/Arthur%20J_%20Gallagher%20%26%20Co_%20logo%20and%20data-%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

With a market capitalization of roughly $77.6 billion, Illinois-based Arthur J. Gallagher & Co. (AJG) is a leading international service provider that plans, designs, and administers a full suite of customized, cost-effective property/casualty insurance and risk management programs, consulting services, and third-party claims settlement across the U.S. and globally.

Companies with a valuation above $10 billion are generally considered “large-cap” stocks, and Gallagher firmly belongs in this category with a market cap well beyond that threshold. The company delivers its services in nearly 130 countries through its owned operations as well as a strong network of correspondent brokers and consultants, reinforcing its position as a global leader in the insurance and risk management space.

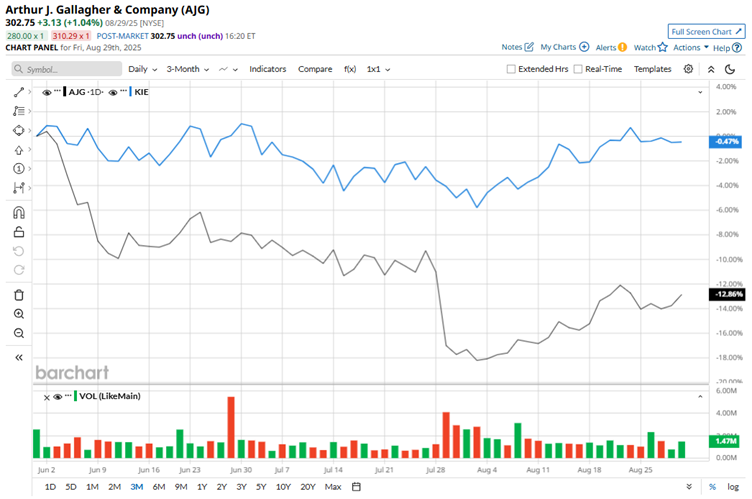

After reaching a 52-week high of $351.23 on Jun. 3, AJG has seen its momentum fade, with the stock sliding 13.8% from that peak. The weakness has been even more evident in recent months. Shares have tumbled nearly 11.5% over the past three months, sharply underperforming the SPDR S&P Insurance ETF’s (KIE) marginal return during the same period.

Over the 52 weeks, AJG has managed a modest 4.1% gain, with year-to-date (YTD) performance showing a stronger 6.7% climb. By comparison, the KIE has delivered a slightly higher 5.7% return over the past year but trails AJG on a YTD basis with a 4.1% gain.

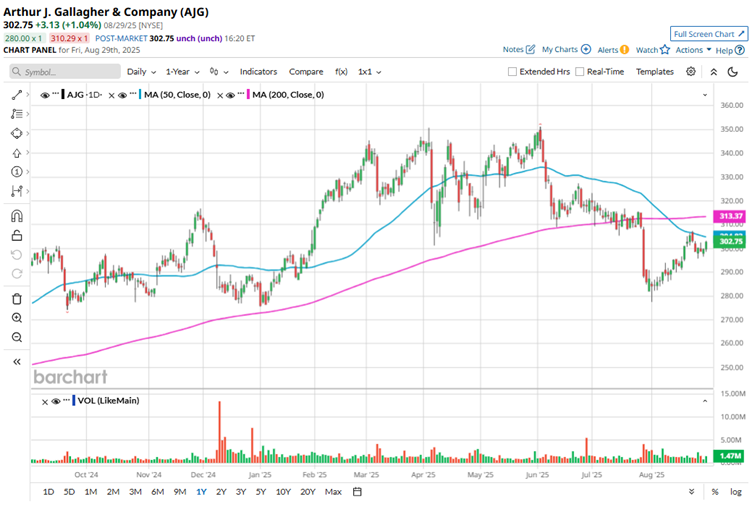

To confirm the bearish price trend, AJG has slipped beneath both its 50-day and 200-day moving averages since the end of July, indicating persistent downward pressure on the stock.

On July 31, AJG reported its Q2 results, highlighting robust top-line momentum with revenue climbing 16% year-over-year and organic growth of 5.4%. The company also benefited from healthy adjusted EBITDAC margins and continued progress on acquisitions and technology-driven initiatives. However, investor excitement was somewhat muted, as adjusted EPS of $2.33 fell just short of estimates, underscoring modest earnings misses despite the company’s strong growth trajectory.

Meanwhile, AJG’s peer Aon plc (AON) has delivered a stronger showing over the past year with an 8.1% gain, outpacing Gallagher’s performance. However, in 2025, the tables have turned. Aon is up a modest 2.2% this year, trailing behind AJG’s healthier advance.

On the bright side, despite AJG’s mixed price action, Wall Street maintains a cautiously optimistic stance. Of the 21 analysts covering the stock, the consensus rating stands at “Moderate Buy,” with an average price target of $337.50, implying about 11.5% upside from current levels.