/Citigroup%20Inc%20ATMs-by%20TennesseePhotographer%20via%20iStock.jpg)

With a market cap of $175.6 billion, Citigroup Inc. (C) is one of the world’s largest diversified financial services institutions. Founded in 1812, the New York-based company operates through five segments: Services, Markets, Banking, U.S. Personal Banking, and Wealth.

Companies worth $10 billion or more are generally described as "large-cap stocks." C fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the regional banking industry. With operations in over 160 countries and jurisdictions, Citigroup has a broad global presence and a long history of international banking leadership. It is particularly strong in credit cards, treasury and trade solutions, and global markets businesses.

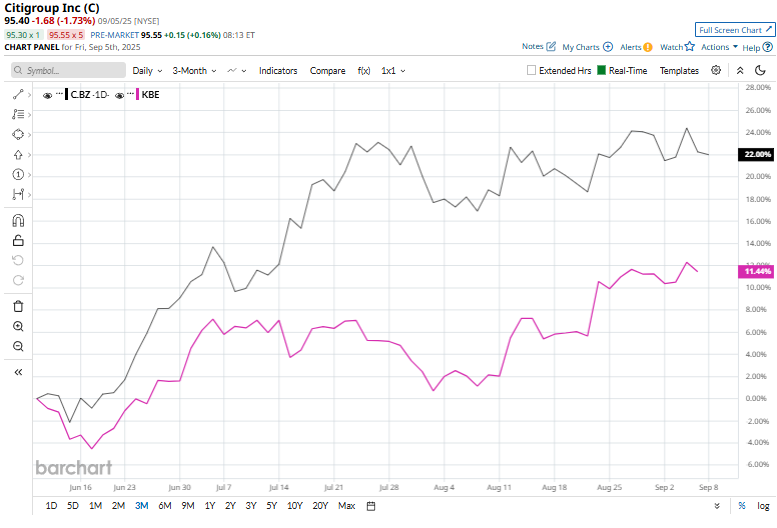

The banking giant's stock touched its 52-week high of $97.98 on the last trading session. C’s stock has surged 24.4% in the past three months, surpassing the S&P Bank ETF SPDR's (KBE) 12.2% gains over the same time frame.

In the longer term, C has climbed 35.5% on a YTD basis, whereas KBE rose 10.3%. Moreover, shares of C soared 57.4% over the past 52 weeks, underperforming the KBE's 17.3% rise over the same time frame.

Citigroup has traded mostly above its 50-day and 200-day moving averages since early May, indicating an uptrend.

Citigroup’s stock prices gained 3.7% following the release of its Q2 results on Jul. 15. The company showcased its resilience by delivering a solid 8.2% year-over-year growth in total revenues to $21.7 billion despite the macro uncertainties. This figure also surpassed the Street expectations by 4.4%. Furthermore, driven by higher net income and share repurchases, its EPS for the quarter came in at $1.96, up 28.9% year-over-year.

Its top rival, Wells Fargo & Company (WFC), has underperformed the stock over the past year, with its shares surging 12.4% on a YTD basis and 38.9% over the past year.

Among the 24 analysts covering the C stock, the consensus rating is a “Moderate Buy.” Its mean price target of $102.67 suggests a 7.6% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

.jpg?w=600)