/Wells%20Fargo%20%26%20Co_%20location-by%20jetcityimage%20via%20iStock.jpg)

With a market cap of $263.3 billion, Wells Fargo & Company (WFC) is one of the largest financial services companies in the United States. The company provides a wide range of banking, investment, mortgage, and consumer and commercial finance products and services both domestically and internationally.

Companies valued at $200 billion or more are generally considered “mega-cap” stocks, and Wells Fargo fits this criterion perfectly. It operates through four main segments: Consumer Banking and Lending; Commercial Banking; Corporate and Investment Banking; and Wealth and Investment Management.

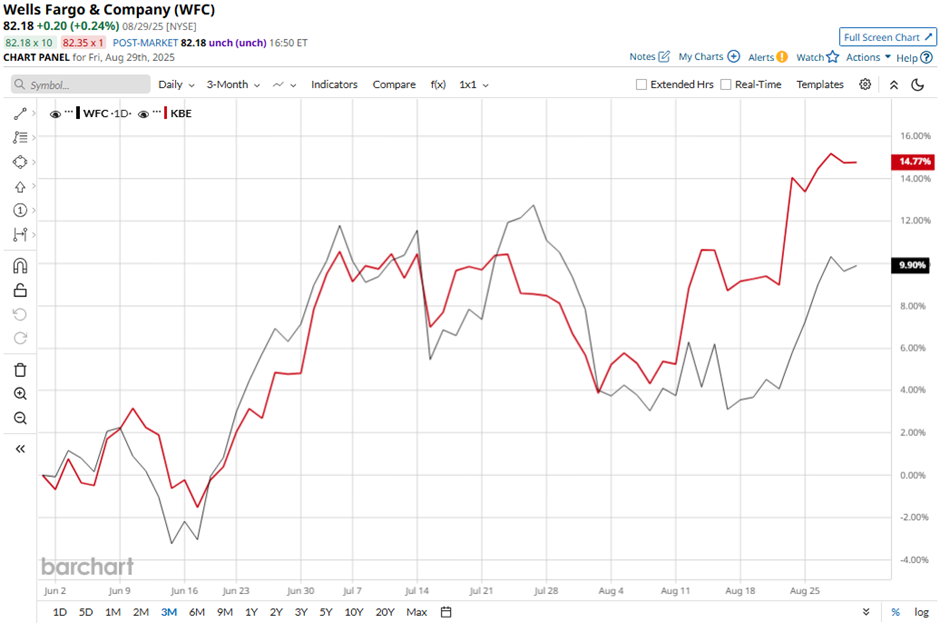

The San Francisco, California-based company's stock has declined 3.1% from its 52-week high of $84.83. Shares of Wells Fargo have gained 10.3% over the past three months, lagging behind the SPDR S&P Bank ETF’s (KBE) 14% increase over the same time frame.

However, WFC stock is up 17% on a YTD basis, outperforming KBE’s 10.1% gain. In addition, shares of the biggest U.S. mortgage lender have climbed 44% over the past 52 weeks, compared to KBE’s 14.7% return over the same time frame.

Despite a few fluctuations, the stock has been trading mostly above its 50-day and 200-day moving averages since last year.

Despite reporting better-than-expected Q2 2025 adjusted EPS of $1.54 and total revenue of $20.8 billion, Wells Fargo shares fell 5.5% on Jul. 15 due to a downward revision in its 2025 net interest income (NII) guidance. The bank now expects NII to remain roughly flat at $47.7 billion, cutting its earlier forecast of 1% - 3% growth, citing lower interest income in its markets business and cautious borrower demand amid elevated interest rates.

Additionally, WFC stock has underperformed its rival, Citigroup Inc. (C). Citigroup stock has soared 37.2% on a YTD basis and 56.8% over the past 52 weeks.

Despite Wells Fargo’s underperformance relative to its industry peers, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of “Moderate Buy” from 26 analysts' coverage, and the mean price target of $87.56 is a premium of 6.5% to current levels.