/Xylem%20Inc%20%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)

Xylem Inc. (XYL), with a market capitalization of $33.5 billion, is a prominent water technology company that delivers innovative solutions spanning the entire water cycle, from collection and distribution to treatment and environmental restoration. The Washington, DC-based company operates through three primary segments, Water Infrastructure, Applied Water, and Measurement & Control Solutions, each focused on addressing essential areas of water management.

Companies valued at $10 billion or more are generally considered "large-cap" stocks, and Xylem fits this criterion perfectly.

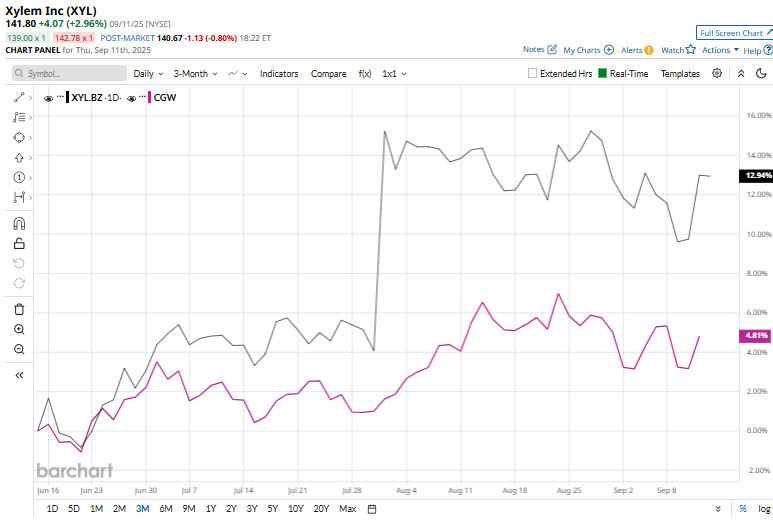

Shares of the water technology firm have dropped 2.4% from its 52-week high of $145.33 touched on Aug. 5. XYL’s shares have soared 11.6% over the past three months, outperforming the Invesco S&P Global Water Index ETF’s (CGW) 3.9% uptick during the same time frame.

XYL shares have climbed 9.2% over the past 52 weeks, slightly lagging behind CGW’s 9.9% gain over the same time frame. However, XYL stock is up 22.2% on a YTD basis, outpacing CGW’s 18.2% increase.

The stock has been trading above its 50-day and 200-day moving averages since early May, indicating a sustained uptrend.

On Jul. 31, XYL shares surged 10.7% after reporting its Q2 results. The company posted an adjusted EPS of $1.26, surpassing Wall Street’s estimate of $1.14, while revenue came in at $2.3 billion, ahead of the expected $2.2 billion. For the full year, the company projects adjusted EPS between $4.70 and $4.85 and revenue in the range of $8.9 billion to $9 billion.

XYL stock has outperformed its rival, Ingersoll Rand Inc. (IR). IR stock has dropped 10.4% on a YTD basis and 9.6% over the past 52 weeks.

The stock has a consensus rating of “Moderate Buy” from 20 analysts' coverage, and the mean price target of $160.40 implies an upswing of 13.1% from the prevailing market prices.