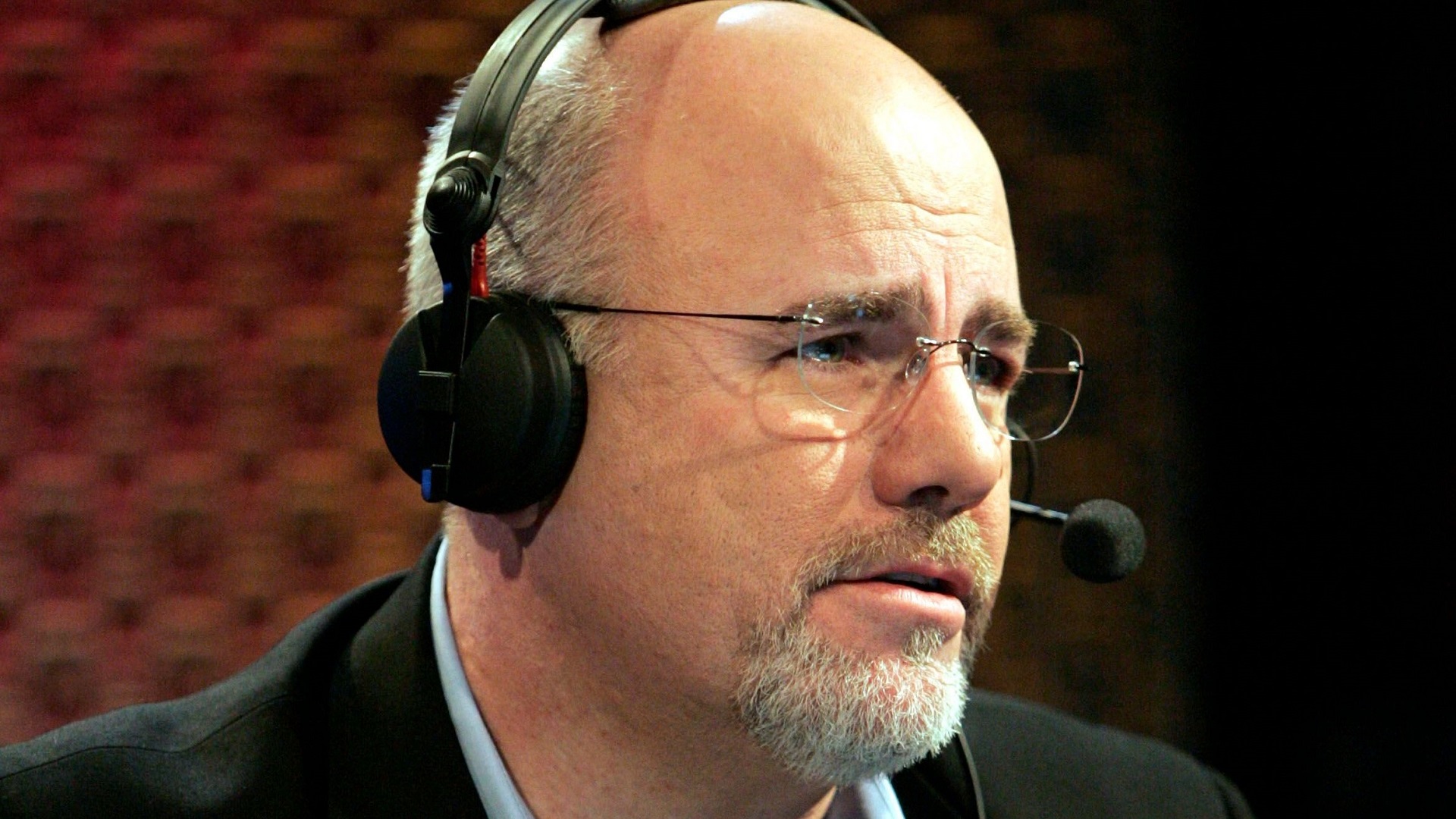

Dave Ramsey doesn’t need Social Security, but he’s entitled to it like everyone else after paying into the system for many years. Since Social Security is based on how much you made in your career, it’s easy to think that Ramsey is bringing in higher Social Security paychecks than most people.

Explore More: Dave Ramsey Says This is the Best Way To Pay Off Debt

Check Out: 4 Affordable Car Brands You Won't Regret Buying in 2025

However, that isn’t the case if we look at estimates and assume that Ramsey followed his own advice. We don’t have an exact figure for Ramsey’s Social Security check, but it’s possible to estimate what he earns.

Ramsey Likely Took Out Social Security at 62

The first part of calculating Ramsey’s Social Security paycheck is guessing when he took out his paychecks. While you can maximize your benefits if you wait until 70, Ramsey is an advocate of taking out Social Security early and investing the money.

The higher Social Security benefits at 70 mean nothing for someone who passes away in their late 60s. You also have to live several years past your 70s just to break even compared to collecting Social Security paychecks when you turn 62.

Read Next: What Is the Highest Social Security Check per Month?

How Much Ramsey Receives From Social Security

Ramsey’s high career earnings will qualify him for the maximum Social Security payout, and if he took it out at 62, he’s currently receiving $2,836 per month. His Social Security income will go up each year due to inflation.

However, Ramsey would be making $5,146 per month if he waited until 70 to cash in on Social Security. He’s missing out on more than $2,000 per month, but since Ramsey is 64, he would still have to wait another six years before he could receive his Social Security check.

While he’s missing out on higher Social Security checks since he likely cashed out early, he also gets to invest the Social Security checks into profitable assets. Using the check to buy stocks, index funds and other high-growth assets can lead to outperformance. Bonds are also an option, especially for risk-averse investors, but bonds aren’t likely to outperform the growth rate of Social Security checks for people who wait.

If those profitable assets grow at a faster rate than what his Social Security paychecks would have grown at, then he’s ahead. If Ramsey passes away at 70, he can say that he received some Social Security instead of passing away right before he had the opportunity to receive his first check.

More From GOBankingRates

- 6 Costco Products That Have the Most Customer Complaints

- This is the Most Frugal Generation (Hint: It's Not Boomers)

- 6 Hybrid Vehicles To Stay Away From in Retirement

- I'm a Retired Boomer: 6 Bills I Canceled This Year That Were a Waste of Money

This article originally appeared on GOBankingRates.com: How Much Is Dave Ramsey’s Social Security Check?