/Uber%20Technologies%20Inc%20logo-by%20jetcityimage%20via%20iStock.jpg)

With a market cap of $195.5 billion, Uber Technologies, Inc. (UBER) is a global technology company that provides a platform for transportation, delivery, and logistics services. The company’s offerings span Mobility, Delivery, and Freight, providing transportation, food and retail ordering, and logistics solutions through its digital marketplace.

Companies valued at $10 billion or more are generally considered “large-cap” stocks, and Uber Technologies fits this criterion perfectly, exceeding the mark. Uber continues to expand its ecosystem by integrating financial partnerships, advertising services, and white-label delivery solutions.

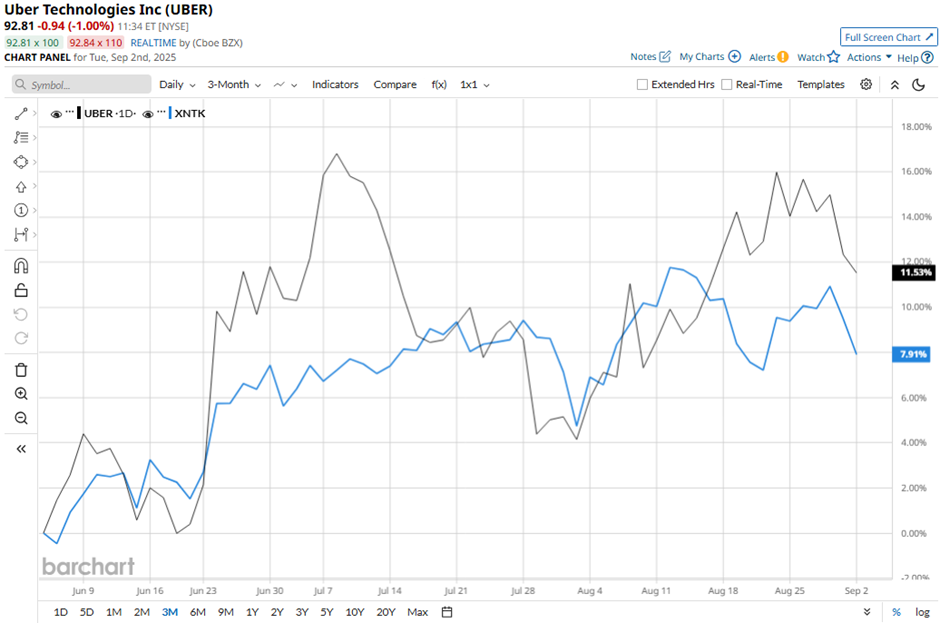

However, shares of the San Francisco, California-based company have dipped 4.9% from its 52-week high of $97.71. Over the past three months, shares of Uber Technologies have increased 11.3%, which slightly outpaced the SPDR NYSE Technology ETF's (XNTK) over 10% gain during the same period.

In the longer term, UBER stock has soared 54.3% on a YTD basis, outperforming XNTK’s 18.6% return. Moreover, shares of the company have returned 27.2% over the past 52 weeks, compared to XNTK’s 26.8% rise over the same time frame.

Despite a few fluctuations, UBER stock has been trading above its 50-day and 200-day moving averages since April.

Shares of UBER rose 3.9% following its Q2 2025 results on Aug. 6, with EPS of $0.63 beating the estimate and improving 34% year-over-year, while revenue of $12.65 billion surpassed the consensus, up 18% year-over-year. Strong segmental performance, led by Mobility revenue of $7.28 billion and Delivery revenue of $4.10 billion, further boosted investor confidence despite Freight weakness.

In comparison, rival ServiceNow, Inc. (NOW) has performed weaker than UBER stock. NOW stock has increased 5.3% over the past 52 weeks and declined 15.1% on a YTD basis.

Due to UBER’s strong performance, analysts are bullish about its prospects. The stock has a consensus rating of “Strong Buy” from the 48 analysts covering the stock, and the mean price target of $108.39 represents a premium of 17% to current levels.