Selling cash secured puts on stocks an investor is happy to take ownership of is a great way to generate some extra income. A cash-secured put involves writing an at-the-money or out-of-the-money put option and simultaneously setting aside enough cash to buy the stock. The goal is to either have the put expire worthless and keep the premium, or to be assigned and acquire the stock below the current price. It’s important that anyone selling puts understands that they may be assigned 100 shares at the strike price.

Why Trade Cash Secured Puts?

Selling cash secured puts is a bullish trade but slightly less bullish than outright stock ownership. If the investor was strongly bullish, they would prefer to look at strategies like a long call or a bull call spread. Investors would sell a put on a stock they think will stay flat, rise slightly, or at worst not drop too much.

Cash secured put sellers set aside enough capital to purchase the shares and are happy to take ownership of the stock if called upon to do so by the put buyer. Naked put sellers, on the other hand, have no intention of taking ownership of the stock and are purely looking to generate premium from option selling strategies.

The more bullish the cash secure put investor is, the closer they should sell the put to the current stock price. This will generate the most amount of premium and also increase the chances of the put being assigned. Selling deep-out-of-the-money puts generates the smallest amount of premium and is less likely to see the put assigned.

TSLA Cash Secure Put Example

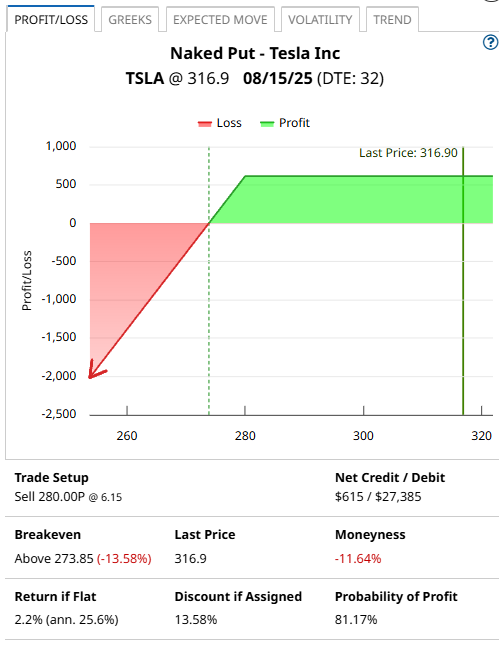

Yesterday, with TSLA trading at $316.90, the August 15 put option with a strike price of $280 was trading around $6.15. Traders selling this put would receive $615 in option premium.

In return for receiving this premium, they have an obligation to buy 100 shares of TSLA for $280. By August 15, if TSLA is trading for $275, or $270, or even $220, the put seller still has to buy 100 shares at $280.

But, if TSLA is trading above $280, the put option expires worthless, and the trader keeps the $615 option premium. The net capital at risk is equal to the strike price of $280, less the $6.15 in option premium. So, if assigned, the net cost basis will be $273.85. That’s not bad for a stock currently trading at $316.90. That’s a 13.58% discount from the price it was trading yesterday.

If TSLA stays above $280, the return on capital is:

$615 / $27,385 = 2.2% in 32 days, which works out to 25.6% annualized.

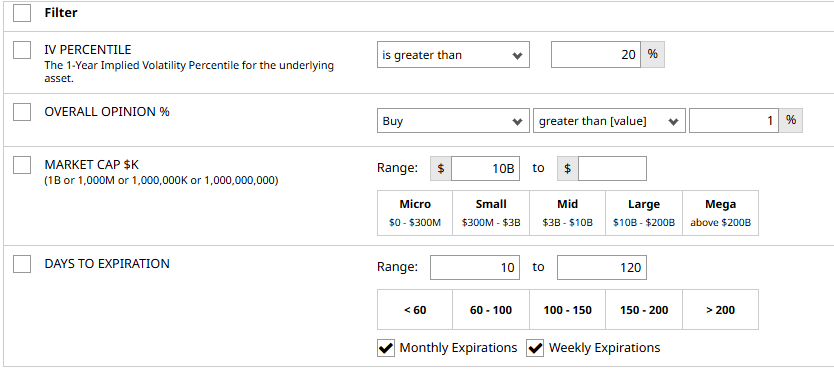

Either the put seller achieves a 25.6% annualized return or gets to buy the stock for a 13.58% discount. You can find other ideas like this using the Naked Put Screener. Below you can see some parameters that you might consider for running this screener. Feel free to tweak them as you see fit.

Yesterday, we looked at some other naked put ideas.

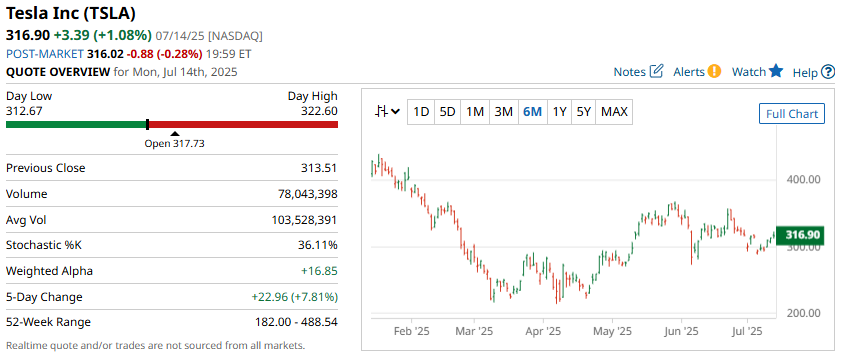

Company Details

The Barchart Technical Opinion rating is a 8% Sell with a Weakest short term outlook on maintaining the current direction.

Of 40 analysts covering TSLA, 12 have a Strong Buy rating, 2 have a Moderate Buy rating, 16 have a Hold rating and 10 have a Strong Sell rating.

Tesla is the market leader in battery-powered electric car sales in the United States, with roughly 70% market share.

The company's flagship Model 3 is the best-selling EV model in the United States.

Tesla, which has managed to garner the reputation of a gold standard over the years, is now a far bigger entity that what it started off since its IPO in 2010, with its market cap crossing $1 trillion for the first time in October 2021.'

Summary

While this type of strategy requires a lot of capital, it is a great way to generate an income from stocks you want to own. If you end up being assigned, you can begin selling covered calls against the long stock position to further enhance the income. You can do this on other stocks as well but remember to start small until you understand a bit more about how this all works.

Risk averse traders might consider buying an out-of-the-money put to protect the downside.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.3