/Computer%20board%20micro%20chip%20green%20by%20blickpixel%20via%20Pixabay.jpg)

Navitas Semiconductor (NVTS) shares are up more than 25% on Tuesday after the company issued an update showcasing progress on its partnership with Nvidia (NVDA).

Nvidia has picked the gallium nitride (GaN) and silicon carbide (SiC) firm as a key supplier for its next-gen high-voltage (HVDC) artificial intelligence (AI) factory architecture.

Including today’s rally, Navitas stock is up roughly 700% versus its year-to-date low in early April.

Why Navitas Stock Soared on Tuesday

NVTS update this morning detailed successful integration of GaN and SiC power semiconductors into Nvidia’s new 800V artificial intelligence architecture.

The announcement confirmed that Navitas chips are now actively supporting the AI darling’s multi megawatt AI workloads – validating both performance and scalability.

This progress indicates real commercial traction, not just theoretical potential – boosting investor confidence in Navitas’ role within the broader AI infrastructure boom.

With demand for energy-efficient power solutions surging, Navitas is positioning as a core supplier to NVDA, which improves its growth outlook, and justified the sharp move higher in NVTS stock.

How High Can NVTS Shares Fly?

Despite a meteoric rally in Navitas shares over the past six months, options traders are positioning for further upside both in the near and long term.

According to Barchart data, contracts expiring Oct. 24 signal potential for another leg up to $15.78. Meanwhile, longer-dated contracts expiring January 2026 suggest NVTS stock could go as high as $19.31.

A near-term tailwind for Navitas Semiconductor could be its quarterly earnings release scheduled for Nov. 3. Consensus is for the Nasdaq-listed firm to lose $0.09 on a per-share basis – 25% less than the same quarter last year.

Note that the semiconductor firm is currently going for a price-sales (P/S) multiple of 21x, which is rather inexpensive for an AI stock. NVDA itself, for example, is currently going for 34x sales.

How Wall Street Recommends Playing Navitas

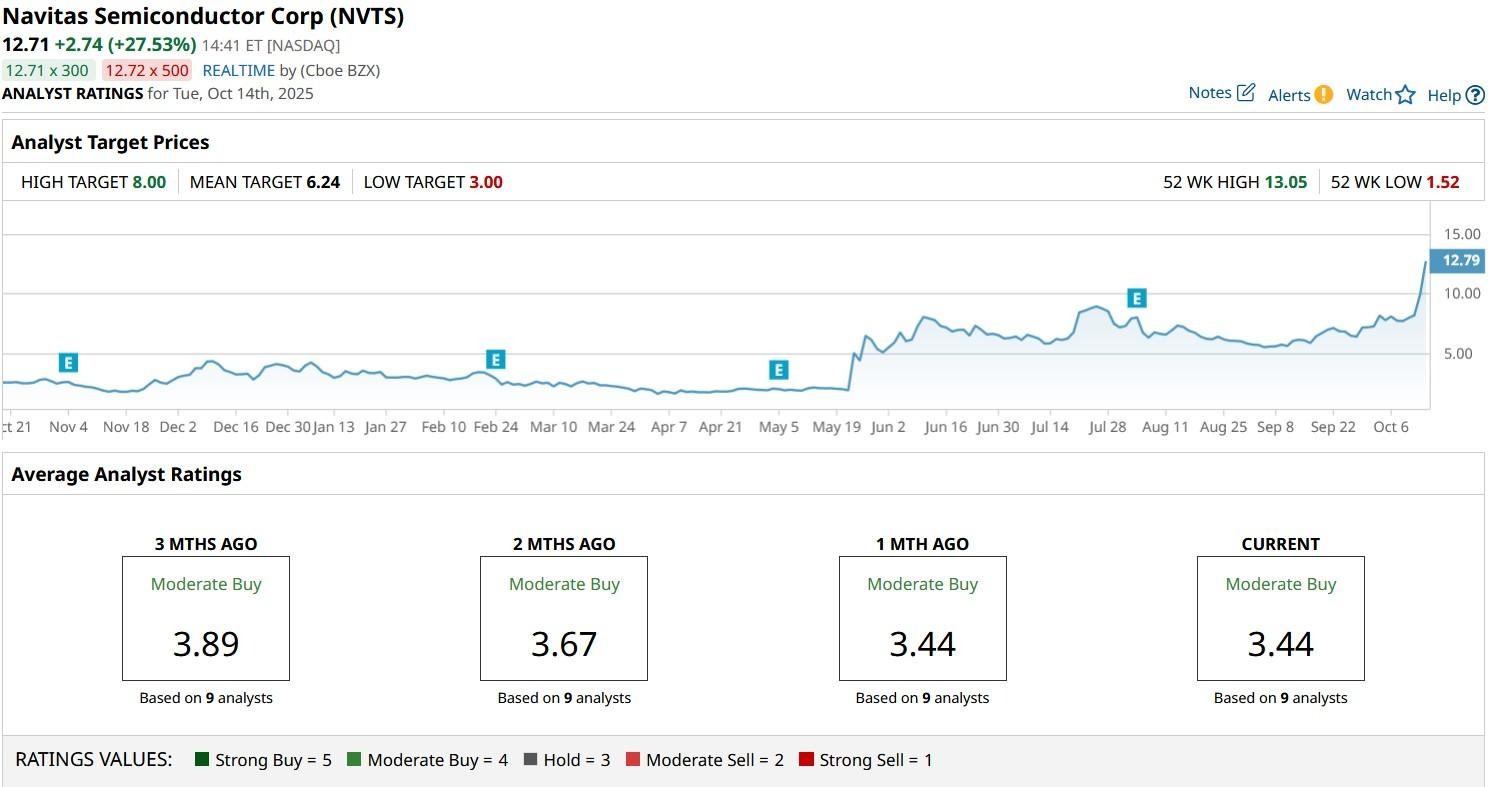

Wall Street firms, however, view much of the upside related to the Nvidia partnership as already priced in Navitas stock.

The consensus rating on NVTS shares remains at “Moderate Buy” but the mean target of $6.24 suggest potential downside of more than 50% from here.