Erie, Pennsylvania-based Erie Indemnity Company (ERIE) serves as the attorney-in-fact for the subscribers at the Erie Insurance Exchange, which is a reciprocal insurer that writes property and casualty insurance. With a market cap of $14.7 billion, the company provides issuance and renewal services, sales-related services, and underwriting services.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Erie Indemnity Company fits this description perfectly.

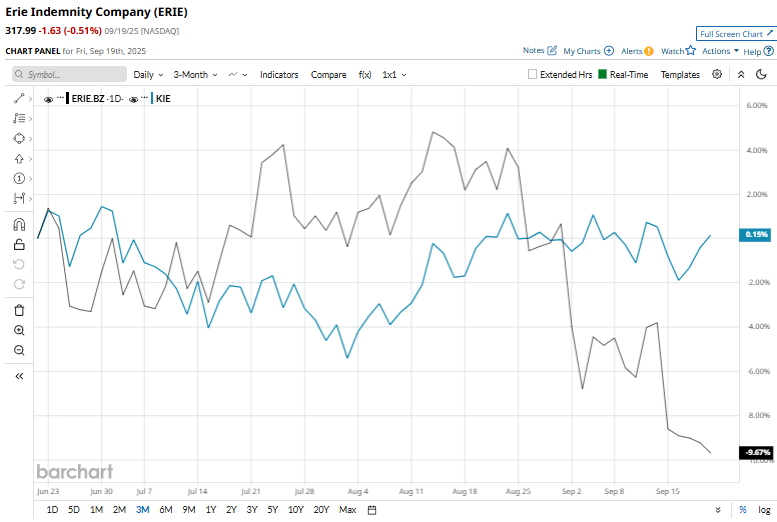

Shares of Erie Indemnity have retreated 41.9% from its 52-week high of $547. ERIE stock has dropped 8.8% over the past three months, lagging behind the SPDR S&P Insurance ETF (KIE), which has gained 1.2% over the same time frame.

In the long term, ERIE stock has dipped 22.9% on a YTD basis, whereas KIE has risen 4.4%. Additionally, over the past 52 weeks, shares of ERIE have decreased 39.6%, underperforming KIE’s 4% return.

Reinforcing a downtrend, the stock has been trading below its 50-day moving average since late April and under its 200-day moving average since mid-May.

On Aug. 7, the company announced its second-quarter earnings, and its shares rose 1.3% in the following trading session. Its net income rose 6.6% year-over-year to $174.7 million, or $3.34 per share, though slightly below analyst expectations. Revenue grew 7% to $1.06 billion, driven by higher management fees and administrative services revenue, but fell just short of forecasts.

Compared to its peer, Willis Towers Watson Public Limited Company (WTW) has outpaced ERIE stock. Shares of WTW have surged 7.5% on a YTD basis and gained 16.6% over the past 52 weeks.

ERIE has a consensus rating of “Moderate Buy” from the three analysts covering the stock, and as of writing, it is trading notably above the mean price target of $73.