Pittsburgh, Pennsylvania-based The Kraft Heinz Company (KHC) is one of the world’s largest food and beverage companies. Its offerings include sauces, cheese, meals, meat, refreshment beverages, coffee, and more. With a market cap of $31.8 billion, Kraft Heinz’s operations span the Americas, Europe, Indo-Pacific, and internationally.

Companies worth $10 billion or more are generally described as "large-cap stocks." Kraft Heinz fits this bill perfectly. Given the company’s long-standing name in the packaged foods industry, its valuation above this mark is not surprising. The company’s extensive brand portfolio includes Kraft, Oscar Mayer, Lunchables, Velveeta, Ore-Ida, Wattie's, and more.

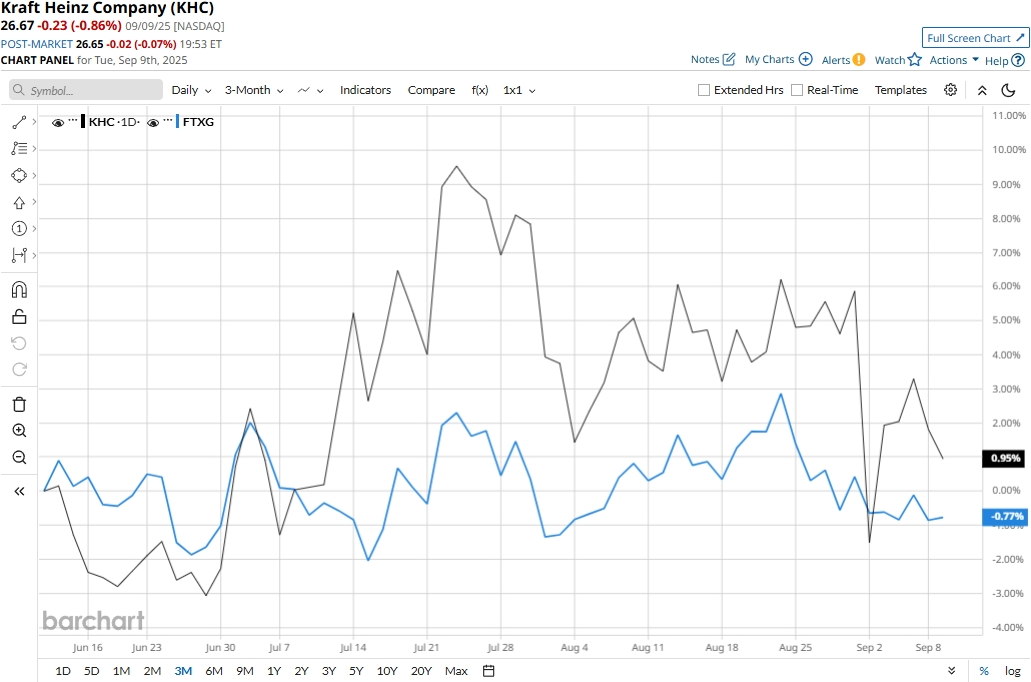

Despite its notable strengths, KHC stock has plummeted 26.5% from its 52-week high of $36.31 touched on Oct. 21, 2024. Meanwhile, KHC stock has observed a marginal 72 bps uptick over the past three months, performing slightly better than the industry-focused First Trust Nasdaq Food & Beverage ETF’s (FTXG) 1.3% dip during the same time frame.

KHC’s performance has remained lackluster over the longer term. The stock has plunged 13.2% on a YTD basis and 26% over the past 52 weeks, significantly underperforming FTXG’s 3.5% dip in 2025 and 14.4% decline over the past year.

To confirm the bearish trend, KHC stock has traded mostly below its 200-day and 50-day moving averages over the past year, with some fluctuations.

Kraft Heinz’s stock prices observed a marginal dip in the trading session following the release of its Q2 results on Jul. 30. The company’s organic sales dropped by 2%, leading to the overall topline dropping 1.9% year-over-year to $6.35 billion. Meanwhile, the company’s adjusted gross margins contracted 140 bps from the year-ago quarter to 34.1%. Further, Kraft Heinz’s adjusted operating income declined 7.5% year-over-year to $1.3 billion. Moreover, its adjusted EPS plunged by 11.5% to $0.69, but surpassed the consensus estimates by 7.8%.

Kraft Heinz has performed slightly better than its peer, Hormel Foods Corporation’s (HRL) 18.7% decline on a YTD basis, but underperformed HRL’s 21.2% plunge over the past 52 weeks.

Among the 22 analysts covering the KHC stock, the consensus rating is a “Hold.” As of writing, its mean price target of $28.67 represents a modest 7.5% premium to current price levels.