is climbing rapidly. SNPS has now joined that group.

How to Use a Collar to Catch the Rebound, if There is One

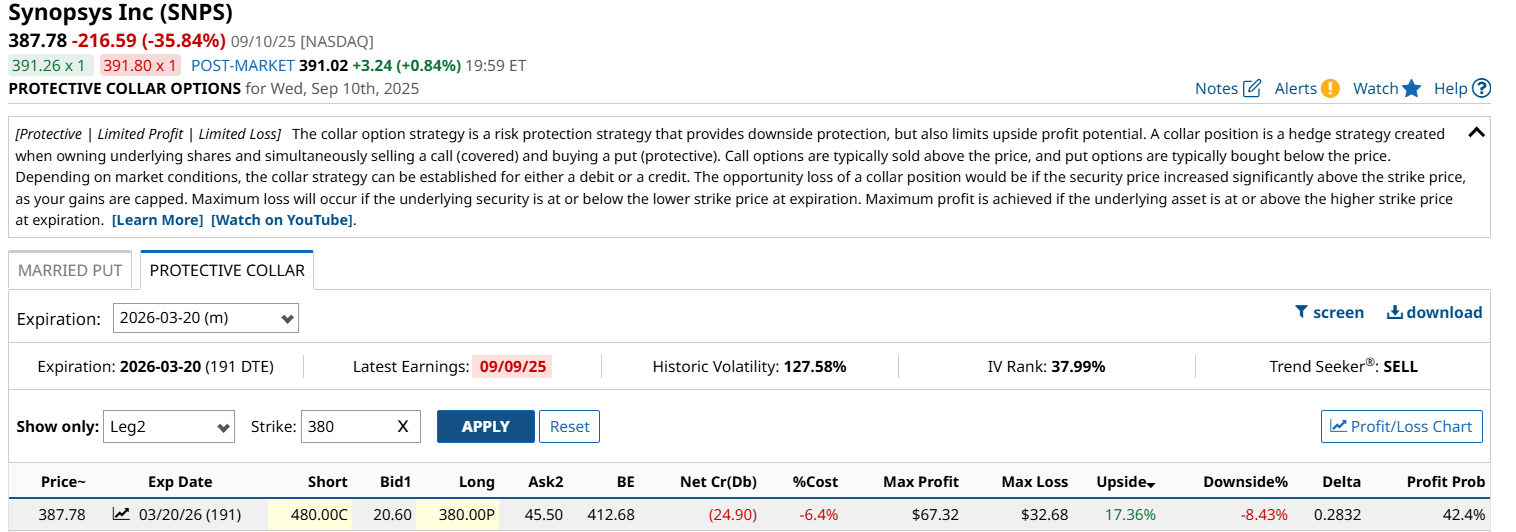

The SNPS collar is not the best reward-to-risk ratio I’ll ever show you, but I squeeze out 2:1 upside to downside by only going out 6 months, to March 2026. Strike prices are $480 and $380 for covered call and protective put, respectively. Not surprisingly with a stock that just went through a shock like this one did, the cost is a bit on the high side for me, at 6%.

The net result is 17% upside to 8% downside. To me, the key here is that if I liked the stock, the ability to own it in some size, but with 8% downside risk for 6 months, gives me the freedom and flexibility to try to buy this dip without as much fear of it falling further.

And What if SNPS Stock Soars?

And if the stock rallies through the call strike price, I can always buy more stock to replace what is called away.

That’s the synopsis of SNPS. For existing shareholders, this week was a tough break. For option-savvy, curious investors willing to put in the effort, it could instead be an opportunity to move carefully but decisively, while the headlines continue to talk about what already happened.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.