With a market cap of $9 billion, Molson Coors Beverage Company (TAP) is a global beverage manufacturer headquartered in Chicago, Illinois. The company produces a diverse portfolio of alcoholic and non-alcoholic beverages, including iconic beer brands such as Coors Light, Miller Lite, and Molson Canadian, as well as flavored malt beverages, hard seltzers, and ready-to-drink (RTD) cocktails.

Companies worth between $2 billion and $10 billion are generally described as "mid-cap stocks," Molson fits right into that category. TAP leverages several competitive strengths to maintain its position in the global beverage market. The company boasts a diverse portfolio of iconic beer brands like Coors Light, Miller Lite, Blue Moon, and Molson Canadian, catering to a wide range of consumer preferences.

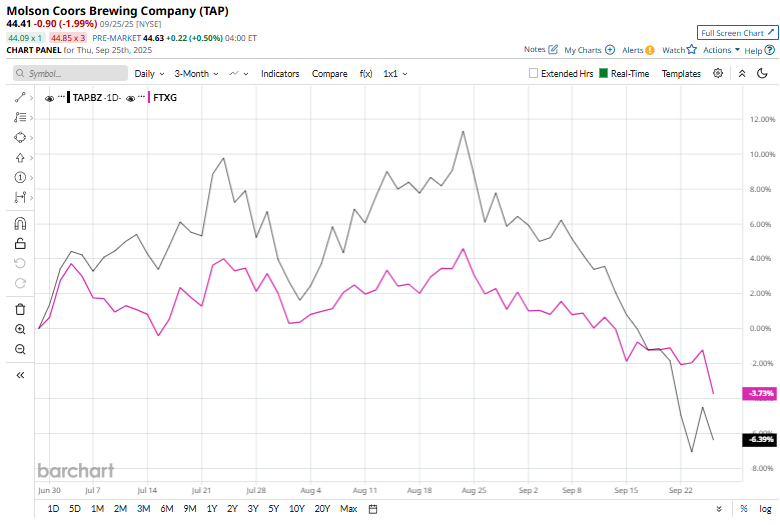

Despite its notable strengths, Molson stock is currently trading 31.3% below its 52-week high of $64.66 on Mar. 10. Molson has gained 6% over the past three months, surpassing the Nasdaq Food & Beverage ETF’s (FTXG) 3.9% rise over the same time frame.

Molson’s performance has remained mixed over the longer time frame. Molson’s stock dropped 22.5% in 2025 and declined 18.7% over the past 52 weeks. In contrast, FTXG has dipped 7.9% on a YTD basis and 16.7% over the past year.

To confirm the recent downtrend, Molson has been trading mostly below its 50-day and 200-day moving averages since the end of April.

On Sept. 12, Molson Coors shares declined over 1% after Barclays plc (BCS) downgraded the stock from “Equal Weight” to “Underweight.” The downgrade reflected the firm’s cautious outlook on the company’s near-term growth prospects, citing potential headwinds in the U.S. beer market, slower-than-anticipated premiumization trends, and pressure from rising input costs.

Furthermore, Molson has significantly outperformed its peer Constellation Brands, Inc.’s (STZ) 40% decline this year and a 47.3% drop over the past 52 weeks.

Among the 22 analysts covering the TAP stock, the consensus rating is a “Hold.” Its mean price target of $54.14 suggests a 21.9% upside potential from current price levels.