/Globe%20Life%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)

McKinney, Texas-based Globe Life Inc. (GL) provides various life and supplemental health insurance products and annuities to lower-middle and middle-income families. With a market cap of approximately $11.9 billion, Globe Life operates through Life Insurance, Supplemental Health Insurance, Annuities, and Investments segments.

Companies worth $10 billion or more are generally described as "large-cap stocks." GL fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the insurance industry.

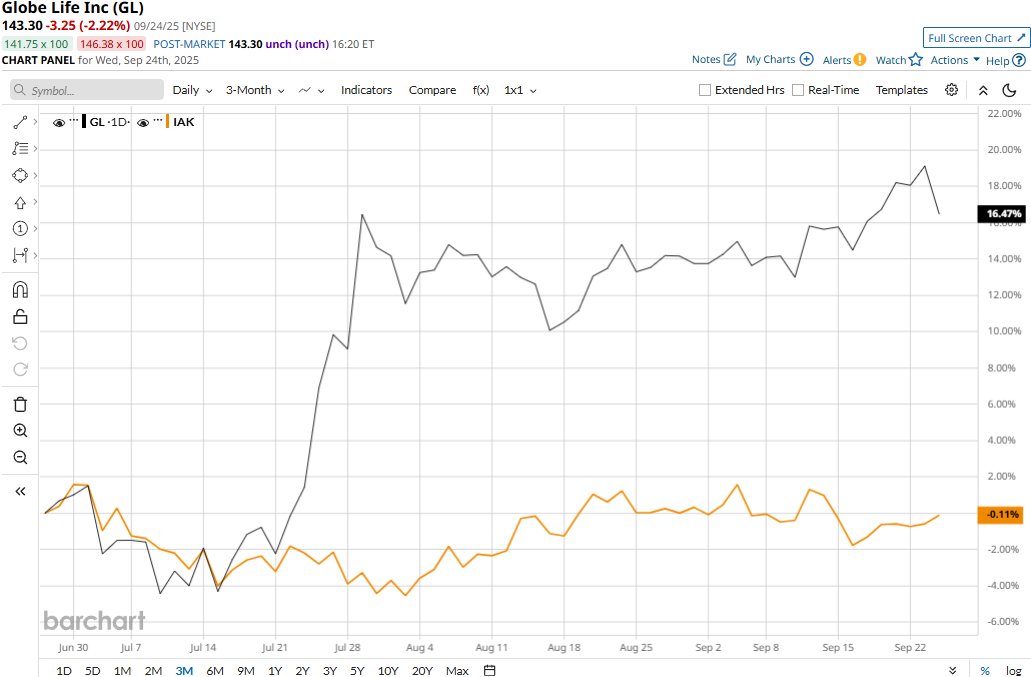

GL stock touched its all-time high of $147.83 on Sept. 23 and is currently trading 3.1% below that peak. Meanwhile, the stock has soared 16.6% over the past three months, notably outperforming the iShares U.S. Insurance ETF’s (IAK) marginal 83 bps dip during the same time frame.

Globe Life’s performance has remained impressive over the longer term as well. GL stock prices have surged 28.5% on a YTD basis and 32.5% over the past 52 weeks, substantially outpacing IAK’s 4.6% gains in 2025 and 2% uptick over the past year.

Further, the stock has remained consistently above its 200-day moving average over the past year and above its 50-day moving average since late July, highlighting its bullish trend.

Globe Life’s stock prices surged 5.4% in the trading session following the release of its mixed Q2 results on Jul. 23. Driven by a notable 3% growth in life insurance premiums and a 7.5% surge in health insurance premiums, the company’s overall insurance premiums increased by an impressive 4.5% year-over-year to $1.2 billion. However, GL’s net investment income observed a notable drop along with deterioration in realized losses, leading to a much more modest 2.8% growth in overall topline to $1.5 billion, missing the Street’s expectations by a small margin.

Nonetheless, the company delivered a robust 10.1% growth in net operating income per share to $3.27 per share, beating the consensus estimates by 62 bps.

Meanwhile, GL stock has significantly outperformed its peer, Unum Group’s (UNM) 5.2% uptick in 2025, but marginally lagged behind UNM’s 33.8% surge over the past 52 weeks.

Among the 14 analysts covering the GL stock, the consensus rating is a “Strong Buy.” Its mean price target of $160.15 suggests a 17.8% upside potential.