/Centene%20Corp_%20logo%20on%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Saint Louis, Missouri-based Centene Corporation (CNC) operates as a healthcare enterprise, providing programs and services to under-insured and uninsured families, commercial organizations, and military families. With a market cap of $15.3 billion, Centene operates through Medicaid, Medicare, Commercial, and Other segments.

Companies worth $10 billion or more are generally described as "large-cap stocks." Centene fits this bill perfectly. Given that the company operates as one of the largest healthcare plan providers in the United States, its valuation above this mark is not surprising.

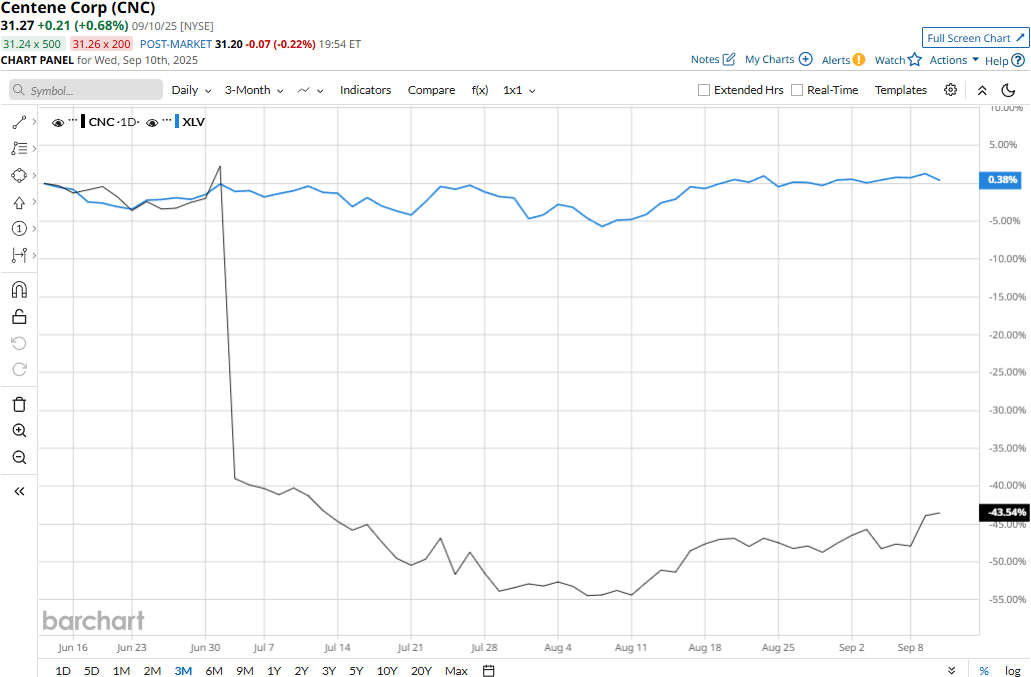

Despite its notable strengths, CNC stock has plunged 59.5% from its 52-week high of $77.29 touched on Sept. 17, 2024. Meanwhile, the stock has dropped 43.7% over the past three months, lagging behind the Health Care Select Sector SPDR Fund’s (XLV) 1.2% uptick during the same time frame.

CNC’s performance has remained grim over the longer time frame as well. CNC has declined 48.4% on a YTD basis and tanked 56% over the past 52 weeks, underperforming XLV’s marginal 17 bps dip in 2025 and 11.8% decline over the past year.

The stock has traded consistently below its 200-day moving average since early October 2024 and plunged below its 50-day moving average in May 2025, underscoring its bearish trend.

Centene’s stock prices plummeted 40.4% in a single trading session on Jul. 2 after the company withdrew its 2025 earnings guidance on Jul. 1, citing unexpected enrollment trends and rising patient costs. The healthcare plans provider, which primarily serves Medicaid and ACA markets, slashed its adjusted earnings outlook by $2.75 per share, erasing roughly $1.8 billion in projections. This triggered a sharp sell-off, sending CNC to a new low. The decision followed internal data from 22 ACA marketplaces showing slower-than-expected membership growth and significantly poorer health status among new enrollees, which disrupted federal reimbursement calculations tied to risk adjustment.

The company also flagged rising medical costs in its Medicaid business, particularly in behavioral health and high-cost drug categories, as additional pressure points. The company is now refilling its 2026 ACA rates to reflect higher morbidity assumptions and plans to implement corrective pricing strategies across most states. These developments have raised broader concerns about the sustainability of ACA economics and investor confidence in managed-care models.

Centene has also underperformed its peer, Humana Inc.’s (HUM) 7.8% gains in 2025 and 21% decline over the past year.

Among the 19 analysts covering the CNC stock, the consensus rating is a “Hold.” Its mean price target of $34.19 suggests a 9.3% upside potential from current price levels.