With a market cap of $48.7 billion, Corteva, Inc. (CTVA) is a leading global agriculture company that develops innovative seed and crop protection solutions to help farmers maximize yield and profitability. Corteva serves farmers and agricultural markets across the United States, Canada, Latin America, Asia Pacific, Europe, the Middle East, and Africa.

Companies worth more than $10 billion are generally labeled as “large-cap” stocks, and Corteva fits this criterion perfectly. Operating through its Seed and Crop Protection segments, the company offers advanced germplasm, trait technologies, digital farming tools, and products that protect crops from pests, weeds, and diseases while enhancing overall crop health.

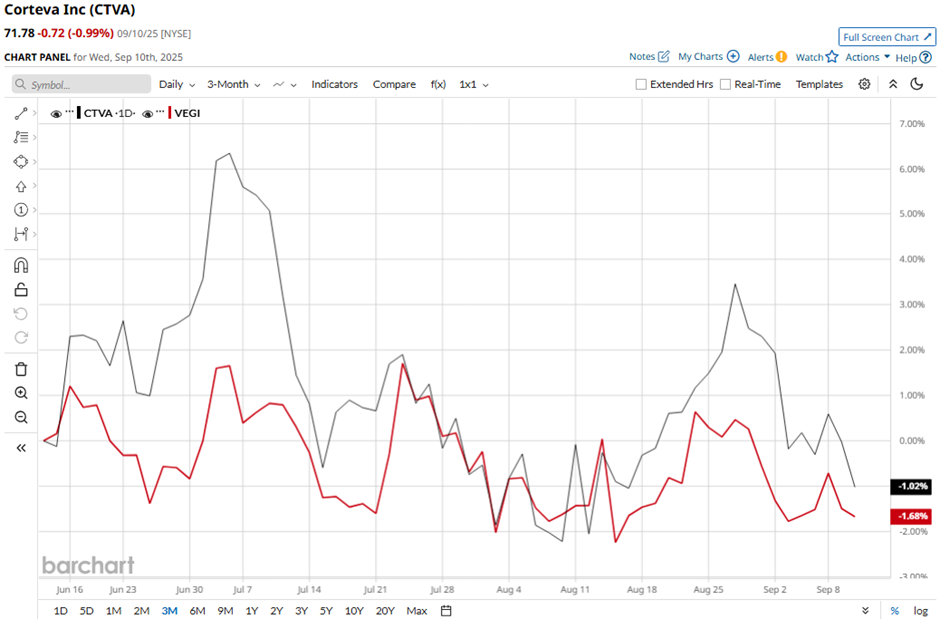

Shares of the Indianapolis, Indiana-based company have decreased 7.3% from its 52-week high of $77.41. Corteva's shares have risen marginally over the past three months, outpacing the iShares MSCI Agriculture Producers ETF's (VEGI) 1.3% decline over the same time frame.

Longer term, CTVA stock is up over 26% on a YTD basis, outperforming VEGI’s 12.6% gain. In addition, shares of the U.S. agrichemicals company have returned 29.6% over the past 52 weeks, compared to VEGI’s 11.2% increase over the same time frame.

The stock has been trading above its 200-day moving average since last year.

Corteva posted strong Q2 2025 results on Aug. 6, with adjusted EPS of $2.20 and revenue of $6.5 billion, both beating estimates. The company also raised its full-year outlook, guiding adjusted EPS to $3 - $3.20 and net sales to $17.6 billion - $17.8 billion on the back of robust global demand and improved crop protection performance. Despite the upbeat results and guidance, shares of CTVA fell slightly the following day.

However, rival CF Industries Holdings, Inc. (CF) has underperformed CTVA stock. Shares of CF Industries have risen 13.2% over the past 52 weeks and 1.9% on a YTD basis.

Due to Corteva’s outperformance, analysts are bullish about its prospects. The stock has a consensus rating of “Strong Buy” from the 22 analysts in coverage, and the mean price target of $81.75 is a premium of 13.9% to current levels.