/Verisk%20Analytics%20Inc%20logo%20magnified-by%20Casimiro%20PT%20via%20Shutterstock.jpg)

Verisk Analytics, Inc. (VRSK), headquartered in New Jersey, specializes in data analytics, risk assessment, and decision‐support tools for industries such as insurance, natural resources, financial services, government, and risk management. Verisk Analytics has a market cap of $36.7 billion.

Companies with a market cap of $10 billion or more are typically classified as “large-cap stocks,” a category that represents established businesses with significant financial strength and global influence. Verisk Analytics comfortably falls into this class, underscoring its scale, stability, and competitive edge. Its deep domain expertise, proprietary data assets, and reputation for thought leadership in catastrophe modeling and underwriting analytics reinforce its leadership position and prospects for sustainable growth.

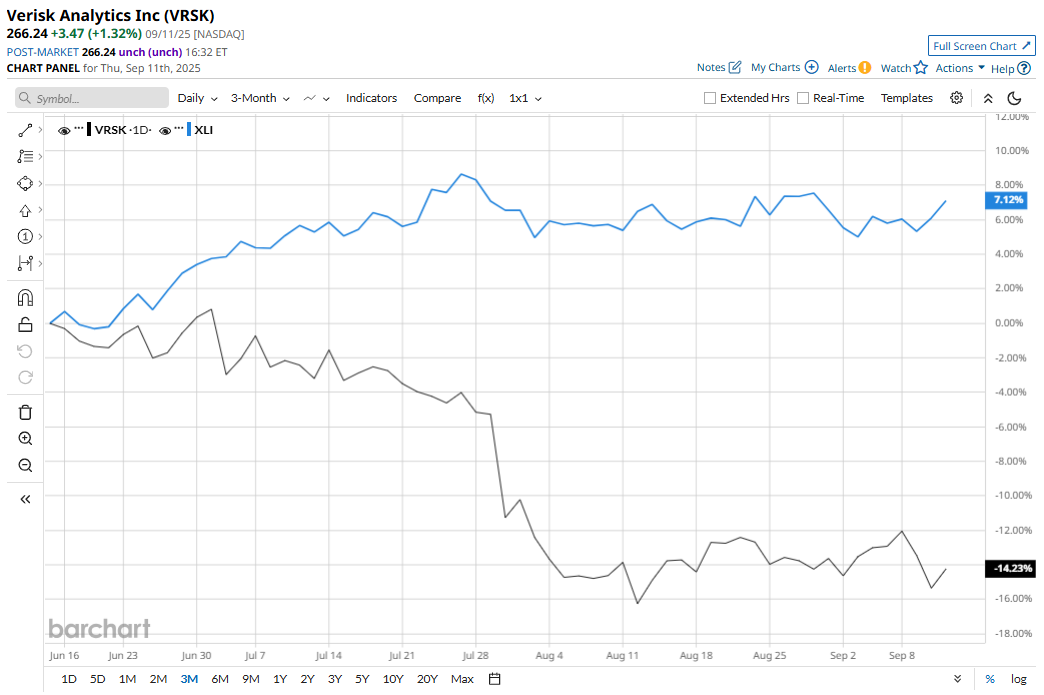

Verisk stock is 17.6% below its 52-week high of $322.92, reached on June 5. Shares of VRSK have declined 14.5% over the past three months, underperforming the broader Industrial Select Sector SPDR Fund’s (XLI) 5.9% rise over the same time frame.

Also, in the longer term, VRSK shares have slumped 3.3% on a year-to-date (YTD) basis and 2% over the past 52 weeks, compared to XLI’s gains of 16% YTD and 19.1% over the past year.

To confirm the bearish trend, VRSK has been trading below its 50-day moving average since early July. Also, the stock has been trading below its 200-day moving average since the end of July.

Verisk’s decline in 2025 has partly stemmed from weakened profitability metrics revealed when it released its Q2 2025 results on July 30. While revenues rose 7.8% year-over-year (YoY), net income dropped sharply by 17.7% due to the absence of prior-year gains and rising operating costs. Nevertheless, adjusted EPS came in at $1.88, up 8% YoY.

Margin pressures from acquisitions and heightened expenses have weighed on investor sentiment. Add to that trimmed full-year adjusted EPS expectations and fears that cost growth may outpace revenue gains, which have contributed significantly to the drop in VRSK stock this year.

However, its industry peer, CBIZ, Inc. (CBZ), has slumped 29.2% on a YTD basis and 11.4% over the past 52 weeks, underperforming VRSK.

Wall Street analysts are moderately bullish on VRSK’s prospects. The stock has a consensus “Moderate Buy” rating from the 20 analysts covering it, and the mean price target of $312 suggests a potential upside of 17.2% from current price levels.