With a market cap of $14.9 billion, The Clorox Company (CLX) is a leading global manufacturer and marketer of consumer and professional products. The company operates through four segments: Health and Wellness; Household; Lifestyle; and International, offering trusted brands such as Clorox, Pine-Sol, Glad, Kingsford, Hidden Valley, Brita, and Burt’s Bees.

Companies valued at more than $10 billion are generally considered “large-cap” stocks, and Clorox fits this criterion perfectly. Its products are sold across mass retailers, grocery stores, e-commerce platforms, and other channels in both U.S. and international markets.

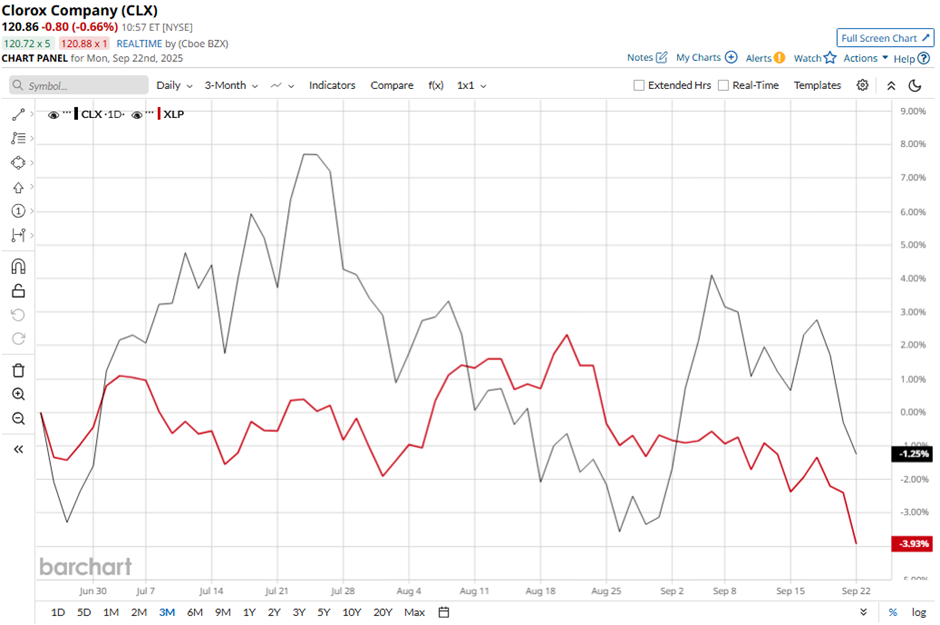

Shares of the Oakland, California-based company have pulled back 29.3% from its 52-week high of $171.37. CLX stock has risen marginally over the past three months, slightly outperforming the Consumer Staples Select Sector SPDR Fund’s (XLP) 3.3% decline over the same time frame.

Longer term, CLX stock is down 25.4% on a YTD basis, a more pronounced decline than XLP’s marginal drop. Moreover, shares of the company have decreased 25.9% over the past 52 weeks, compared to XLP’s 5.7% dip over the same time frame.

Despite a few fluctuations, the stock has been trading mostly below its 50-day moving average since late December last year. Also, it has fallen below its 200-day moving average since February.

Despite Clorox’s stronger-than-expected Q4 2025 adjusted EPS of $2.87 and net sales of $1.99 billion on Jul. 31, shares fell nearly 2% the next day as investors focused on its weak FY2026 outlook. The company guided for net sales to decline 6% - 10% and organic sales to drop 5% - 9%, largely due to the 7 pts - 8 pts reversal of incremental ERP shipments that had boosted fiscal 2025 results. Additionally, EPS is projected to fall sharply to $5.60 - $5.95, with adjusted EPS of $5.95 - $6.30 still reflecting an 18% - 23% decline.

In addition, rival Church & Dwight Co., Inc. (CHD) has shown a less pronounced dip than CLX stock. CHD stock has dipped 16.3% on a YTD basis and 15.2% over the past 52 weeks.

Due to the stock’s weak performance, analysts are cautious about its prospects. CLX stock has a consensus rating of “Hold” from the 19 analysts in coverage, and the mean price target of $132.44 is a premium of 9.6% to current levels.