SBA Communications Corporation (SBAC), headquartered in Boca Raton, Florida, owns and operates wireless communications infrastructure including towers, buildings, rooftops, distributed antenna systems (DAS) and small cells. Valued at $21.4 billion by market cap, the company offers site leasing and development, construction, and consulting services. SBAC leases antenna space on its multi-tenant towers to a variety of wireless service providers under long-term lease contracts.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and SBAC perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the REIT - specialty industry. SBAC's market leadership is built on its vast infrastructure of nearly 40,000 cell towers across multiple continents. With a strong presence in the U.S. and Brazil, the company enjoys stable and recurring revenue streams from top mobile carriers, ensuring consistent demand and financial stability.

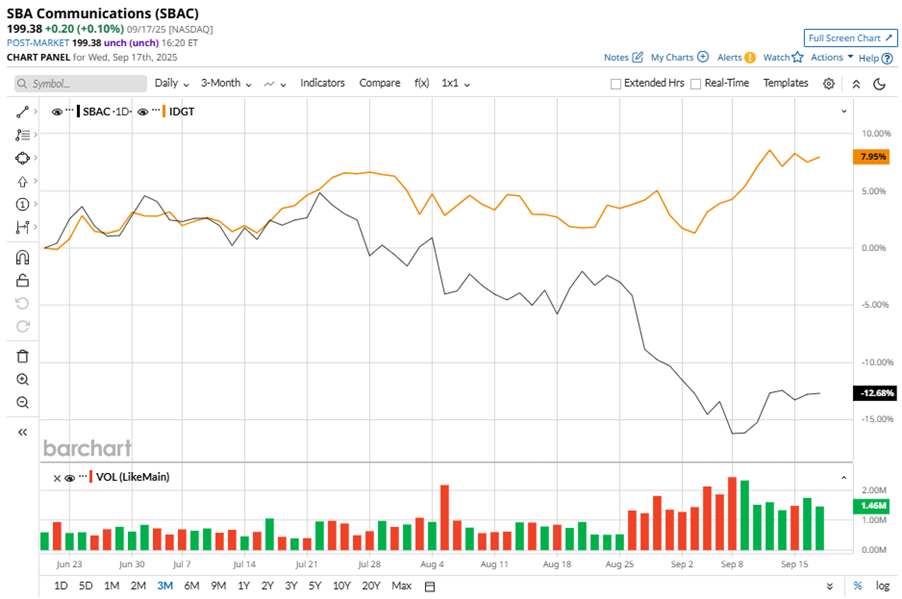

Despite its notable strength, SBAC slipped 21.1% from its 52-week high of $252.64, achieved on Oct. 16, 2024. Over the past three months, SBAC stock declined 12.8%, underperforming the iShares U.S. Digital Infrastructure and Real Estate ETF’s (IDGT) 8.8% gains during the same time frame.

In the longer term, shares of SBAC dipped 2.2% on a YTD basis and fell 18.6% over the past 52 weeks, considerably underperforming IDGT’s YTD gains of 7.9% and 11.3% returns over the last year.

To confirm the bearish trend, SBAC has been trading below its 50-day moving average since late July, with slight fluctuations. The stock has been trading below its 200-day moving average since early August, with minor fluctuations.

On Aug. 4, SBAC reported its Q2 results, and its shares closed down by 4.9% in the following trading session. Its adjusted FFO per share of $3.17 surpassed Wall Street expectations of $3.12. The company’s revenue was $699 million, beating Wall Street forecasts of $670.1 million. SBAC expects full-year FFO in the range of $12.65 to $13.02 per share, and expects revenue in the range of $2.78 billion to $2.83 billion.

In the competitive arena of REIT - specialty, Crown Castle Inc. (CCI) has taken the lead over SBAC, showing resilience with a 4.5% uptick on a YTD basis but lagged behind the stock with a 20.7% decline over the past 52 weeks.

Wall Street analysts are reasonably bullish on SBAC’s prospects. The stock has a consensus “Moderate Buy” rating from the 20 analysts covering it, and the mean price target of $250.89 suggests an ambitious potential upside of 25.8% from current price levels.