/Carmax%20Inc%20logo%20at%20location%20by-%20jetcityimage%20via%20iStock.jpg)

Richmond, Virginia-based CarMax, Inc. (KMX) is the largest retailer of used vehicles in the U.S. and one of the nation's largest operators of wholesale vehicle auctions. With a market cap of $8.7 billion, CarMax operates through Sales Operations and Auto Finance segments.

Companies worth between $2 billion and $10 billion are generally described as "mid-cap stocks." CarMax fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the auto & truck dealership industry.

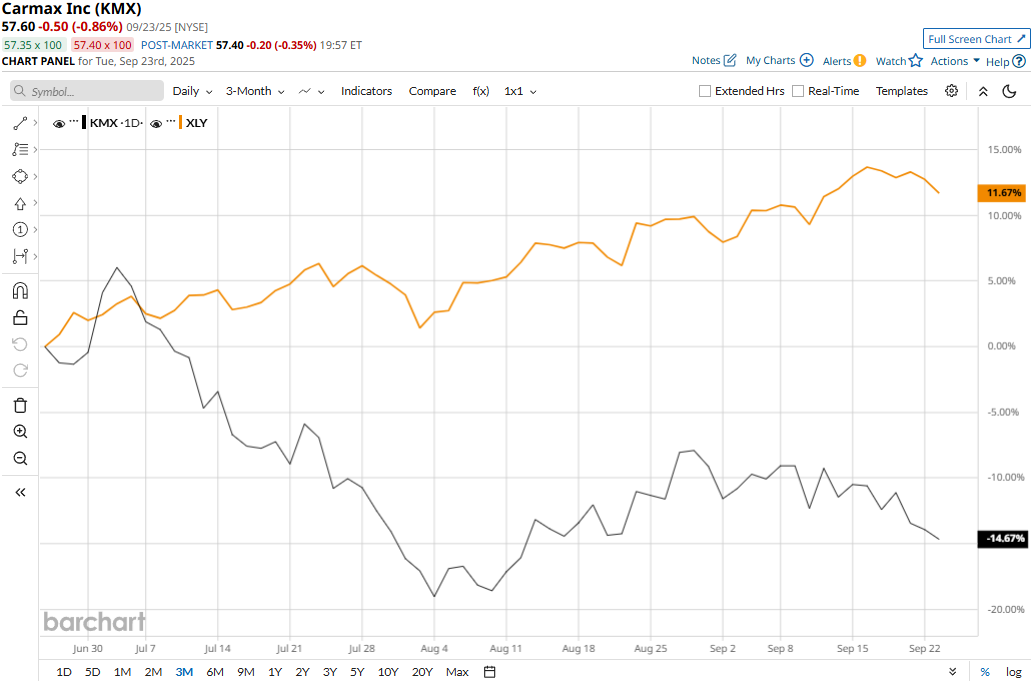

Despite its notable strengths, CarMax stock has plummeted 36.9% from its three-year high of $91.25 touched on Dec. 19, 2024. Meanwhile, the stock plunged 14.3% over the past three months, notably underperforming the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 11% surge during the same time frame.

CarMax’s performance looks even grimmer over the longer term. The stock has declined 29.6% on a YTD basis and 24.7% over the past 52 weeks, notably underperforming XLY’s 6.1% uptick in 2025 and 19.8% surge over the past year.

KMX stock has traded consistently below its 200-day moving average since March and mostly below its 50-day moving average since late February, underscoring its bearish trend.

CarMax’s stock prices gained 6.6% in the trading session following the release of its robust Q1 results on Jun. 20. The company’s used vehicle sales increased 9% year-over-year to 230.2 thousand, and wholesale vehicle sales inched up 1.2% year-over-year to 149.5 thousand. Overall, its topline came in at $7.5 billion, up 6.1% year-over-year and slightly above the Street’s expectations. Further, CarMax delivered a massive 42.3% year-over-year surge in EPS to $1.38, beating the consensus estimates by 17%, boosting investor confidence.

However, when compared to its peer, AutoNation, Inc. (AN) has surged 29.8% on a YTD basis and registered 24.6% gains over the past 52 weeks, notably outperforming KMX.

Among the 19 analysts covering the KMX stock, the consensus rating is a “Moderate Buy.” Its mean price target of $79.81 suggests a 38.6% upside potential.