New York-based International Flavors & Fragrances Inc. (IFF) is a global ingredients and specialty-solutions company. Valued at a market cap of $16.7 billion, the company formulates sensory and functional solutions that enhance taste, smell, texture, and nutrition in everyday products.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and IFF fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the specialty chemicals industry. With a broad customer base and a global R&D network, the company plays a central role in enabling leading brands to create differentiated and consumer-preferred products.

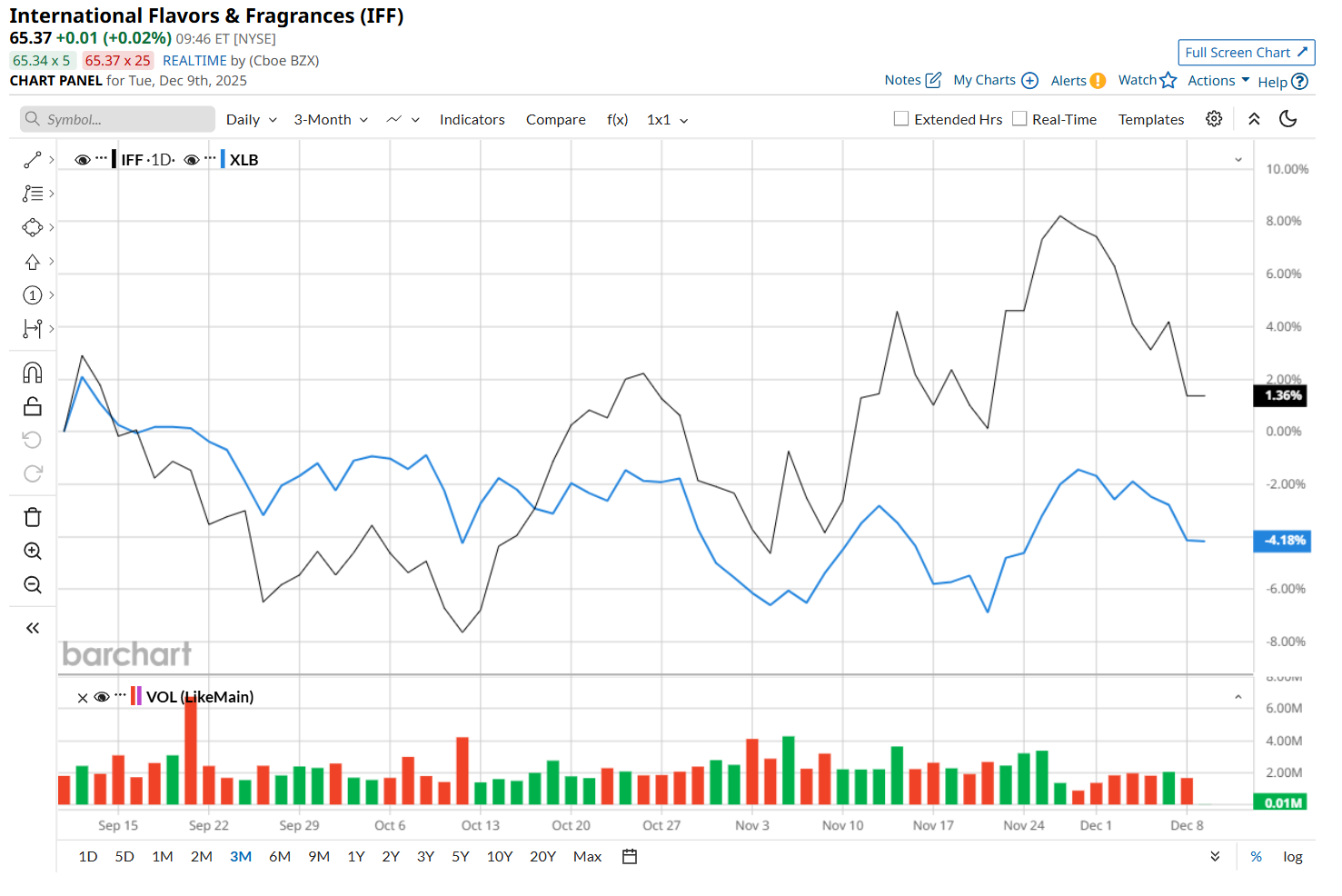

This specialty-solutions provider has slipped 27.9% below its 52-week high of $90.64, reached on Dec. 9, 2024. Shares of IFF have declined 1.2% over the past three months, outperforming the State Street Materials Select Sector ETF’s (XLB) 3.9% drop during the same time frame.

However, in the longer term, IFF has fallen 26.5% over the past 52 weeks, lagging behind XLB’s 5.3% loss over the same time frame. Moreover, on a YTD basis, shares of IFF are down 22.7%, compared to XLB’s 3.4% return.

To confirm its recent bullish trend, IFF has been trading above its 50-day moving average since early November. However, it has remained below its 200-day moving average over the past year.

On Nov. 4, IFF posted better-than-expected Q3 results, prompting its shares to surge 4.1% in the following trading session. The company’s net sales declined 7.9% year-over-year to $2.7 billion, but topped analyst expectations by 2.3%. Meanwhile, IFF’s productivity and cost-efficiency initiatives drove solid margin expansion, which helped offset lower sales. As a result, its adjusted EPS rose nearly 1% from the prior-year quarter to $1.05, exceeding consensus estimates by 2.9%.

IFF has considerably lagged behind its rival, Ecolab Inc. (ECL), which gained 3.4% over the past 52 weeks and 10% on a YTD basis.

Given IFF’s recent outperformance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 20 analysts covering it, and the mean price target of $80.61 suggests a 22.8% premium to its current price levels.