Hunt Valley, Maryland-based McCormick & Company, Incorporated (MKC) is a global leader in flavor, producing and distributing spices, seasonings, and condiments. With a market cap of $17 billion, it operates in over 150 countries through its Consumer and Flavor Solutions segments.

Categorized as a "large-cap stock," McCormick's valuation highlights its dominance in the flavor industry. Its innovative products and global reach underscore its position as a leader in the packaged food space.

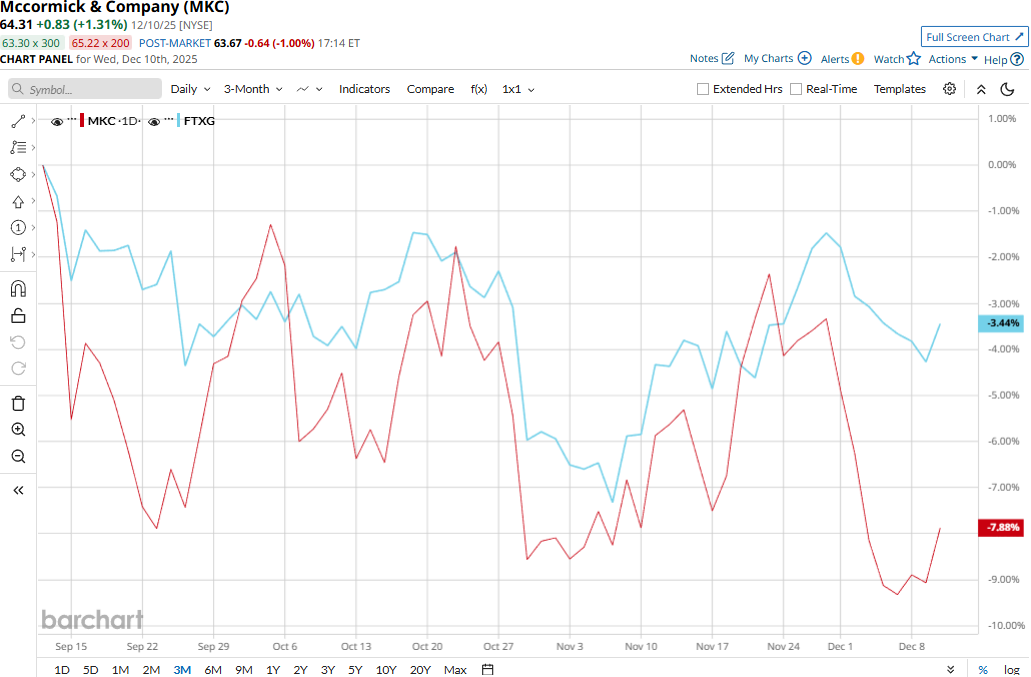

McCormick touched its two-year high of $86.24 on Mar. 10 and is currently trading 25.4% below that peak. Meanwhile, MKC stock prices have declined 6.2% over the past three months, lagging behind the First Trust Nasdaq Food & Beverage ETF’s (FTXG) 2.8% dip during the same time frame.

McCormick’s performance has remained grim over the longer term as well. MKC stock prices have dropped 15.7% on a YTD basis and 21.5% over the past 52 weeks, compared to FTXG’s 7% dip in 2025 and 11.9% decline over the past year.

MKC stock has traded consistently below its 200-day moving average and mostly below its 50-day moving average with some fluctuations since early April, underscoring its bearish movement.

Despite reporting better-than-expected financials, McCormick & Company’s stock prices declined 3.9% in the trading session following the release of its Q3 results on Oct. 7. Driven by 1.8% growth in organic revenues, the company’s overall topline grew 2.7% year-over-year to $1.7 billion, surpassing the consensus estimates by 60 bps. However, this was supported by a 90 bps favorable impact of currency movement.

Meanwhile, the company’s adjusted EPS inched up 2.4% year-over-year to $0.85, surpassing the consensus estimates by 4.8%. Following the initial dip, MKC stock prices maintained a positive momentum for three subsequent trading sessions.

Meanwhile, McCormick has notably outperformed compared to its peer Hormel Foods Corporation’s (HRL) 24.3% drop on a YTD basis and 29.2% plunge over the past year.

Among the 13 analysts covering the MKC stock, the consensus rating is a “Moderate Buy.” As of writing, its mean price target of $80.21 suggests a 24.7% upside potential from current price levels.