/Tyler%20Technologies%2C%20Inc_%20logo%20on%20laptop-by%20monticello%20via%20Shutterstock.jpg)

Headquartered in Plano, Texas, Tyler Technologies, Inc. (TYL) develops integrated software and technology solutions for the public sector. Its platforms enable local, state, and federal governments to operate efficiently and transparently, improving citizen engagement while optimizing internal processes.

The company commands a market capitalization of nearly $19.6 billion, comfortably above the $10 billion “large-cap” threshold. This scale enhances TYL’s ability to provide end-to-end solutions that modernize government operations and drive efficiency across public sector functions.

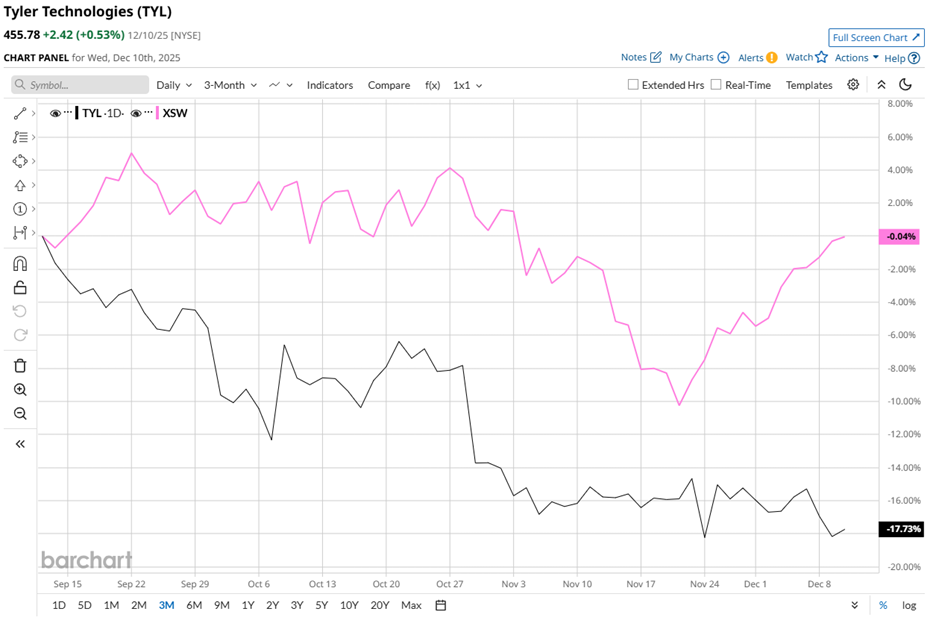

TYL stock currently trades roughly 31.1% below its February high of $661.31, reflecting market caution. The stock has fallen 16.5% over the past three months, while the State Street SPDR S&P Software & Services ETF (XSW) gained 1.7%, underscoring relative underperformance.

Over the past 52 weeks, TYL stock has plunged 26.2%, with year-to-date (YTD) losses of 21%, contrasting sharply with XSW’s modest 1.3% decline over a year and 3.4% YTD gain. These trends imply heightened volatility and market skepticism.

Technical indicators also show limited strength, as TYL stock is trading below its 50-day moving average of $481.93 and 200-day moving average of $545.82 since mid-August, signaling persistent downward momentum.

However, TYL stock jumped 3.9% on Nov. 25 after the City of Homestead, Florida, successfully launched Tyler’s AWS-powered Enterprise Permitting & Licensing cloud platform, completing the seven-month rollout on time and within budget.

The platform replaces legacy systems, streamlines permitting, licensing, code enforcement, and payments citywide, demonstrating Tyler’s SaaS reliability. The successful deployment is also expected to accelerate recurring revenue growth and expand TYL’s market share in public sector digitization.

For context, TYL’s rival Guidewire Software, Inc. (GWRE) has gained 17.1% over the past 52 weeks and 19% YTD, highlighting TYL’s potential to catch up with top-performing peers.

Analysts remain optimistic despite recent stock softness. TYL holds a “Moderate Buy” consensus rating from 18 analysts, with a mean price target of $646.38, signaling a premium of 41.8% to current levels.