/Broadcom%20Inc%20HQ%20photo-by%20Sundry%20Photogrpahy%20via%20iStock.jpg)

With a market cap of $1.5 trillion, Broadcom Inc. (AVGO) is a global technology leader specializing in the design, development, and delivery of semiconductor and infrastructure software solutions. The Palo Alto, California-based company's innovations support critical applications across enterprise and data center networking, broadband connectivity, smartphones, industrial automation, and cybersecurity, making it a key enabler of modern digital infrastructure.

Companies valued over $200 billion are generally described as “mega-cap” stocks, and Broadcom fits right into that category. Broadcom’s combination of semiconductor leadership, enterprise software integration, and disciplined capital allocation positions it as a key player in the global digital infrastructure market.

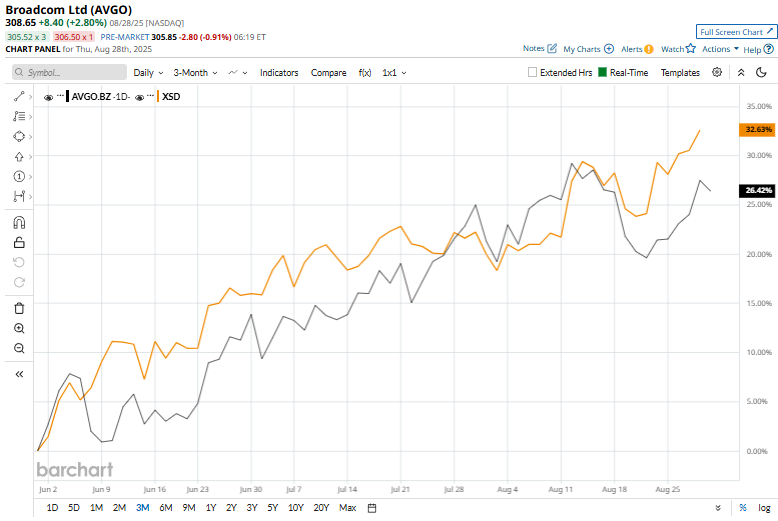

AVGO shares have dipped 2.7% from its 52-week high of $317.35. Over the past three months, shares of AVGO have increased 28.9%, matching the SPDR S&P Semiconductor ETF’s (XSD) returns during the same time frame.

In the longer term, the chipmaker has risen 33.1% on a YTD basis, outperforming XSD’s 18.1% rise. Moreover, shares of AVGO have surged 95.1% over the past 52 weeks, compared to XSD’s 25.8% rise over the same time frame.

AVGO stock has been trading above its 50-day and 200-day moving averages since the end of May, indicating an uptrend.

On Jun. 5, AVGO reported its Q2 results, and its shares closed down by 5% in the following trading session. Its adjusted EPS of $1.58 beat Wall Street's expectations of $1.57. The company’s revenue was $15 billion, surpassing Wall Street forecasts of $14.95 billion.

In comparison with its rival, NVIDIA Corporation (NVDA) has performed weaker than AVGO, with a 32.2% increase in 2025 and 43.4% gains over the past 52 weeks.

Due to AVGO’s strong performance, analysts are very bullish about its prospects. The stock has a consensus rating of “Strong Buy” from the 37 analysts covering the stock, and it is currently trading above the mean price target of $306.53.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.