With a market cap of $13.7 billion, Kimco Realty Corporation (KIM) is a leading U.S. real estate investment trust specializing in high-quality, open-air, grocery-anchored shopping centers and mixed-use properties concentrated in top metropolitan and high-barrier-to-entry markets. The company brings more than 65 years of expertise in shopping center ownership, management, acquisitions, and redevelopment.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Kimco Realty fits this criterion perfectly. As of September 30, 2025, Kimco owned interests in 564 U.S. properties totaling approximately 100 million square feet, with a strong focus on necessity-based tenants and corporate responsibility.

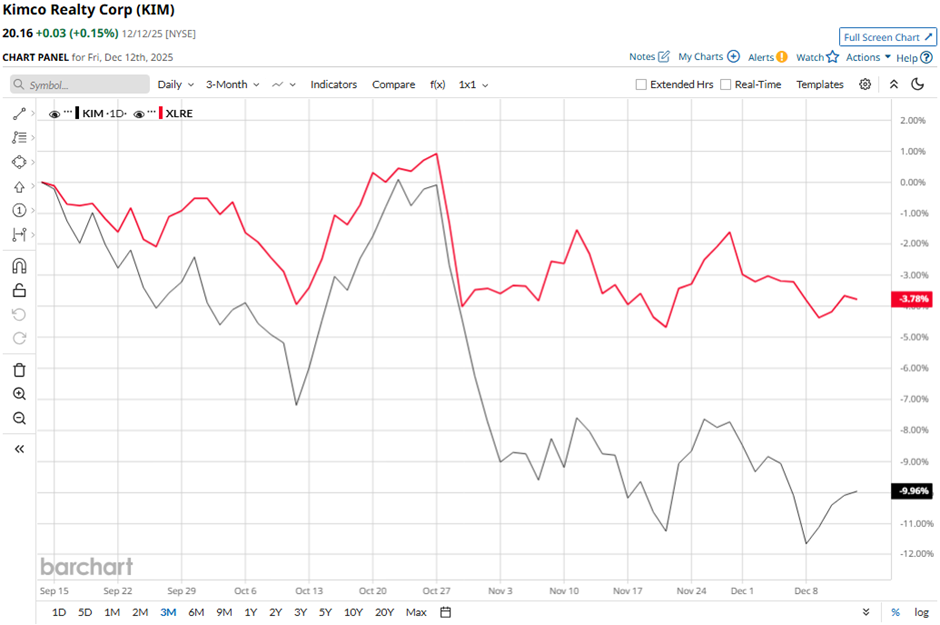

Shares of the Jericho, New York-based company have declined 19.6% from its 52-week high of $25.06. Over the past three months, its shares have fallen nearly 10%, underperforming the Real Estate Select Sector SPDR Fund’s (XLRE) 3.8% dip during the same period.

Longer term, KIM stock is down nearly 14% on a YTD basis, lagging behind XLRE's marginal gain. Moreover, shares of Kimco Realty have decreased 17.7% over the past 52 weeks, compared to XLRE's 5.3% decline over the same time frame.

The stock has fallen below its 50-day and 200-day moving averages since late October.

Despite posting better-than-expected Q3 2025 FFO of $0.44 per share and revenue of $535.9 million, Kimco’s shares fell 1.9% on Oct. 30. The quarter reflected higher costs, including a $13.6 million increase in depreciation and amortization and an $8.0 million rise in interest expense, which partially offset revenue and operating gains.

In comparison, rival Realty Income Corporation (O) has outpaced KIM stock. Shares of Realty Income have risen 8.1% on a YTD basis and 4.7% over the past 52 weeks.

Despite the stock’s weak performance, analysts remain moderately optimistic about its prospects. KIM stock has a consensus rating of “Moderate Buy” from 25 analysts in coverage, and the mean price target of $24.20 is a premium of 20% to current levels.