/Ball%20Corp_%20canning%20by-%20Keith%20Homan%20via%20Shutterstock.jpg)

Ball Corporation (BALL), headquartered in Westminster, Colorado, supplies aluminum packaging products for the beverage, personal care, and household products industries. Valued at $13.6 billion by market cap, the company also supplies aerospace and other technologies and services to commercial and governmental customers.

Companies worth $10 billion or more are generally described as “large-cap stocks.” BALL effortlessly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the packaging & containers industry. BALL’s strength lies in its diversified portfolio across packaging and aerospace, providing stability and synergies. With a dominant global market share in aluminum beverage cans, BALL benefits from economies of scale and long-term relationships. Its aerospace segment offers high-margin, technologically advanced opportunities, while its commitment to sustainability enhances its brand image.

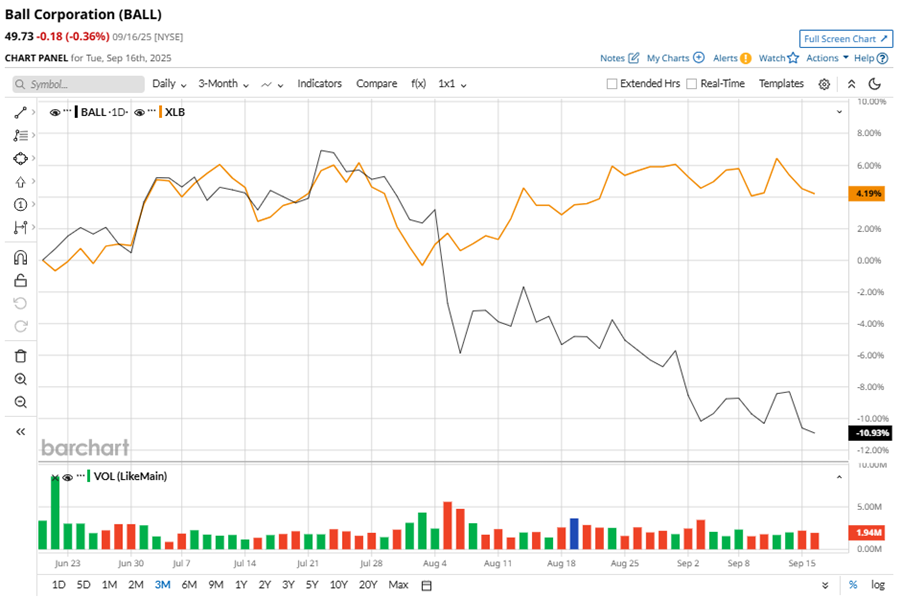

Despite its notable strength, BALL slipped 27% from its 52-week high of $68.12, achieved on Oct. 1, 2024. Over the past three months, BALL stock has declined 11.2%, underperforming the Materials Select Sector SPDR Fund’s (XLB) 2.9% gains during the same time frame.

In the longer term, shares of BALL dipped 9.8% on a YTD basis and fell 25.8% over the past 52 weeks, underperforming XLB’s YTD gains of 7.8% and 3.1% dip over the last year.

To confirm the bearish trend, BALL has been trading below its 200-day moving average since late October, 2024, with some fluctuations. The stock has been trading below its 50-day moving average since early August.

On Aug. 5, BALL reported its Q2 results, exceeding expectations, with revenue growing 12.8% year-over-year to $3.3 billion and adjusted EPS of $0.90, up 21.6% from the prior-year quarter. Despite beating consensus estimates by 6% and raising fiscal 2025 adjusted EPS growth guidance to 12% to 15%, the company's stock price dropped 5.8% after the earnings release.

In the competitive arena of packaging & containers, Crown Holdings, Inc. (CCK) has taken the lead over BALL, showing resilience with a 15.3% uptick on a YTD basis and 3.1% returns over the past 52 weeks.

Wall Street analysts are reasonably bullish on BALL’s prospects. The stock has a consensus “Moderate Buy” rating from the 14 analysts covering it, and the mean price target of $65.08 suggests an ambitious potential upside of 30.9% from current price levels.