/Regeneron%20Pharmaceuticals%2C%20Inc_%20logo%20on%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Tarrytown, New York-based Regeneron Pharmaceuticals, Inc. (REGN) discovers, invents, develops, manufactures, and commercializes medicines for various diseases. With a market cap of $61.5 billion, Regeneron’s operations span various countries in North America, Europe, and Asia.

Companies worth $10 billion or more are generally described as "large-cap stocks." Regeneron fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the pharma space. The company has a track record of developing new technologies to help discover better and novel antibody medicines.

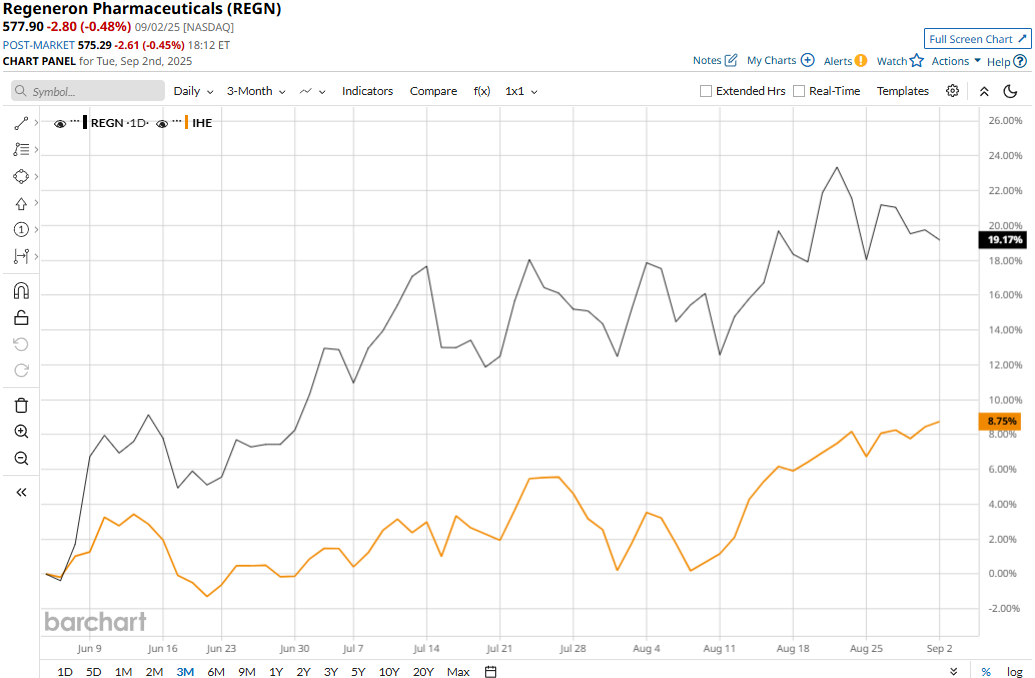

Despite its notable strengths, Regeneron’s stock prices have plummeted 51.5% from its 52-week high of $1,192.54 touched on Sept. 3, 2024. However, over the past three months, REGN has gained 17.7%, outpacing the industry-focused iShares U.S. Pharmaceuticals ETF’s (IHE) 9.1% uptick during the same time frame.

Regeneron’s performance has remained much more concerning over the longer term. Its stock prices have plummeted 18.9% on a YTD basis and 51.2% over the past year, underperforming IHE’s 8.6% gains in 2025 and 2.1% dip over the past 52 weeks.

To confirm the overall bearish trend and recent upturn, REGN stock has remained consistently below its 200-day moving average since October last year. But the stock has climbed above its 50-day moving average in the past couple of months.

Regeneron Pharmaceuticals’ stock prices gained 2.5% in the trading session following the release of its robust Q2 results on Aug. 1. The quarter was marked with solid growth in U.S. sales of EYLEA HD and global sales of Dupixent and Libtayo, along with multiple regulatory approvals. The company’s overall revenues for the quarter came in at $3.7 billion, up 3.6% year-over-year and beating the Street expectations by 9.9%. Further, its adjusted EPS surged 11.5% year-over-year to $12.89, surpassing the consensus estimates by a staggering 60.5%.

Meanwhile, the company has significantly underperformed its peer, BeiGene, Ltd.’s (BGNE) 2.4% uptick in 2025 and over the past 52 weeks.

Among the 27 analysts covering the REGN stock, the consensus rating is a “Moderate Buy.” Its mean price target of $733.36 suggests a 26.9% upside potential from current price levels.