With a market cap of $24.9 billion, FirstEnergy Corp. (FE) is a leading diversified energy company that generates, transmits, and distributes electricity across the United States. Operating through its Regulated Distribution, Regulated Transmission, and Other segments, the company serves customers in Ohio, Pennsylvania, New Jersey, West Virginia, Maryland, and New York.

Companies valued more than $10 billion are generally considered “large-cap” stocks, and FirstEnergy fits this criterion perfectly. Its energy portfolio includes coal, nuclear, hydroelectric, wind, and solar facilities, supported by more than 252,000 miles of distribution lines and 24,000 miles of transmission infrastructure.

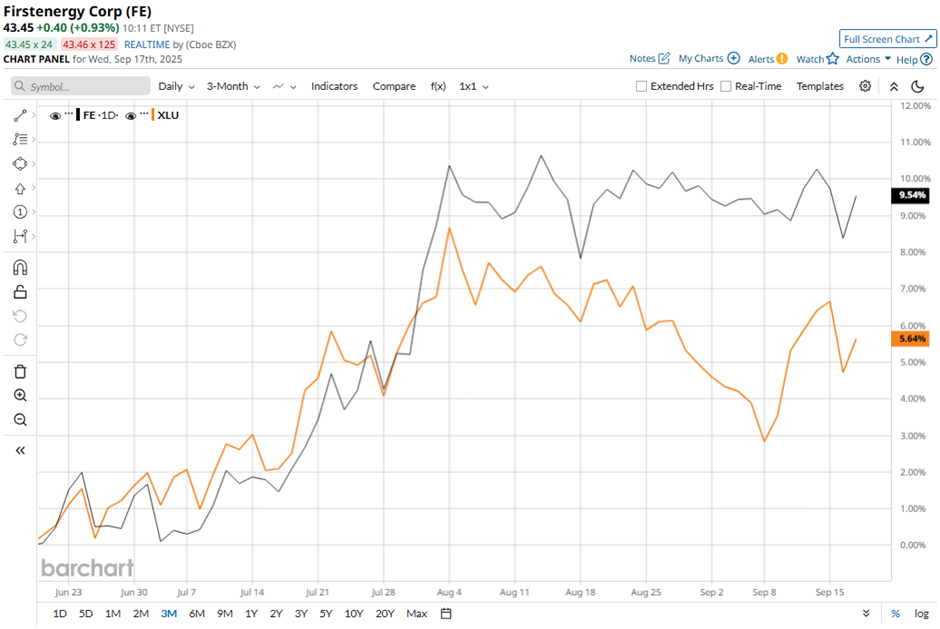

Shares of the Akron, Ohio-based company have dipped 2.3% from its 52-week high of $44.58. Shares of FirstEnergy have risen 9.6% over the past three months, outperforming the Utilities Select Sector SPDR Fund's (XLU) 5.8% rise during the same period.

Longer term, the company’s shares have gained 9.5% on a YTD basis, lagging behind XLU's 12.3% increase. Moreover, FE stock has declined marginally over the past 52 weeks, compared to XLU's 7.5% return over the same time frame.

Yet, the stock has been trading above its 50-day and 200-day moving averages since late July.

Shares of FirstEnergy rose 2.2% after Q2 2025 results as adjusted EPS of $0.52 beat the consensus estimate, marking year-over-year growth despite weather-related demand softness. Investors were encouraged by a 52.7% jump in operating income to $646 million and a 4.5% decline in operating expenses to $2.73 billion, which offset slightly weaker-than-expected revenues of $3.38 billion.

Confidence was further supported by management reaffirming 2025 EPS guidance of $2.40 - $2.60 and a long-term 6% - 8% earnings growth rate, underpinned by a robust $28 billion capital investment plan through 2029.

However, FirstEnergy stock has lagged behind its rival The Southern Company (SO). SO stock has returned 2.5% over the past 52 weeks and 11.7% on a YTD basis.

Despite FE’s underperformance relative to its industry peers, analysts are moderately optimistic with a consensus rating of "Moderate Buy" from 16 analysts. The mean price target of $45.92 is a premium of 5.7% to current levels.