/Northern%20Trust%20Corp_%20site%20and%20phone-by%20T_Schneider%20via%20Shutterstock.jpg)

Northern Trust Corporation (NTRS) is a financial services firm specializing in wealth management, asset servicing, and banking solutions for institutions, corporations, high-net-worth individuals and families. It operates in two segments, Asset Servicing and Wealth Management. The company is headquartered in Chicago, Illinois and boasts a market capitalization of $24.8 billion.

Companies with a market cap of $10 billion or more are typically classified as “large-cap stocks,” signifying established companies with broad financial strength and often global reach. Northern Trust Corporation fits firmly in this tier, underlining the company’s position as a major player in the financial services sector, particularly in wealth management, asset servicing, and banking for institutional and highly affluent clients.

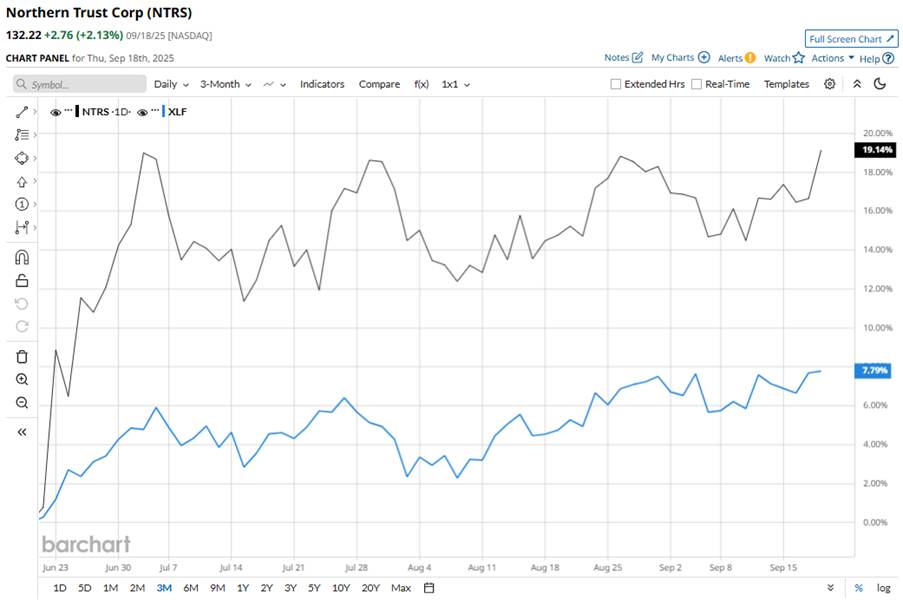

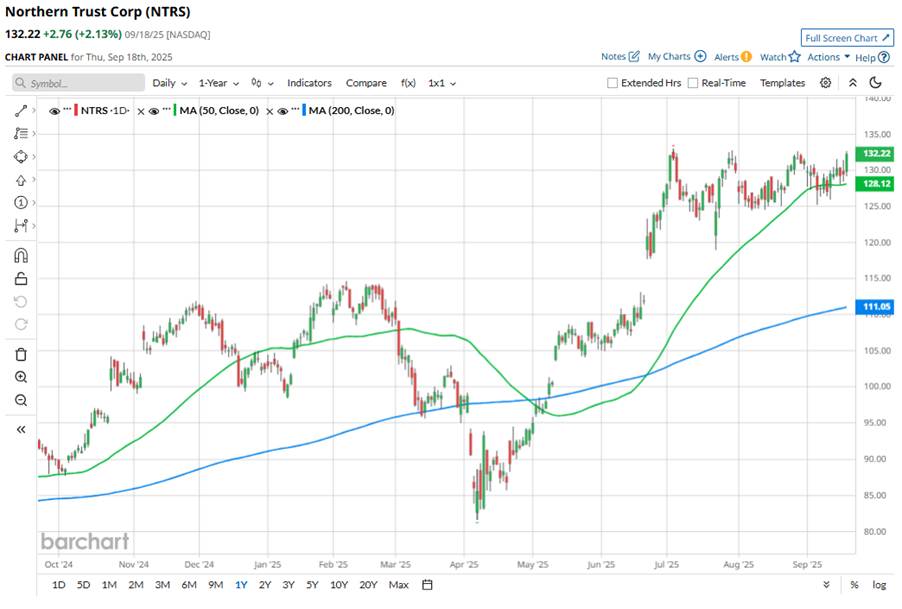

NTRS stock is just marginally below its 52-week high of $133, reached on July 3. Shares of Northern Trust have gained 19.1% over the past three months, outperforming the broader Financial Select Sector SPDR Fund’s (XLF) 7.8% rise over the same time frame.

Also, in the longer term, NTRS shares have gained 29% on a year-to-date (YTD) basis and 46.4% over the past 52 weeks, compared to XLF’s gains of 12% YTD and 19.8% over the past year.

To confirm the bullish trend, NTRS has been trading above its 200-day moving average since early May. Also, the stock has been mostly trading above its 50-day moving average since early May, but with some fluctuations lately.

Northern Trust Corporation has been rising largely because its core operations have shown strong momentum. In its Q2 earnings report, released on July 23, Trust, investment, and other servicing fees rose about 6% year-over-year (YoY) to $1.2 billion, helped by growth in assets under custody/administration (AUC/A) and assets under management (AUM). AUC/A grew 9% YoY to about $18.1 trillion, and AUM rose 11% to $1.7 trillion.

Net interest income also hit a record, jumping 16% annually to $615.2 million. Northern Trust reported EPS of $2.13, compared to $1.90 in the first quarter of 2025 and $4.34 in the prior-year quarter, surpassing expectations.

In the financial services sector, Northern Trust has significantly outperformed its peer T. Rowe Price Group, Inc. (TROW), which experienced a 6.5% decline in 2025 and a 2.2% drop over the past 52 weeks.

However, analysts remain cautious about the stock’s prospects. Out of the 15 analysts covering the NTRS stock, the consensus rating is a “Hold,” and it currently trades above its mean price target of $126.25.