/Universal%20Health%20Services%2C%20Inc_%20magnified-%20by%20Casimiro%20PT%20via%20Shutterstock.jpg)

With a market cap of $12.4 billion, Universal Health Services, Inc. (UHS) is a top medical care facilities provider that owns and operates acute care hospitals, behavioral health centers, surgical hospitals, ambulatory surgery centers, and radiation oncology centers. The Pennsylvania-based company operates through Acute Care Hospital Services and Behavioral Health Care Services segments.

Companies worth $10 billion or more are generally described as "large-cap stocks." Universal Health fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the medical care facilities industry. Universal Health Services leverages a diversified model across acute care and behavioral health, ensuring stable revenue streams. Its scale and growing focus on high-demand behavioral health enhance its competitive edge.

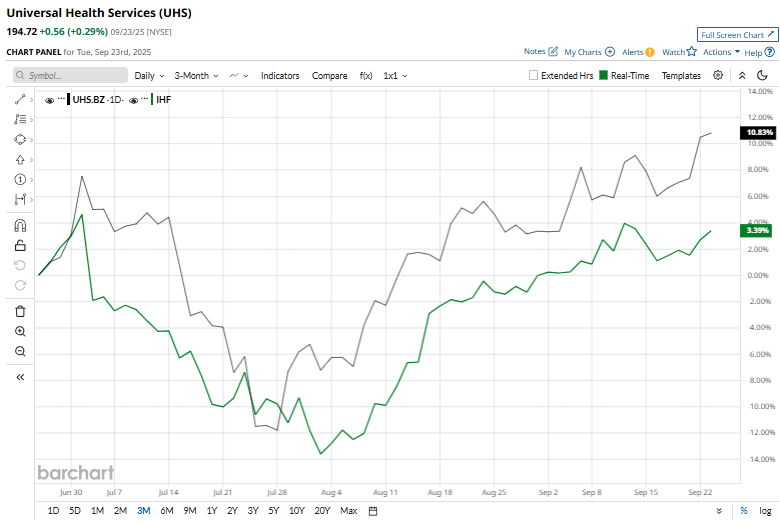

UHS touched its all-time high of $243.25 on Sep. 24, 2024, and is currently trading 20% below that peak. Over the past three months, UHS stock has soared 12.2%, outperforming the iShares U.S. Healthcare Providers ETF (IHF), which has soared 3.7%

UHS stock has climbed 8.5% on a YTD basis and dropped 19.1% over the past 52 weeks, compared to IHF’s 1.8% rise in 2025 and 14.7% plunge over the past year.

UHS has recently climbed above its 50-day and 200-day moving averages since last month, indicating an uptrend.

On Sept. 16, Universal Health Services shares fell more than 1% amid a broader healthcare sector pullback following Wells Fargo & Company’s (WFC) downgrade of the sector from “Neutral” to “Unfavorable.”

Meanwhile, UHS has notably underperformed its peer Encompass Health Corporation (EHC), which has seen a 30.6% surge in 2025 and 37.3% returns over the past 52 weeks.

Among the 20 analysts covering the UHS stock, the consensus rating is a “Moderate Buy.” Its mean price target of $217.75 suggests an 11.8% upside potential from current price levels.