Netflix (NFLX) has been the surprising force of reckoning in the FAANG group.

With Apple (AAPL) stock making new 52-week lows this week, the entire group has come under immense selling pressure in 2022.

At one point, Netflix stock was down more than 76.7% from its all-time high. It got so bad, Netflix was being talked about as a value stock!

With the continued selloff in Meta (META), though, that stock now owns the infamous crown of the biggest loser in the FAANG group after it fell 77.1% from peak to trough.

Regardless, Netflix stock is the best performing stock of the group over the past three and six months, up 18% and 61%, respectively. Further, all other FAANG components are lower over those stretches.

That begs the question: Can Netflix stock continue to lead the FAANG group in 2023? Let’s look at the charts and spot the must-hold support level.

Trading Netflix Stock

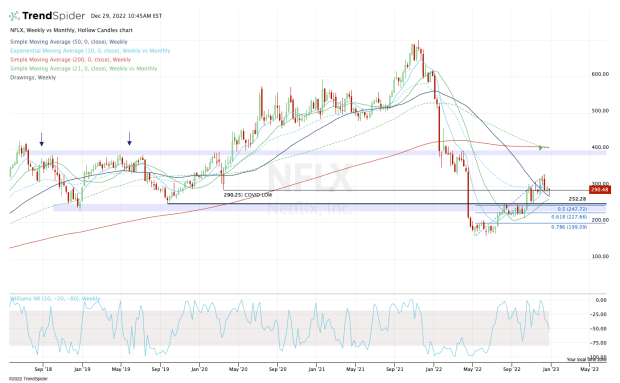

Chart courtesy of TrendSpider.com

Netflix stock plunged from $700 down to a low of $162.71. The stock then found its footing and decisively moved higher.

Even as the market would go through a few bouts of volatility, Netflix stock held strong by not retesting the low it made in May. In fact, after the summer, it never even got close to retesting that level.

The weekly chart above looks a little busy, but it outlines a couple of scenarios.

Netflix recently made a push to the $330 area, which was support in the first quarter of this year. Most recently, it was resistance, which is natural price action.

If the stock can take out this level in 2023, it opens the door toward the $400 area. Currently, that’s where we find a big pivot level from the past few years, as well as the 200-week and 21-month moving averages.

As for the downside, Netflix has a major must-hold support area near $250.

If the stock breaks below $247, it will have lost its 10-week, 21-week and 50-week moving averages, as well as the 50% retracement of the current rally.

Even more important, the $230 to $250 area was key in the years leading up to the 2020 rally. Netflix broke below this zone but was able to reclaim it in October and use it as support in November.

Losing the $247 to $250 area would really shift the momentum to the downside.

Below $247 to $250 and the $225 to $230 area becomes vulnerable. A break of this zone opens the door back down to $200.

While Netflix stock can be a FAANG leader in 2023 if the recent trends hold, it can also suffer a large pullback if support doesn’t hold.

We’re still in a bear market and traders need to respect their levels and remain disciplined.