/Steris%20Plc%20logo%20and%20chart-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Valued at a market cap of $24.4 billion, STERIS plc (STE) is a leading global provider of infection prevention, decontamination, and surgical products and services, primarily serving the healthcare, pharmaceutical, and research industries. Headquartered in Dublin, Ireland, the company traces its roots back to 1985 and has grown into a key player in supporting hospitals, laboratories, and pharmaceutical companies with sterilization and surgical solutions.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and STERIS fits this description perfectly. Its strong base of recurring revenues from consumables, service contracts, and equipment maintenance provides stability and resilience. With a global presence in over 100 countries and essential products critical to hospital safety, pharmaceutical production, and research, STERIS maintains a durable competitive edge in highly regulated and growing healthcare markets.

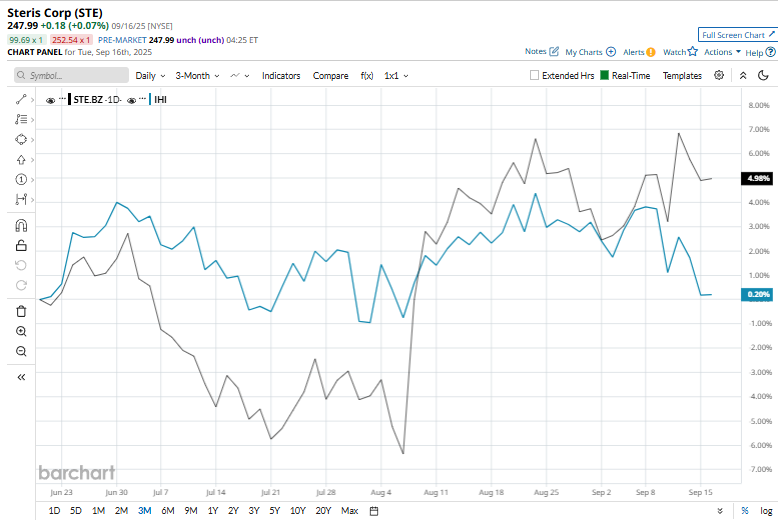

STE shares met their 52-week high of $253 recently on Sept. 12. STERIS has surged 2.8% over the past three months, surpassing the iShares U.S. Medical Devices (IHI), which posted a 1.2% dip over the same time frame.

Shares of STE have gained 20.6% on a YTD basis, outpacing IHI’s 3.4% increase. Additionally, STERIS has returned 18% over the past 52 weeks, whereas the IHI has surged marginally over the same time frame.

STE has been mostly trading above its 50-day and 200-day moving averages since early May, indicating a sustained uptrend.

On Aug. 6, STERIS reported strong Q1 FY2026 results, and its shares jumped 6.8% in the next session. Its revenue rose 9% to $1.39 billion, and adjusted EPS improved 15% to $2.34, fuelled by broad-based strength across segments, particularly Applied Sterilization Technologies and Healthcare. Benefiting from margin expansion, firm pricing, and operational efficiencies, management raised its full-year revenue growth outlook to 8–9% (from 6–7%) and also lifted its free cash flow forecast to $820 million, underscoring confidence in business momentum.

In contrast, key rival AdaptHealth Corp. (AHCO) has lagged behind STE. AHCO stock has decreased by 19.3% over the past 52 weeks and has seen a decline of 3.2% on a year-to-date basis.

STE holds a consensus rating of “Moderate Buy” from eight analysts, with an average price target of $272.14, implying an upside potential of 14.8% from its current trading levels.